After seven years as a lawyer specializing in public and private securities offerings, I was an investment banker at Goldman Sachs for more than a twelve years and then managed a small advisory firm. I also served as CEO of a firm providing counterparty credit management services in the derivatives markets. For the last two years, I have focused my efforts on financial system reforms, participating in dozens of formal comments and various roundtable discussions at the request of regulatory agencies. I am a Senior Fellow at Demos, a multi-issue national organization, combining research, policy development and advocacy to influence public debate and catalyze change.

For me, today’s hearing evokes memories of a time 33 years ago when, as a young attorney, I was commissioned to write testimony to be delivered to a committee of Congress on behalf of the Securities Industry Association, one of the predecessors of SIFMA, that represented the interests of investment banks. The goal of the testimony was to resist the repeal of Glass-Steagall, and so to protect investment banks from competition fueled by the massive cheap capital of the commercial banks.

Circumstances are different today, but some fundamental principles remain the same. Universal banking is no longer an abstract concept in the US financial services sector, but has become a dominant way of doing business. In light of the catastrophic and ongoing consequences of the 2008 financial crisis, it is appropriate to reflect on the path chosen in the last decade of the 20th century, culminating in the repeal of the Glass Steagall Act.

Today’s hearing examines the results of the dramatic deregulation of the financial sector that allowed banks to expand their businesses far beyond the limits established in the wake of the last major financial and economic crisis, the Great Depression. In the 1930’s, wise policy-makers came to understand the danger of allowing financial institutions that are entrusted with customer deposits to also participate in the business of volatile trading markets and complex and inherently risky financial instruments. No doubt, the Subcommittee will hear that these concepts are out of step with today’s global marketplace, dominated by elaborate technology and cutting-edge quantitative analysis. This argument is totally inadequate for the purposes of today’s enquiry. Clearly, the systemic risks that threatened the irretrievable collapse of global financial systems in 2008 must be addressed. The problems arising from too-big-to-fail institutions, interconnected by shadowy and complex exposures to risks, are clearly related to the universal bank model.

But today’s hearing goes even further. Universal banking also leads to oligopolistic markets that are inefficient in performance of their fundamental social purpose, the intermediation between sources and productive uses of capital. There is a vast difference between efficient extraction of profits from the capital and commodities markets, which is a hallmark of universal banking, and providing for the efficient capitalization of businesses and governments. The two must be rigorously distinguished.

The questions raised at today’s hearing are profound. Regulatory responses to the specific causes of the financial crisis are high priorities. But this effort is not complete unless the underlying conditions that gave rise to the crisis are addressed as well. The universal banking model that was the culmination of deregulation severely distorts the provision of financial services. This has created massive inefficiencies at the same time that technology and quantitative advances are deployed to benefit the dominant market participants.

The details of the next potential financial crisis are unknowable. But it is certain that the distortions created by the great deregulation experiment will produce another calamity if the oligopoly of universal banks is not addressed.

Universal Banking in Perspective

It might be useful to place the concept of universal banking into the context of the fundamental social purpose of the financial markets. Aside from insurance and risk transfer and payment systems, the essential service of the financial sector is efficient intermediation.[1] Sources of capital (savings, pension funds and similar funds that need to be “put to work”) must be matched up with users of capital to finance productive activities and households that require credit. The matching systems must be efficient in terms of fundamental capital cost and the cost of intermediation. The price paid for matching, i.e., intermediation, must be reliable and rationally related to the service provided.

Universal banking commingles two forms of intermediation, the traditional commercial banking intermediation between customer deposits and lending; and the intermediation between investment capital and investment opportunities provided by various traded financial markets. (It also involves insurance and payment transfers, subjects that are important, but not directly related to the issues discussed in this testimony.) The question is whether the universal banking model is intolerably risky and/or expensive.

Major developments in the financial markets prior to the repeal of Glass Steagall blurred the distinctions between investment banking and commercial banking, particularly the advent of money market mutual funds. As a result, the commercial banking function became more and more identified with an important distinguishing characteristic, FDIC insurance. The insurance was designed to provide a firewall against depositor runs on banks. Money market funds, which were the investment banks’ way to compete against commercial banks for deposits, have no such protection against runs, as illustrated by the Fed intervention to support money market funds in 2008.

The debate in the years prior to repeal of the Glass Steagall Act is particularly instructive. The investment banks were vehemently opposed to repeal in those years, and they were uniquely positioned to evaluate the issues associated with universal banking. Their opposition centered on two points. First, they expressed concern that the commingling of commercial banking with investment banking would give rise to systemic risks.[2] Additionally, they predicted that universal banking would create predatory market power.[3] Eventually, the investment banks came to realize the inevitability of the repeal and discovered ways to accrue market power of their own. They relented in 1999, paving the way for repeal. The result was the oligopoly that exists today. Thus, the investment banks’ warnings have proven to be accurate and the handful that survive are now part of the problem that they warned against.

Responses to Questions

Below are my responses to the specific questions raised that have been raised in connection with the hearing.

1. To what extent, and in what ways, have large, diversified banks – sometimes referred to as “universal banks” – changed the business of banking?

Banking in the United States has become extraordinarily concentrated and oligopolistic. Waves of change have swept over financial services throughout the era of deregulation, primarily resulting in an economy skewed toward extraction of value by financial institutions.

CONCENTRATION

As universal banking approached, investment banking began a period of dramatic consolidation. Lehman Brothers did not achieve too-big-to-fail status (judged in retrospect) through internal growth. Its DNA included firms such as Kuhn Loeb, Shearson, Hammill & Co. and EF Hutton. It was even owned by American Express for a time. As repeal of Glass Steagall approached, the commercial banks got into the consolidation frenzy, as Citicorp acquired Salomon and Smith Barney and Credit Suisse acquired First Boston and Donaldson, Lufkin and Jenrette. Finally, during the crisis, Bear Stearns was scooped up by JP Morgan Chase (which earlier had acquired Hambrecht & Quist) and Bank of America absorbed Merrill Lynch, both with the direct involvement of the government. Morgan Stanley and Goldman Sachs converted to banks to steady themselves in the turmoil.

During these 30 years, commercial banking consolidated as well. Consider the banks that were absorbed into JP Morgan: Chase Manhattan, Chemical, Manufacturers Hannover, First Chicago, National Bank of Detroit and BankOne. The consolidation was widespread, resulting in a system of mega-banks.

