Wealth—and the Security it Brings—Is Unequally Distributed by Race

While the longest shutdown in U.S. history leaves millions of Americans with missed paychecks and mounting bills, this piece explores why we must build wealth for all, especially for communities that have been historically kept from economic opportunity.

We are in the midst of the longest-ever federal government shutdown. Millions of people across the United States are unable to access services they count on. Federal workers are on furlough, unpaid, and grappling with mounting bills, missed paychecks, and uncertainty about their futures.

The shutdown is also casting a shadow over our ability to understand and effectively respond to what's happening in the economy. Last month's jobs report was never released, and given the ongoing shutdown, it now looks like the jobs report won't be released again this month, marking the second consecutive month without an official jobs report. Without this critical data, policymakers and the public are effectively operating without crucial information in a fragile economic moment. This moment underscores a simple truth: Without wealth, it's harder for families to weather economic downturns, and without reliable data, it's harder for policymakers to see those hardships taking shape.

Even as labor market data remains delayed, the Federal Reserve's Distribution of Household Wealth in the U.S. provides a crucial snapshot of how profoundly uneven our economy remains and underscores the importance of wealth for weathering economic shocks. Wealth, or net worth, is defined as total assets (such as real estate, corporate equities, and mutual fund shares) minus liabilities (such as home mortgages and consumer credit). Unlike income, which is a periodic inflow of resources, wealth represents the resources families can rely on to weather financial shocks and maintain long-term economic stability.

White households hold roughly 21 times more wealth than Black households and nearly 30 times more than Hispanic households.

