Reclaiming Our Money, Reclaiming Our Power: Strategy and Solidarity at the Public Banking Convening

In May, Dēmos held a national convening of financial justice leaders to reimagine our financial systems and build community wealth through public banks. These are our top takeaways.

On May 20, advocates, organizers, and financial justice leaders from across the country came together in Washington, D.C., to mark the release of Public Banks for Racial Equity: Democratizing Finance to Build Community Wealth, a joint report from Dēmos and New Economy Project. The convening and report launch marked an exciting milestone for the growing public banking movement, highlighting how organizers and policymakers are designing public banks to address systemic racial inequities and build lasting community wealth.

Public banking is not an abstract concept—it’s a concrete and urgently needed policy tool capable of shifting power and resources into the hands of communities.

Throughout the day, participants from across the U.S. dug into the report’s findings, reflected on campaigns gaining traction from coast to coast, and engaged in strategy sessions focused on accountable governance, community wealth building, and scaling the impact of public banks. One theme rang loud and clear: Public banking is not an abstract concept—it’s a concrete and urgently needed policy tool capable of shifting power and resources into the hands of communities.

Local Wins and National Lessons

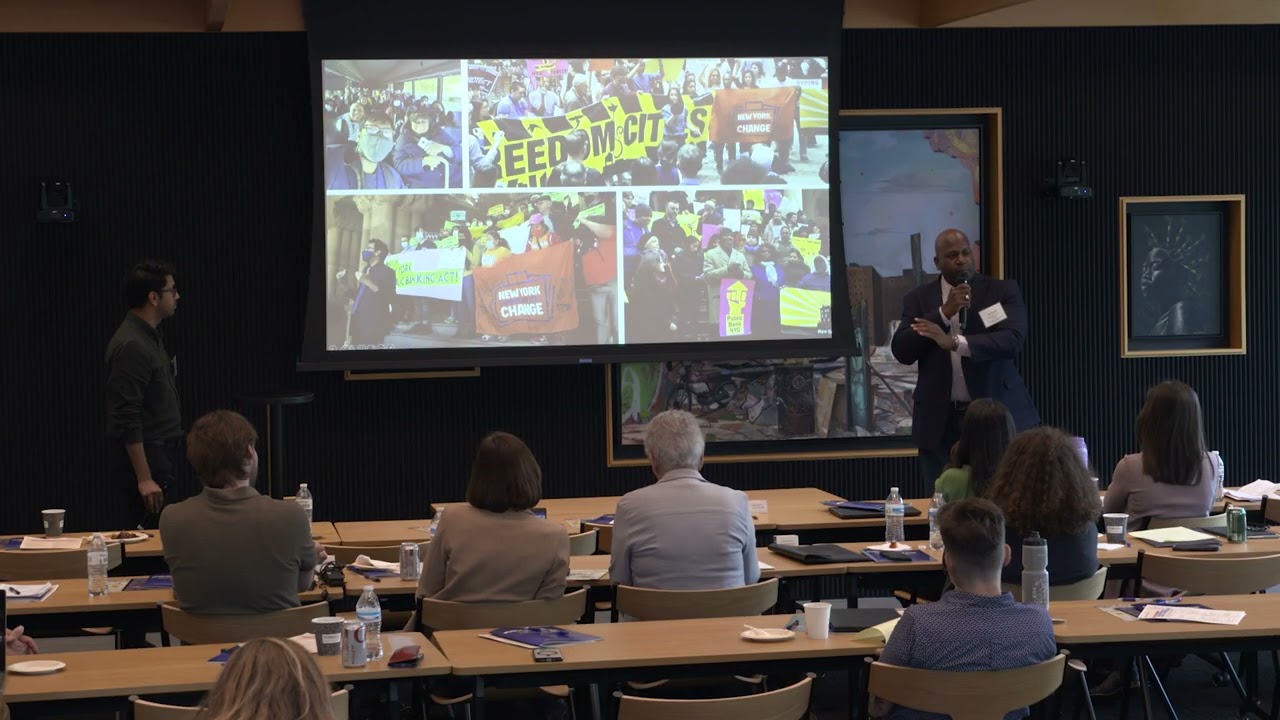

Organizers from the Public Bank NYC coalition, which New Economy Project convenes, shared insights from their multiyear campaign to bring public banking to New York. On the way to securing statewide enabling legislation, the coalition has already won major victories. It successfully pushed New York City to cut ties with Wells Fargo after the bank was exposed—yet again—for lending discrimination against Black homeowners, and it won major reforms to the city’s process for designating banks to hold city deposits, introducing public hearings and greater accountability. This hard-won progress reflects the coalition's deep base-building and community education work, which has brought together labor, housing, and grassroots organizations, as well as community development financial institutions. Recent events have only intensified calls for public banks. Earlier this year, the Trump administration seized $80 million from a New York City bank account held at Citibank—with no apparent resistance from the bank. As one convening participant put it, “We’re watching private banks fail to protect public money while serving the interests of federal overreach. We need banks that answer to us.”