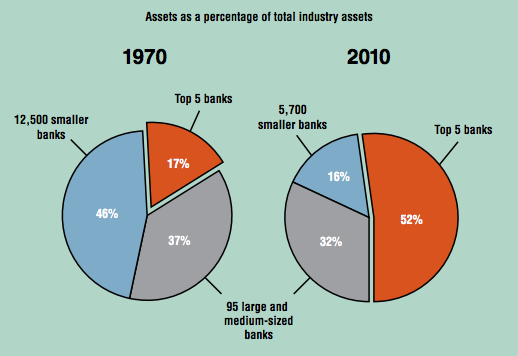

A recent research piece by the Dallas Fed provides a window on this process.[4] The study observes that in 1970 the top 5 banks in terms of assets held 17% of aggregate bank assets. By 2010, the top 5 banks held 52% of aggregate assets, as shown in the following chart extracted from the report:

The most dramatic part of the report and the covering letter by Dallas Fed President Richard W. Fisher is that they call for a “downsizing” of these megabanks. Their primary argument is that financial institutions remain “too-big-to-fail,” risking another painful and damaging bailout if a large financial crisis is threatened. In their view, the continuing cloud of too-big-to-fail hanging over the economy is simply intolerable and costly.

However, this report also contains some intriguing observations that go beyond the systemic risk of over concentration in the banking system. Chief researcher Harvey Rosenblum states that:

"When competition declines, incentives often turn perverse and self-interest turns malevolent."

This goes beyond worries about to-big-to-fail. It is not a concern with the intolerability of the risk of liquidation of a large bank. Rosenblum identifies distortions in a market that is dominated by an oligopoly of banks. This passage points out the damage that can be done to the economy even if these banks do not fail. The systemic risk of to-big-to-fail exists because of concentration. But, the pernicious oligopolistic marketplace that Rosenblum describes an ongoing problem that burdens the economy and intensifies the risks of a financial crisis occurring.

It must be noted that the literal transformation to a system dominated by universal banks was not completed until the onset of the financial crisis itself. Bear Stearns and Merrill Lynch were absorbed, Lehman evaporated as an entity and Goldman Sachs and Morgan Stanley converted to banks. However, the remaining investment banks had grown very large and engaged in ever more risky behavior as they sought to compete with the universal banks. The advent of universal banking played an enormous role in the evolution of financial services to the conditions that existed in 2007 and 2008. The extraordinary concentration of institutions that resulted from the crisis was the final chapter in a long story.

GROWTH OF FINANCIAL SECTOR

The other dramatic development is that financial sector share of the economy has increased to unprecedented levels growing from 2.3% to 7.7% of the GDP in the last 60 years,[5] while the manufacturing and services sectors have become relatively smaller. This was not because of increased demand for financial services, which only grew by 4% in the last decade.[6] It is clear that this cannot be explained as the value of exporting financial services by US institutions.[7] The explanation lies in the domestic economy.

Perhaps most telling is the financial sector share of profits in the entire economy. The chart below, prepared by Yardeni Research, tracks 60 years of data on financial sector profits, illustrating that profit share has ranged from 8 to 34%.[8] More recent data indicate that the profit share has once again exceeded 33%.

Source: Yardeni Research, Inc.

The relative growth of the financial sector is not necessarily a problem if the services provided by the sector provide commensurate value to the overall economy. Otherwise, the reallocation of value drains resources that could be put to uses that would increase the productivity of the economy and the public’s wealth. It might benefit the owners of financial firms (and bonus recipients), but to the extent that it only transfers wealth, it does not benefit the broad economy. As discussed below, wealth transfer has been the predominant result.

A groundbreaking study by Thomas Philippon of New York University’s Stern School of Management reaches dramatic conclusions.[9] Professor Philippon uses the neoclassical growth model (which focuses primarily on productivity, capital accumulation and technological advances) to examine financial intermediation in the United States over a 140-year period. He constructs an index that measures the unit cost of financial intermediation. His work indicates that the finance industry has become less efficient in providing intermediation services over time. He summarizes his findings as follows:

[T]he finance cost index has been trending upward, especially since the 1970s. This is counter-intuitive. If anything, the technological development of the past 40 years (IT in particular) should have disproportionately increased efficiency in the finance industry. How is it possible for today’s finance industry not to be significantly more efficient than the finance industry of John Pierpont Morgan? I conclude from [the historic trends] that there is a puzzle…

Finance has obviously benefited from the IT revolution and this has certainly lowered the cost of retail finance. Yet, even accounting for all the financial assets created in the US, the cost of intermediation appears to have increased. So why is the non-financial sector transferring so much income to the financial sector? Mechanically, the reason is an enormous increase in trading.

The study indicates that the cost of intermediation between the suppliers of capital and the productive consumers of capital has increased notwithstanding IT advances, sophisticated quantitative analysis, massively larger trading volume and diversity in financial and derivatives markets. Under the Efficient Market Hypothesis (famously espoused by Alan Greenspan), the professor correctly concludes that this is absolutely counter-intuitive. But from the perspective of an observer of trading behavior and market evolution, his results make perfect sense. Technology and volumes can decrease individual transaction costs. Simultaneously, the entire intermediation system can be burdened by oligopolistic market activity that diverts value from the system. That these conditions coexist is actually the most likely outcome when one combines oligopolistic universal banking, high tech and advanced quantitative analysis and a preoccupation of money managers with transaction costs rather than fundamental value.

DECLINE OF CORPORATE LENDING

In 1978, the financial sector contracted $13 of credit for every $100 contracted by the private economy; by 2007, the financial sector share was $51.[10] This excludes the credit associated with the $30 trillion derivatives market that is a complex and volatile form of leverage. The capital and derivatives markets had largely displaced corporate borrowing.

Aside from insurance and risk transfer and payment systems, the essential service of the financial sector is efficient intermediation.[11] Sources of capital (savings, pension funds and similar funds that need to be “put to work”) must be matched up with users of capital to finance productive activities. The matching systems must be efficient in terms of fundamental capital cost and the cost of intermediation. The price paid for matching, i.e., intermediation, must be reliable and rationally related to the service provided.

Intermediation can be effectively provided by traditional commercial banking or by market based trading.[12] Commercial banks loan from capital and funds held as individual and corporate customer deposits. In this business, the mismatches between sources of capital and its uses are covered by the capital reserves of the banks. These mismatches include credit differentials in the form of loan defaults and mismatches of long-term (such as 20-year, fixed rate mortgages) vs. short term (demand deposits). As an outgrowth of the two financial crises of the 20th century, this business model was reinforced by creation of the Federal Reserve System (in response to the 1907 Panic) and FDIC insurance (in response to the Great Depression).

