The Shutdown Hid the Data, Not the Inequality: What We Know About Economic Instability

Despite living in one of the world’s wealthiest nations, millions of Americans remain financially vulnerable, with stark racial disparities in who has enough emergency savings to weather even a brief crisis.

When the government was shut down, the result wasn’t just halted paychecks and disrupted critical public services. The shutdown also created gaps in our ability to understand the economy. These gaps aren't neutral. They obscure who is being left behind at a time when many families are navigating what can sometimes feel like a series of shocks—from empty EBT cards for SNAP recipients to sudden layoffs. Even with incomplete data, one truth is still clear: The way our economy is structured leaves Black and brown households the most exposed to financial shocks.

With key federal data delayed, or gone altogether, businesses, policymakers, and the public have scrambled for substitutes. While private-sector data can help to fill some gaps, it can't replace the jobs report which uniquely provides payroll and household data, long and consistent time series, and key demographic and industry information. In the midst of this confusion, we even saw claims from the White House pointing to a deceptive DoorDash report as evidence of economic strength, despite other indications suggesting a much less clear story.

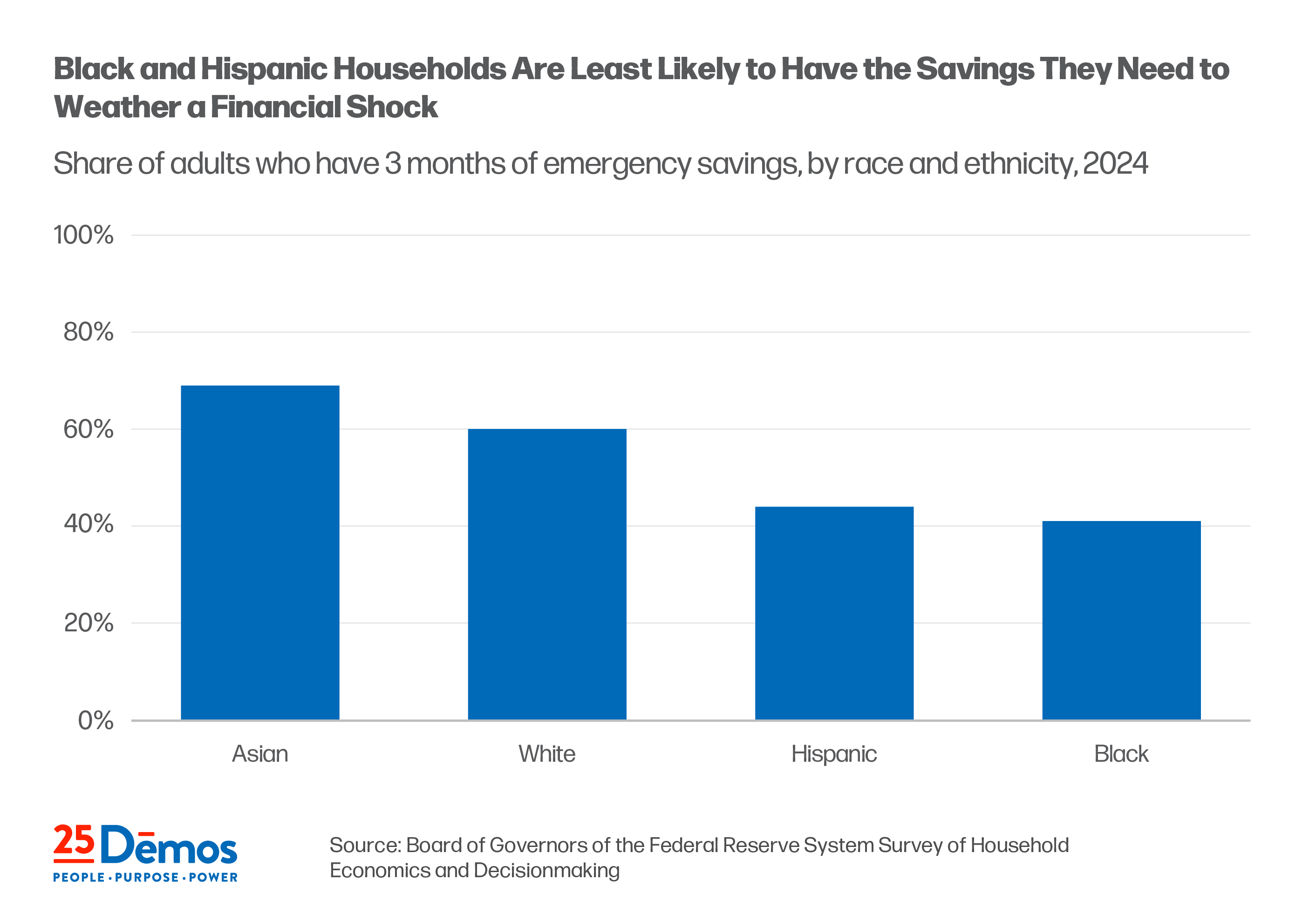

At Dēmos, we turned to a different stand-in for understanding how people are actually experiencing this economic moment: the Federal Reserve's Survey of Household Economics and Decisionmaking (SHED). Specifically, we looked at the share of adults who have three months emergency savings broken out by race and ethnicity.

In 2024 just over half of all people in the country reported having three months of emergency savings.

In 2024, the most recent year for which data is available, just over half of all people in the country reported having three months of emergency savings. This means that even in relatively stable times, many households have no financial cushion. A sudden expense like a missed paycheck or a prolonged disruption (like, say, a government shutdown) can force impossible choices: fall behind on rent, skip bills, or drain what little savings may exist. These vulnerabilities aren't evenly distributed. While about 60 percent of white households reported having three months of savings, only 44 percent of Hispanic households and 41 percent of Black households had those resources. These gaps reflect long-standing racial wealth divides and structural barriers to economic security.

The reality is that any sign of a downturn lands hardest on those with the fewest resources.

With last months' delayed release of the September Employment Situation report, the first jobs report release since the shutdown, some of our gaps in our understanding are finally being filled, offering a clearer picture of the economy after many weeks of uncertainty. Tomorrow's numbers will provide additional insight and help us track how working people and families are faring in the economy. But whatever the topline numbers show, the reality is that any sign of a downturn lands hardest on those with the fewest resources. Black workers in particular are the first to feel the impact of economic downturns.

As we parse through the latest data, we'll not just look at what they say about job growth but also what they will imply for the millions of people who live one crisis away from instability.