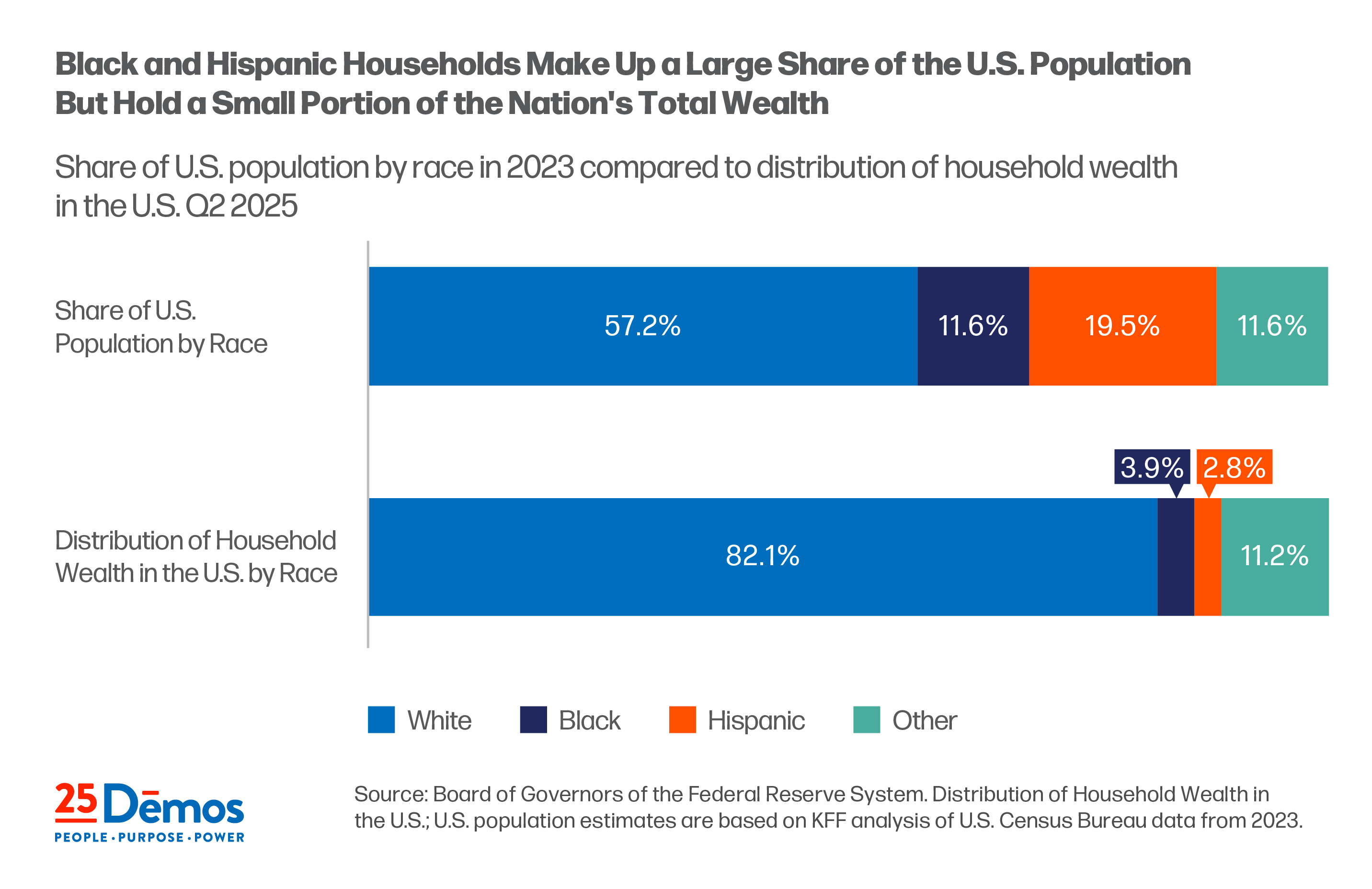

The most recently released numbers are staggering. As shown in the figure below, in the second quarter of 2025, white households held 83.5 percent of all wealth in the U.S.—$153.41 trillion in total. Black households held just 3.4 percent ($7.26 trillion), and Hispanic households 2.4 percent ($5.21 trillion). In other words, white households hold roughly 21 times more wealth than Black households and nearly 30 times more than Hispanic households. These numbers show a wildly uneven skew, one that can’t be corrected by accounting for the representation of racial groups in the broader population. As Figure 1 shows, fewer than 6 in 10 people in the United States identify as white, yet this group holds more than 8 of every 10 dollars of wealth in the country. (Figure 1 compares 2023 population data to 2025 wealth data. Due to problems with data availability during the government shutdown, the latest estimates are not yet available. However, projections indicate that over this period the share of the population that identified as white decreased, making the discrepancy between population and wealth share a lower-bound estimate.)

These divides are not new. This data series, which stretches back to 1989, shows that the racial wealth divide has remained stubbornly wide for decades. The persistence of this divide reflects how structural racism continues to shape who can build and maintain wealth in the U.S.

Wealth isn't just about comfort. It's about survival.

Wealth isn't just about comfort. It's about survival. For some, wealth buys fancy cars and luxury vacations. Many dream of using it to pay for a roof overhead that doubles as an investment. It can fund an education that leads to a higher-paying job, offer the freedom to take the risks needed to start and run a business, and allow someone to invest and watch that investment grow. But wealth’s most basic function is perhaps its most important one: Wealth allows people to weather the rainy day that occurs when income stops flowing. It acts as a cushion that allows families to withstand job loss. Indeed, the stability and certainty associated with wealth decreases stress in ways that even income cannot, including yielding dividends in better health.

Yet those advantages have never been shared equally. Systemic barriers and racist policies have excluded Black, Hispanic, and other communities of color from the very opportunities that make wealth possible, limiting the ability to pass prosperity from one generation to the next. For example, racist, government-backed housing policies historically denied Black families access to mortgages and neighborhoods, undermining their ability to accumulate home equity and pass on wealth. The racial wealth divide doesn't just reflect inequality. It perpetuates it. Policy choices that favor the wealthy reinforce the divide and harden inequality across generations.

And when downturns hit, they don't hit all groups equally.

This matters now. Recent private-sector data from ADP, along with earlier federal releases from before the shutdown, point to warning signs about where the economy is headed: Work is getting harder to come by, and that trend may soon accelerate. And when downturns hit, they don't hit all groups equally. A key driver of this cascading hardship is that many low-income households and households of color have little financial cushion, which magnifies the impact of economic shocks. For example, in the wake of recent downturns, low-income households of color faced cascading hardship, from heightened housing insecurity and depressed earnings that can last long after the broader economy "recovers."

The uncertainty of the labor market makes this a terrible time to be missing the data that can help us identify the problems coming down the pike. When policymakers can't see where the economy is weakest or who is being hit hardest, they lose the ability to respond effectively and help us tackle inequities through much-needed investments in our communities.

The next jobs release won't just tell us how many jobs were added or lost, nor what the headline unemployment number is. It will signal something deeper about who has the resources to withstand uncertainty, to save, to keep food on the table and who doesn't. Ensuring that we have the data to inform just policy and that families have the wealth to weather downturns is essential to building economic resilience. In this moment of uncertainty when both economic conditions and the institutions that measure them are under strain, it's critical that we remember that wealth is not just a measure of success but of security, too.