Alternatively, intermediation can be provided by the traded markets. Capital suppliers invest in securities (often pooling resources for investment in mutual funds), capital consumers issue securities to procure funding and both contract for derivatives. Financial institutions provide the trading capital needed to make sure that “supply and demand,” represented by capital suppliers and consumers is in equilibrium in terms of timing. Derivatives, in theory, mitigate the risk of mismatches of loan interest rates and currency differentials.

For advocates of the Efficient Market Hypothesis, the capital market is the preferred venue for intermediation. It is the perfect environment for the use of information technology and sophisticated algorithmic trading strategies that should (in their view) squeeze out even the most miniscule pricing inefficiency. The evolution of the financial system during the period of deregulation has reflected this premise, with banks declining in importance to intermediation and capital markets increasing. The bank share of all financial assets fell from 50% in the 1950’s to below 25% in the 1990’s.[13] The pace of this shift increased with the growth of money market funds, pension funds and mutual funds (providing direct investment that displaced bank lending) and securitization of consumer debt over the last 30 years.[14]

Conventional views of the markets, represented by the Efficient Market Hypothesis, would predict that the price received by providers of capital and the price received by consumers of capital must have narrowed proportionately with the greater ability to deploy vast sums of cash to exploit tiny market anomalies identified in “real time,” using technology informed by sophisticated analytics. In other words, the cost of intermediation paid by the economy as a whole should have plummeted as ever more powerful efficiencies were introduced. The research of Professor Philippon, described above, indicates that the results were precisely the opposite.

The most powerful reason behind the decline in corporate lending may well be the profit margins of the banks. A bank has finite capacity to take on the credit of any corporate entity. It can use this capacity to make a loan. Alternatively it can use the capacity to enter into a derivative or other exotic financial arrangement. As recounted by a bank insider in a recent interview, the profitability of a derivative transaction per unit of credit capacity is ten times the profitability of using the capacity for a loan.[15] This is precisely in line with my personal conversations with corporate lending professionals at large banks. Under these conditions, it is unsurprising that corporate lending has declined.

FINANCIALIZATION

The corollary to the decline in corporate lending was explosion of financialization fueled by universal banking. Professor Simon Johnson describes financialization as “the transformation of one dollar of lending to the real economy into many dollars of financial transactions.”[16] This represents the financialization of typical bank assets through asset-backed securitizations. However, equity securities (Exchange Traded Funds) and commodities (Commodity Index Funds and Commodity ETFs) are also financialization vehicles for assets that are not traditionally held by commercial banks.

The damage inflicted by asset-backed securitizations in the residential housing markets has been well documented. The large banks were able to seize a dominant position in the household lending businesses and mismanaged the process terribly.

ETFs and Commodity Index Funds have also had a destabilizing effect because of structural inefficiencies. Both are structures designed to create synthetic ownership of assets. The investors actually own instruments that are valued based in indices of market baskets of assets. Equity ETFs have been shown to influence the prices of stocks that are constituents of the particular index.[17] And Commodity Index Funds have been shown to influence commodity price curves, creating commodity price disruption by creating the impression of rising prices.[18]

Financialization has been driven by the changing role of commercial banking in a system dominated by universal banks. It is inherently an inefficient system because structural elements have unintended consequences. Mortgage Backed Securities, including synthetic MBS, were clearly the proximate cause of the financial crisis of 2008. But it is now understood that the opaque asset value associated with financialization of every sort can be seen as an inefficiency that is extraordinarily costly to the economy. In stressed conditions, it can also result in a shutdown of financial flows in part or all of the financial system. In the drive to make banking more and more universal, this is a path that is treacherous indeed.

2. What are the benefits or dangers associated with the “universal bank” model that combines traditional banking and trading? In particular, what does this mean for consumers, industry competition and financial stability?

FINANCIAL STABILITY

Clearly, concentration in the banking sector creates great danger of systemically significant failures.[19] Banks become too-big-to-fail and government is left with the Hobson’s Choice of a bailout in a crisis.[20] The existence of this phenomenon has been recognized since at least 1984, when insolvency of Continental Illinois precipitated a bailout and the Comptroller of the Currency identified 11 banks as too-big-to-fail.[21] The moral hazard implications are enormous.

However, it is more than just size. The Federal safety net that supports depository institutions is an important element. The FDIC occupies a pivotal role in resolving a failed institution that benefits from its insurance. To minimize loss, it must actively manage the disposition of the failed bank’s component parts. The government is directly involved with the entire process. In the universal bank model, the trading operations are extraordinarily complex and susceptible to liquidity crises of their own, as margin calls are made and access to securities financing such as repurchase agreements is foreclosed. It should be noted that Lehman Brothers had 2,854 subsidiaries around the globe. In this process, the government’s involvement is inescapable.

As a result, the universal banking model is a poor vehicle for the allocation of capital. The safety net and the too-big-to-fail condition mean that consequences of failure are mitigated and capital is plentiful and cheap. Business lines that might not make sense in a more limited, smaller and diverse business regime are completely rational to managers in a universal bank. Especially in complex and volatile trading activities, this can amplify the risks taken by the bank, to the ultimate detriment of the taxpayers and the economy as a whole.

CONSUMERS

But the damage is more pervasive, regardless of the occurrence of an actual bank failure. As the Securities Industry Association foresaw in the 1980s and 1990s (described above), universal banking embeds opportunities for oligopolistic and predatory business practices. Services can be tied together. Customers can become so reliant on access to the universal banks that competition is stifled. And abundant cheap capital can be deployed to create trading advantages.

Advances in technology and quantitative analysis have made this problem much worse. Transactions can be made more complex. In such circumstances, value is obscured and the market power of the universal bank can be optimized. Recent research has pointed out that the value of many derivatives products that are successfully sold to customers are beyond the ability of the most sophisticated banks to comprehend, much less the customers.[22] A separate question is why the customers buy transactions that they cannot understand. Perhaps the persuasive abilities of universal bankers are enhanced by the reliance of the customer on access to the bank.

The transfer of deposit assets to the trading business rather than lending has another subtle, but important, effect. The relationship of the banks to customers is far more transactional. A business interacts with its banks in a completely new way. The opportunity for conflicts of interest is enormous, and both sides recognize it. The long-term relationship of a business with its banks can be dynamic and stabilizing. Its decline as a way of doing business is a net loss.