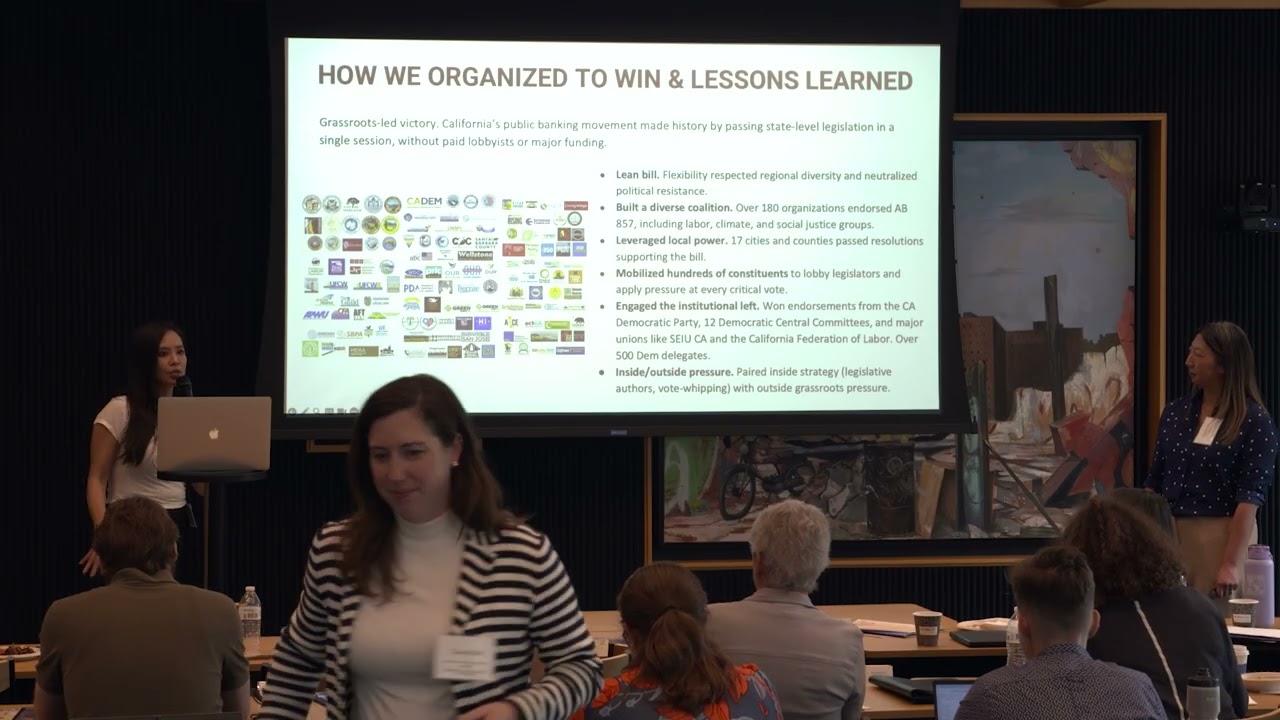

Organizers from the California Public Banking Alliance (CPBA) reflected on their campaigns to win passage of the California Public Bank Act of 2019, which created a statewide framework for municipal public banking. They also discussed the passage of the California Public Banking Option Act, which established the CalAccount program to expand access to no-fee debit accounts. The organizers stressed the importance of centering impacted voices in their campaigns to build political will to pass key legislation. With more than 180 groups in its statewide coalition, CPBA has demonstrated the power of broad-based organizing. The alliance continues to build local coalitions of community lenders, advocates, and educators to support public banking implementation across the state, laying critical groundwork for the long-term transformation of California’s financial landscape.

Strategy Sessions

Building off our report’s findings and recommendations, participants strategized ways to design public banks that are accountable, equitable, and scalable.