BENEFITS

The benefits of economies of scale in the universal banking model are undeniable. It should be remembered, however, that even the most predatory monopoly can provide economies of scale. The Philippon study described above suggests that the balancing of costs and benefits does not favor universal banking. This system has proven efficient in maximizing profit for the banks. But it has actually made the process of raising capital for productive uses and consumer needs more costly.

It is often asserted that greater trading market liquidity is a benefit inherent in universal banking. In particular, overt proprietary trading and proprietary trading that is housed in businesses denoted as market making or similar activities is the liquidity that is referred to.

This assertion, even when made in “expert” studies, is superficial and perhaps worse. Market liquidity is generally defined as the degree to which a security or derivative can be bought, sold or entered into without affecting its market price. Liquidity must not be confused with volume. Some trading volume can provide liquidity incidentally to its actual purpose. But that liquidity is not reliable, especially in stressed market conditions when liquidity serves its most useful purpose. For example, a recent study of the “flash crash” shows that computer-driven algorithmic trading activity can amplify the price effect of a given market event.[23] Market participants misperceive the volume generated by the algorithmic traders as stabilizing liquidity. However, the algorithmic systems are rigged to exit the market and dump inventories at the worst possible time, in terms of stability. The perceived stabilizing liquidity is an illusion. In fact, this volume becomes an immense consumer of liquidity.

Nonetheless, universal banks claim that limitations on their activities will burden the economy with premia on capital investment. The forecasting of liquidity in the absence of universal banking and measurement of its consequences in terms of liquidity premia and bid/ask spreads is analytically difficult. Many factors intervene. For instance, liquidity is related to credit spreads (the interest rate impact of the credit quality of the issuer of debt) in complicated ways. Conditions in the financial markets can affect the appetite for higher yielding, lower credit quality debt. When there is great confidence in the economy and interest rates are generally low, investor appetite for the yields generated by relatively lower credit quality will be higher. As a result, liquidity is relatively higher for this category of debt. In contrast, when the economic outlook is weak and financial markets are more concerned about failures, relative liquidity is lower for this debt. This represents a “flight to quality.”

Oliver Wyman Approach to Liquidity. The recently published Oliver Wyman study is a good example of the claimed benefits. It relies on a prior study entitled “Corporate bond liquidity before and after the onset of the subprime crisis.”[24] The purpose of this prior study was to examine the particular effects of the crisis on liquidity premia. One thing is for certain: extrapolation of liquidity premia based on data from the most stressed economic and financial conditions in modern times to forecast general liquidity costs is a bad idea. The forces affecting liquidity costs under such specifically stressed conditions distort liquidity cost relationships in the extreme.

As a result of using the study of liquidity during the crisis to estimate the premium for lower liquidity, other flaws in the Oliver Wyman study are amplified. For instance, assumptions for the amount of reduced liquidity (i.e., no replacement for bank liquidity from other sources was assumed) were compounded by application of cost factor derived from distorted, extraordinarily stressed conditions.[25] The Oliver Wyman Study obtains the result it seeks because it has assumed the result as the starting point, that is to say that liquidity will evaporate rather than migrate.

In addition, the overall approach misses a critically important point. Higher liquidity premia have a self-correcting effect in normal conditions. Liquidity premia are related to bid/ask spreads. When liquidity is low, the spreads will be high because liquidity providers will require greater compensation for the service they provide. (I will buy your bond, but only if my expected compensation is relatively high, since there is greater risk of re-selling it because of low liquidity.) As bid/ask spreads increase because of lower liquidity, more capital will be attracted to the market to take advantage of the profit potential. This, in turn, moderates bid/ask spreads and liquidity premia until equilibrium is achieved.

It is remarkable that the financial services industry puts forth arguments that simply ignore the laws of supply and demand as they apply to capital.

Volume vs. Liquidity. Much of the analysis and comment is based on confusion between volume and liquidity. Trading activity that provides liquidity, in particular market making, provides real value to the economy. Other activity generates volume, but the value is less clear, to say the least. In fact, this activity may impose a net drag on the economy. Recent academic studies indicate that

- dealer activity is overwhelmingly weighted toward trading that does not provide liquidity;

- activity that represents the greatest volume increases the costs of accessing liquidity; and

- the layers of intermediation that have arisen from trading practices other than market making, while efficiently executed to generate profits for traders, involve costs to the rest of the economy that result in an inefficient financial system for the economy as a whole.

As a result, the assertion that universal banking benefits the economy is extremely questionable, and the better analysis is that the real economy suffers costs. These studies are reviewed below.

A study by professors at MIT’s Sloan School of Management examines this issue in the context of modern market behavior.[26] The Wang Study focuses on a phenomenon illustrated most graphically by the Flash Crash. While trading volumes may be extremely high, most dealer trading does not appear to be providing market making. It does not work to provide liquidity to investors so as to provide stable and efficient pricing. Key points of observation are times of market stress.

Not only is the social function of liquidity provision most important to other market participants during these periods, it is also these periods (when prices have likely diverged from fundamentals) during which expected profits from providing liquidity should theoretically be the highest. Therefore, if market makers are providing liquidity by accommodating order imbalances, we should observe greater dealer trade activity during periods of higher volatility and kurtosis.[27]

The Wang Study finds that such greater activity does not occur at these times. Further, the study finds substantial evidence that trading activity is largely based on information and designed to profit from short-term price movements. “We have shown that dealers do not provide liquidity to the market; instead, they trade on information.”[28]

In contrast with the Oliver Wyman Study, a better analysis of the universal banking model is that the effects on liquidity largely center on the availability of subsidized capital deployed to chase transactions that would not make sense but for the subsidy. Capital raised by short-term leverage (which is so dangerous to the markets) may also recede as lenders can no longer depend on a too-big-to-fail bail out. It can also be anticipated that high frequency, algorithmic trading activity will moderate as more demanding and socially useful rationales for capital deployment are imposed.

But more importantly, the liquidity argument centers on transaction costs. When the market is functioning normally, volume can have beneficial effects on transaction costs (often expressed as bid/ask spreads). But this does not translate directly into an efficient intermediation system. If a significant portion of the market volume actually distorts the perceived value of the securities and derivatives being traded, the transactions may be inexpensive to transact but also fundamentally mispriced. Elimination of the perverse incentives induced by the universal banking system will result in a more rational and disciplined set of market participants. This should curb the volume that is injurious to the economy and improve the efficiency of the overall market function.

Liquidity may be affected if universal banking were not the norm, though the Oliver Wyman Study provides little guidance on how. But the best analysis is that the effects will be, on the whole, healthy for the economy and the public. The recent study by Thomas Philippon of New York University’s Stern School of Business described above undertakes a quantitative analysis of the economy-wide cost of financial intermediation over the last century through the device of a “finance cost index.”[29] The Philippon Study concludes that, historically, the cost of intermediation has been remarkably stable. However, the further conclusion is particularly relevant to the liquidity discussion: the financial cost index has been trending upward for 40 years, a period when technological and quantitative advances must have reduced financial costs.[30]

At least a part of the answer to this puzzle may well be the inefficient deployment of bank capital to layers of uneconomic intermediation as banks seek higher returns from the spreads between cheap capital costs and exotic securities and derivatives. This is completely consistent with the answer suggested by Professor Philippon.

Finance has obviously benefited from the IT revolution and this has certainly lowered the cost of retail finance. Yet, even accounting for all the financial assets created in the US, the cost of intermediation appears to have increased. So why is the non-financial sector transferring so much income to the financial sector? Mechanically, the reason is an enormous increase in trading.[31]

The layers of socially unproductive intermediation are best illustrated by the algorithmic trading that contributes heavily to today’s market volume. In fact, it is clear that the dominance of algorithmically driven trading using techniques associated with high frequency trading does not provide liquidity. Rather, it consumes liquidity with adverse consequences. A recent study of these issues draws conclusions that are summarized as follows:

We analyze the impact of high frequency trading in financial markets based on a model with three types of traders: liquidity traders (LTs), professional traders (PTs), and high frequency traders (HFTs). Our four main findings are: i) The price impact of liquidity trades is higher in the presence of the HFTs and is increasing with the size of the trade. In particular, we show that HFTs reduce (increase) the prices that LTs receive when selling (buying) their equity holdings. ii) Although PTs lose revenue in every trade intermediated by HFTs, they are compensated with a higher liquidity discount in the market price. iii) HF trading increases the microstructure noise of prices. iv) The volume of trades increases as the HFTs intermediate trades between the LTs and PTs. This additional volume is a consequence of trades which are carefully tailored for surplus extraction and are neither driven by fundamentals nor is it noise trading. In equilibrium, HF trading and PTs coexist as competition drives down the profits for new HFTs while the presence of HFTs does not drive out traditional PTs.[32]

Thus, algorithmic and high frequency trading actually extracts value by intermediating between liquidity providers (market makers) and liquidity traders (large scale investors) and extracts value so as to widen spreads. This volume does not provide liquidity that is beneficial to the overall intermediation process; it exploits the process at a cost to the investors.

The consequences to the shape of the American economy are potentially dramatic. Professor Philippon eloquently poses this issue as follows: “the finance industry that sustained the expansion of railroads, steel and chemical industries, and the electricity and automobile revolutions was more efficient than the current finance industry.”[33]

INDUSTRY COMPETITION

It is difficult to imagine a financial services industry that is less competitive than that which prevails today. As described above, concentration has increased dramatically in the last 35 years. The advent of universal banking in the United States is a primary cause.

A reversal of this condition would undoubtedly reorder the industry. Capital and talented personnel would migrate from the dominant universal banks into existing and new institutions. It is likely that investment banks would reemerge. Without the need to compete with the subsidized and plentiful capital of the universal banks, the investment banks would probably be leaner and more risk averse than they were in the years leading up to the crisis. Importantly, conflicts of interest that are embedded in the existing system would decline.

Indeed, the buy-side has recognized the harm to their bottom line posed by the universal banks trading against them. In its 2009 report on financial reform, the Council of Institutional Investors (“CII”) prominently highlighted the need to address proprietary trading, noting that "Proprietary trading creates potentially hazardous exposures and conflicts of interest, especially at institutions that operate with explicit or implicit government guarantees. Ultimately, banks should focus on their primary purposes, taking deposits and making loans."[34] As one member of the CII Investors’ Working Group panel explained it, proprietary trading has significantly harmed the institutional investors:

Proprietary trading by banks has become by degrees over recent years an egregious conflict of interest with their clients. Most if not all banks that prop trade now gather information from their institutional clients and exploit it. In complete contrast, 30 years ago, Goldman Sachs, for example, would never, ever have traded against its clients. How quaint that scrupulousness now seems. Indeed, from, say, 1935 to 1980, any banker who suggested such behavior would have been fired as both unprincipled and a threat to the partners’ money.[35]

Furthermore, the bipartisan Levin-Coburn Report by the Senate Permanent Subcommittee on Investigations offers a detailed description of some of the conflicts of interest that directly cost investors billions of dollars.[36]

SUMMARY

Balancing benefits and dangers is critically important to the economy as a whole. If capital is misallocated away from productive uses and value is extracted by the universal banking system, the ability of businesses to generate productive employment is damaged. Income inequality grows as the value of non-financial employment shrinks and the profit share of the financial sector increases (along with bonuses). And the effectiveness of monetary policy is diminished as the system of intermediation capital sources to productive uses is compromised.

In reality, the issues of systemic risk and the efficient functioning of the financial system are one in the same. In the US economy, inefficiencies are exploited relentlessly and incent risk-taking in the process. Asset and debt bubbles, together with the inevitable bust cycles, are an obvious result. The velocity of these forces is breathtaking in markets operating with high technology and fast evolving financial innovation. Universal banking, in the context of the US economy, is inherently risky and costly.

3. Do traditional banks need to be large or engage in trading/investment banking activities in order to serve clients and customers, including large multinational corporations?

4. Can the needs of customers be served by smaller banks, or banks that solely provide particular services?

Large, oligopolistic companies always raise the issue of economies of scale when arguing against the efficiencies of competition. This position is particularly difficult to understand in the context of universal banks that are too-big-to-fail.

It is understandable that large clients and customers might perceive benefits from dealing with universal banks. Much of the service provided to these entities involves renting the balance sheet of the universal banks. If a large customer seeks to move a big securities position, its bank will take it off the customer’s hands and distribute the position over time so as not to affect the price by flooding the market. The cost of capital to hold the position is transferred from the customer to the bank. If the capital of the bank benefits from the Federal safety net and too-big-to-fail status, the customer benefits proportionately.

The problem, of course, is that the benefit exists because the American taxpayer ultimately bears risks of the universal bank’s failure. No one sees the cost until a financial crisis ensues and a very large bill is presented to the public.

Implicit in the question is that only large universal banks will serve the trading/investment banking needs of the multinational corporations. Such an assertion would have sounded ludicrous to the bankers in Goldman Sachs’ London office in 1995 that competed so successfully with European universal banks (and I should know, having been assigned there at that time). In reality, customers would be served better by a financial sector made up of an array of smaller, institutions that are well capitalized in relation to their business activity. In this model, conflicts of interest would be fewer and costs more transparent. The incremental costs to users of services from a leaner system would be those associated with too-big-to-fail. This is a good trade indeed.