Accountable Governance

In a breakout session about accountable governance, participants discussed approaches to ensure that public banks remain truly accountable to the people they serve. Participants grounded their discussion in lived experiences with governance, highlighting systemic failures such as tax policies that harm Black and brown communities. Additionally, participants pointed to democratic models already thriving in communities, such as worker co-ops, community land trusts, and participatory budgeting.

Strategies to ensure democratic oversight of public banks included establishing community advisory boards, convening town halls and public hearings, and requiring transparent reporting by public banks of their activities and impact. Participants emphasized that public pressure is essential for ensuring long-term accountability and preventing concentrations of power that can undermine the will of the people.

There was also consensus that public banks need a firm public purpose mandate that resists profit-driven or political capture. Participants proposed lending standards that prioritize community wealth building and land stewardship, as well as clear prohibitions on harmful investments. For example, instead of financing extractive industries like fossil fuels—activities that would be explicitly excluded—public banks would invest in regenerative, community-driven solutions. These could include renewable energy projects, permanently affordable housing, and small and worker-owned businesses that provide good, local jobs. All investments would be publicly disclosed, with their scale, impact, and alignment with the bank’s mission used to evaluate the bank’s performance and guide future decisions.

Partnership Lending That Builds Community Wealth

Participants in a second breakout session envisioned public banks not just as lenders but as engines of local reinvestment. They identified areas where public funding could make a transformational difference, expanding access to capital for affordable housing, clean energy, transit, green space, libraries, child care, and even guaranteed-income programs.

The group emphasized how public banks could partner with and support undercapitalized community lenders, such as community development financial institutions (CDFIs) and credit unions, to expand fair banking access and keep wealth circulating within communities. Public banks could provide simplified financial tools, extend credit enhancements to lenders serving low-income and Black and brown communities, and invest in land back initiatives and cooperative enterprises.

By cutting out Wall Street intermediaries and aligning public money with local needs, public banks can unlock new possibilities for community wealth building.

Participants agreed: To counteract extractive financial systems, we need public banks intentionally built to serve community interests. By cutting out Wall Street intermediaries and aligning public money with local needs, public banks can unlock new possibilities for community wealth building.

Scale: Realizing the Potential of Public Banks

A third breakout session tackled important questions of scale. Should public banks operate at the state and/or local level? How should they be structured to maximize their effectiveness and impact? And what policies are needed to achieve scale, ensuring that public banks are not only established but also adequately capitalized and empowered to meet community needs?

Participants highlighted the power of starting locally, especially in cities confronting the urgent need for investments in essential infrastructure like housing, schools, and transportation. Municipal public banks can serve as proof of concept and create momentum for broader implementation at the state level. But the work doesn’t stop there: to build public support, we need to make public banking a household concept. That means launching sustained public education campaigns and producing accessible and compelling information, such as The Economic Impact of a New York City Public Bank, that measures the concrete benefits of public banking.

Our report highlights the importance of establishing public banks at a scale that enables meaningful impact. Participants at the May convening also stressed the need for flexible policies and structures that can adapt to local contexts and address entrenched legal, regulatory, and political barriers. The group strategized around federal preemption laws, the influence of the banking lobby, and how to make the case that public banks will serve markets that private banks mostly ignore.

From hyperlocal organizing to state-level coalition building, participants emphasized creative legal and political solutions. They concluded that scaling public banking would require both strategic infrastructure and community-driven leadership.

Meeting the Moment: Building Democratic, Resilient Economies Through Public Banks

The strategy sessions led us to a broad, honest conversation about the current political moment. The erosion of public institutions, policymaking by large financial institutions and other large corporations, and the crises facing cities remind us that public banking is imperative. Many cities are staring down massive budget deficits, and public banking offers a way to keep money circulating locally and reduce reliance on Wall Street.

In the context of federal retrenchment and political disarray, state and local movements can and must lead. Policymakers must listen to expertise on the ground and learn from movements across the country. Strategies like public banking are key to long-term wins because they help communities build wealth and harness control over their economic futures.

What’s Next?

The convening closed with energy and clarity. With public banking initiatives taking root across the U.S., there was strong consensus around the need to ...

- build organizing capacity at the local level

- coordinate nationally to align strategy, amplify research, and share tools, and

- deepen our understanding of public finance as we design truly public financial ecosystems.

The public banking movement is rising to meet a transformational moment. It’s time to reclaim our public dollars, reimagine what our financial systems can do, and demand institutions that serve people over profit.