5. Does the government offer support or subsidies for large banks? If so how?

The response to question 1 details the support provided in the form of too-big-to-fail realities and the Federal safety net of FDIC insurance and access to the Fed window.

There are indirect supports as well. Large banks depend on an enormous number of businesses to trade continuously. The too-big-to-fail guarantee that was made explicit in 2008 is not useful unless it extends to the large bank ecosystem. Thus, the $700 billion direct bank bailout known as the Troubled Asset Relief Program, or “TARP,” was only the tip of the iceberg. The Federal Reserve acted decisively, barely pausing to build consensus or consult with political leaders. It allowed banks to borrow freely at low rates, a conventional tool of the central bank, and provided interest on amounts deposited by the banks on reserves, generating a risk-free arbitrage profit. And, on the heels of the Lehman Brothers collapse, it was discovered that AIG, the world’s largest insurance company, was bankrupt as a result of spiraling losses on exotic financial instruments. This threatened to drag the banking system down alongside AIG. The Fed loaned it $85 billion to cover amounts owed to the largest banks, a mere down payment into the financial black hole that AIG was fast becoming. The money passed directly through to the creditor banks, taking pressure off of the financial system but adding to the amount of the “bail out.”

But the bailout was even broader. Over thirty years of deregulation, the financial system had rapidly evolved away from the structures put in place during the Great Depression, and the new system could not withstand the stresses of 2008. Pushing the bounds of its legal authority, the Fed took actions targeted at critical elements of the new system that dwarfed TARP in scope, but of which that the public was largely unaware.[37]

- Losses at money market funds threatened a depositor run on the $3.4 trillion of assets held by these entities.[38] Over the years, money market funds had largely replaced conventional bank savings deposits, but these funds did not enjoy the stabilizing benefits of FDIC deposit insurance, the New Deal program assuring against depositor runs. The Fed immediately put a lending facility in place that effectively guaranteed money market deposits and warded off a catastrophic run that would have dragged down the banks.

- One of the most popular investment sources for money market funds is the commercial paper market into which companies and structured financing vehicles sponsored by banks issue short term IOU’s. In 2008, there was $1.8 trillion of commercial paper outstanding, approximately 70% of which had terms of 3 days or less.[39] When the commercial paper market started to fail, the Fed stepped in to purchase the IOUs and guarantee investors that the commercial paper would be rolled over or paid off as it matured.

- Banks had more and more used “repurchase agreements” to finance their holdings of securities and derivatives. They would borrow money against the securities and derivatives, agreeing to repay the loans and retrieve the collateral on a daily basis. The “repo” market, as it was known, had mushroomed to $4.5 trillion and almost all of it had to be rolled over every single day.[40] As banks grew to believe that other banks might implode at any moment, and as the securities and derivatives used as collateral fell in value, repurchase agreement lending started to dry up. Banks started selling off the securities and other collateral that could no longer be financed, creating a “fire sale” effect. This drove down the collateral value of the securities and derivatives, threatening a death spiral of epic proportions. The Fed stepped in to guarantee the repo market, slowing the spiral.

- Foreign banks needed access to US dollars to avoid default on ongoing dollar denominated liabilities. They could not rely on borrowing dollars in the crippled US commercial paper market. So the only source was the market for swapping dollars in exchange for other currencies with US Banks, a $4 trillion per day market.[41] Banks in other countries came to doubt the reliability of US banks - no one knew whether US bank were solvent. A worldwide collapse might ensue if the foreign banks defaulted for want of dollars. The Fed offered unlimited access to foreign central banks to swap dollars for foreign currency so that the central banks could in turn loan dollars to local banks, avoiding their default. Most accurately measured, the daily peak of Fed swaps exceeded $850 billion.

Actions by the US administration, Congress and the Fed held off a general collapse, but the consequences of these events persist to this day. Andrew Haldane, Bank of England Executive Director for Financial Stability, has estimated the ultimate cost to the worldwide economy to be between $60 and $200 trillion.[42] By comparison, worldwide GDP for the 12 months ending May 2011 was $65 trillion.[43] To state the obvious, even if Haldane’s figure is off by a bit, the consequences have been grave.

As a result, the subsidy provided by the too-big-to-fail reality extends far beyond a direct bailout to the banks. It covers the ecosystem that supports their continued existence.

6. Is government “safety net” support appropriate, either for institutions of a certain size or for institutions that engage in certain activities?

Bank runs of various sorts continue to be a threat to the financial system. In one manifestation, depositors instigate a run on the system by withdrawing deposited funds (recall Jimmy Stewart holding off the townspeople in It’s a Wonderful Life). This happened to money market funds in 2008. In another version, banks cut off short term funding provided to other banks. This occurred in the bank-centered repurchase agreement, commercial paper and currency swap markets in the recent crisis, as banks decided that no one holding toxic assets could be trusted. If the “bank run” cannot be contained, commercial activity comes to a halt, as in the Great Depression.[44] Mitigating the risk of such an event has obvious value, and as Andrew Haldane’s estimate illustrates, the value is indisputably enormous.

The safety net must target the financial panics that can lead to runs. Depositor runs are addressed by deposit insurance. Interbank liquidity runs are addressed by access to the Fed window.

But the safety net makes sense only under certain conditions. Foremost, is that the safety net should only be used to benefit low risk, stable return institutions. Commercial banks, not universal banks, fit this description. The commingling of deposit insurance and financial market intermediation is inherently a source of systemic risk and moral hazard.

Furthermore, the safety net only makes sense if other sources of bank runs, transmitted through interconnectedness, are addressed by either regulatory intervention or similar safety nets. Regulation is far preferable. The potential for money market depositor runs must be dealt with. Fed Chairman Bernake has recently reiterated this point and pledged to take action.[45] Similarly the inherent instability of the repurchase agreement market must be addressed. Some prospects for this exist, but the prudential regulators need to be extremely meticulous in the measurement of the short-term volatility of this market and the required liquid capital needed to mitigate its effects. Similarly, the stability of the $4 trillion a day foreign exchange market must be addressed. An answer to this seems far away. The intervention by the Fed to facilitate transactions, which continues to this day, is not a solution.

Finally, systemically important financial institutions must be designated and brought under prudential supervision, as envisioned in the Dodd-Frank Act. It is unrealistic to believe that dealing with banks subject to the safety net will avoid the contagion of major failure by systemically important non-banks. The Dodd-Frank regulation of systemically important non-banks must be finalized.

7. Would you favor limiting the size – for example, leverage or nondeposit liabilities - of financial institutions?

Leverage is a critically important issue. The assets held by the financial sector exploded in the 30 years prior to 2008, and it was in large part financed with debt. In 1978, commercial banks held an aggregate of $1.2 trillion in assets, or 53% of the US GDP. By the end of 2007, this figure had grown to $11.8 trillion representing 84% of GDP. Similarly, investment banks grew from $33 billion (1.4% of GDP) to $3.1 trillion (22% of GDP).[46] Compare this with the $4.7 trillion repurchase agreement market in which securities are financed by selling them with an obligation to repurchase, primarily in overnight transactions (described above). This practice - in substance, a form of secured lending - exposes the financial system to tremendous risk. Declines in the value of securities impair the value of the collateral securing the loans. Banks can be forced to sell the securities to extinguish the repo debt, and this causes securities to decline further setting off a dangerous spiral.

Regulations limiting debt to equity rations are important. Prudent rations are in the range of 10 -15 to 1, a far cry from the levels of 2007 and 2008. However, limitations on leverage must effectively measure and limit the use of short term financing, such as repos and securities lending. These limitations must not be limited to the trading books of banks. They must take into consideration the potential moving of assets to the loan books as well.

Other non-deposit liabilities must also be addressed. Off balance sheet financing of assets was a major component in the demise of Bear Stearns. Banks must be foreclosed from entanglement in hedge funds and asset-backed financings.

But derivatives pose a risk even larger. These positions must be seen for the leveraged transactions that they are. This $30 trillion per year market embeds huge uncapped credit exposures to price movements in a vast array of securities, commodities and other assets. Transactions through clearinghouses, a goal of the Dodd-Frank Act and international policy-makers, are managed transparently under rules overseen by regulators. However, the bilateral over-the-counter market will simply not be eliminated by the Dodd-Frank Act, with its exclusions for end users and other derivatives users.

Finally, the corporate practices of the banks create leverage that goes unseen. The banks operate multiple subsidiaries throughout the world. As an example, Lehman Brothers had 2,854 subsidiary companies. A common practice is to manage risk on a consolidated basis and sweep cash into the parent institution, often as frequently as overnight. It is unrealistic to assume that the exposures of subsidiaries, and in particular complex and difficult to measure undertakings, do not constitute leverage of the parent bank.

8. Would you favor limiting activities of individual banks, such as restricting the amount of investment banking or trading activities they may engage in?

There are three conceptual ways to limit the risks of investment banking businesses conducted by universal banks. Some or all of these investment banking activities can be prohibited, with priority given to those that involve the greatest risk. Safe forms of capital may be required as reserves against loss and as a means of curbing excessive risk taking. And regulations may require the activities to be ring-fenced in subsidiaries that can fail without damage to the bank. Of these, the approach in the US has focused on activity restrictions and capital requirements, recognizing that the conceptual justification of ring fencing may well prove to be illusory in practice.

The need for activity restrictions is inescapable. Capital requirements are useful, especially if intelligently applied in proportion to the risks that are reserved against. However, capital requirements are based on the measurement of risk. Faulty risk measurement was a major factor in the financial crisis. Forecasting risk is always influenced by historic experience, even if the statistical measurements relied on prior to 2008 are expanded. It is difficult to anticipate the unprecedented.

Moreover, risks are measured using forecasting models. This is a reasonable and centrally important practice. But models are created by people and are therefore subject to their biases.

Prudency dictates that there are activities that simply must be prohibited to banks. This does not mean that a given activity cannot exist in the marketplace. It means that the activity must be limited to financial institutions that are not commercial banks.

Section 619 of the Dodd-Frank Act (often referred to as the Volcker Rule) is intended to prohibit activities, in particular proprietary trading and excessive involvement with hedge funds. Certain proprietary activities are permitted, most notably market making. The response from industry has been loud and strong, as should be expected. For example, it is asserted that taking a position, with respect to which there is no market for the bank to exit the trade, is actually market making if the counterparty is a client. Taking on such a risk is not primarily motivated as customer service; it is primarily a proprietary bet. One hopes that the regulatory agencies do not suffer from amnesia: positions that cannot be liquidated at a known price precisely describes the toxic assets that rendered bank balance sheets indiscernible, triggering the runs that caused the crisis.

The Proposed Rules to implement Section 619 are said to be long and complicated, but this is an almost absurd exaggeration based on a double-spaced version and including the lengthy discussion of the issues issued with the Proposed Rule. The Proposed Rule itself runs only about 13 pages in the Federal Register, with 12 pages of appendices, hardly a threat to any record for length of regulation. The reason behind any complexity is not the desire of regulators to burden the banks with rules. Section 619 of the Dodd-Frank Act surgically excises only those elements of trading that pose the greatest risks, allowing banks to continue activities such as market making, underwriting and restrained participation in hedge funds and private equity funds. The intent was to limit bank activities as little as possible.

However, the banks themselves had allowed the proprietary trading fever to infect the client-oriented businesses that the Volcker Rule seeks to exclude from the prohibition. For instance, desks engaged in client-oriented market making could never hope to generate revenues to match their colleagues on desks explicitly dedicated to prop trading. As a result, market-making desks migrated into prop trading by seeking client business that justified the accumulation of huge positions that they called “inventory” (semantics that are best described as Orwellian). There is no better illustration than the recent Oliver Wyman study that describes inventory levels at 4.6 times average daily volume for less liquid products.[47] The conclusion is inescapable: this is not making a market under any conventional meaning of the concept; it is proprietary trading using a more benign name.

As a result, to preserve certain activities that are less risky, client oriented businesses, the regulators were compelled to define and describe them using legitimate, non-Orwellian rules and monitoring regimes.

Moreover, many of the complexities of the Volcker Rule stem from endless entreaties of financial institutions, which met with the regulatory agencies some 350 times. Having prevailed with the insertion of numerous exceptions and permissions, it is ironic that banks now complain about the complexity that is an inescapable consequence.

The only reasonable response to the criticisms leveled to date regarding the Proposed Rule under Section 619 is to eliminate the exceptions from the proprietary trading prohibition for less risky forms of trading. That way, the banks will not have to be monitored for non-compliance, behaviors that they have exhibited in the past.

***

Thank you for the opportunity to present my views.

[1] Thomas Philippon, “The Size of the US Finance Industry: A Puzzle,” November 2011.

[2] Senate Banking Committee, Comprehensive Reform in the Financial Services Industry, Part II, June 11, 13, 18-20, 1985, S. Hrg. 99-120, pt. 2, testimony of Shapiro, Robert F., board chairman, Securities Industry Association (SIA).

[4] Federal Reserve Bank of Dallas, 2011 Annual Report, Choosing the Road to Prosperity, available at http://www.dallasfed.org/fed/annual/index.cfm.

[5] Thomas Philippon, “The Equilibrium Size of the Financial Sector,” New York University, August 2007.

[6] Thomas Philippon, “The Evolution of the Us Financial Industry from 1860 to 2007: Theory and Evidence,” November 2008, available at http://pages.stern.nyu.edu/~tphilipp/papers/finsiz.pdf.

[8] Yardeni Research, Inc., “Products, Productivity, Prosperity,” March 7, 2012.

[9] Thomas Philippon, “Has the U.S. Finance Industry Become Less Efficient?” November 2011. (Hereinafter cited as “Philippon 11/2011”).

[10] Simon Johnson and James Kwak, “Thirteen Bankers,” Pantheon Books, 2010 at page 59.

[11] Thomas Philippon, “The Size of the US Finance Industry: A Puzzle,” November 2011.

[12] Ross Levine, “Bank-Based or Market Based Financial Systems: Which is Better?” William Davidson Institute Working Paper 442, February 2002.

[13] Hyman Minsky, “Stabilizing an Unstable Economy,” McGraw-Hill, 2008, introduction at page xxii.

[14] Johnson and Kwak, at page 84.

[15] Frontline Broadcast, “Money, Power and Wall Street.” Chapter 2, available at http://www.pbs.org/wgbh/pages/frontline/money-power-wall-street/.

[16] Johnson and Kwak at page 59.

[19] Federal Reserve Bank of Dallas, “Choosing the road to Prosperity: Why We Must End Too-big-to-fail Now” available at http://www.dallasfed.org/fed/annual/index.cfm

[20] Gary H. Stern and Ron J. Feldman, “Too-Big-to-Fail: The Hazards of Bank Bailouts,” Washington: Brookings Institution Press, 2009.

[21] Johnson and Kwak at page 134.

[22] Arora, S., Barak, B., Brunnermeier, M., Ge, R., “Computational Complexity and Information Asymmetry in Financial Products,” October 19, 2009, available at http://scholar.princeton.edu/markus/publications/term/39.

[23] A. Kirilenko, A. Kyle, M. Samadi and T. Tuzun, “The Flash Crash: The Impact of High Frequency Trading on an Electronic Market,” May 2011 available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1686004.

[24] J. Dick-Nielson, P. Feldhutter and D. Lando,” Corporate bond liquidity before and after the onset of the subprime crisis.” May 2011, available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1364635.

[25] To calculate the cost of power liquidity, the Oliver Wyman Study used values calculated by Dick-Neilson, Feldhutter and Lando. Oliver Wyman describes how they selected the particular cost percentages for their study: “DFL construct two independent ‘panels’ of bond liquidity data – one for the Q3 2005-Q2 2007 period, one for the Q3 2007-Q2 2009 period – using TRACE data. The most recently available panel is used in our analysis; the earlier period shows smaller, but still significant effects.”

[26] J. Chae and A. Wang, “Who Makes Markets? Do Dealers Provide or Take Liquidity?,” August 2003 (the Wang Study”) available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1364635.

[27] Wang Study, pages 17-18.

[28] Wang Study, page 30.

[29] Thomas Philippon, “Has the U.S. Finance Industry Become Less Efficient,” November 2011 (“Philippon Study”), available at (SSRN-id1972808[1]).pdf.

[30] Phillipon Study, pages 16-17.

[31] Phillippon Study, page 22.

[32] A. Cartea and J. Penalva, “Where is the Value in High Frequency Trading?,” December 2011, available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1712765.

[33] Philippon Study, page 2.

[34] CII Investors’ Working Group, “U.S. Financial Regulatory Reform: The Investor’s Perspective,” July 2009, page 3, available at http://www.cii.org/UserFiles/file/resource%20center/investment%20issues/Investors'%20Working%20Group%20Report%20(July%202009).pdf)

[35] Jeremy Grantham, “Lesson Not Learned: On Redesigning Our Current Financial System,” GMO Q. LETTER SPECIAL TOPIC, 2 (Oct. 2009), available at http://www.scribd.com/doc/21682547/Jeremy-Grantham.

[36] United States Senate, Permanent Subcommittee on Investigations, Committee on Homeland Security and Governmental Affairs, Majority and Minority Staff Report, “Wall Street and the Financial Crisis: Anatomy of a Financial Collapse,” April 2011.

[37] Board of Governors of the Federal Reserve System, Office of Inspector General, “The Federal Reserve’s Section 13(3) Lending Facilities to Support Overall Market Liquidity: Function, Status, and Risk Management,” November 2010.

[38] Diana Henriques, “Treasury to Guaranty Money Market Funds,” New York Times, September 19, 2008, available at http://www.nytimes.com/2008/09/20/business/20moneys.html.

[39] Richard Anderson and Charles Gascon, “The Commercial Paper Market, the Fed, and the 2007-2009 Financial Crisis,” Federal Reserve Bank of St. Louis Review, November/December 2009, 91(6), pp. 589-612, available at http://research.stlouisfed.org/publications/review/09/11/Anderson.pdf.

[41] Bank for International Settlements, “Triennial Central Bank Survey, Report on Global Foreign Exchange Market Activity in 2010,” December 2010, available at http://www.bis.org/publ/rpfxf10t.pdf.

[42] Paul Hannon, “Economic Hit from Crisis: A very Big Number,” Wall Street Journal, March 30, 2010; text of speech available at www.bankofengland.co.uk/publications/speeches/.../speech433.pdf

[43] “In Search of Growth,” The Economist, May 25. 2011, available at http://www.economist.com/blogs/dailychart/2011/05/world_gdp.

[44] Bernanke, Ben S., "Non-Monetary Effects of the Financial Crisis in the Propagation of the Great Depression," American Economic Review, 73 (June 1983), pp. 257–76.

[45] International Business Times, “Bernake Calls for More Shadow Banking Curbs,” April 10, 2012, available at http://www.ibtimes.com/articles/326117/20120410/federal-reserve-bernanke-speech-shadow-banking-regulation.htm.

[46] Johnson and Kwak at page 59.

[47] Oliver Wyman Study, page 9.