Introduction

The Financial Infrastructure Exchange (FIX) is a federal tax-and-subsidy program to promote long-term investment in a financial system that otherwise prioritizes short-term gains. Funded by a financial transactions tax (FTT) on a spectrum of short-term trading activities, FIX revenues empower institutional investors—like pension funds, individual retirement accounts, or college endowments—to shift their allocation of capital toward much-needed, longer-term investments, including investments in next generation infrastructures for sustainability needs. By leveraging such investment, the FIX can also be the cornerstone for new large-scale job creation in an era of diminishing employment opportunities in the private sector and in many or our communities—particularly in communities of color, which were hardest hit by the Wall Street crisis and the Great Recession.

The FIX is predicated on the idea that the financial system is badly misaligned with the need to meet pressing twenty-first century economic, environmental, and social challenges. In particular, the FIX provides a remedy for the problem of financial models that value short-term price and liquidity higher than long-term value creation. This and related phenomena are often referred to as financial “short-termism.”

Financial short-termism—a product, ultimately, of the shortened time-scales used to measure the value of investments—burdens our infrastructure development, particularly for sustainability needs. This is mainly a consequence of the hyper-valuation of continuous liquidity (the ability to liquidate or acquire investments at a moment’s notice and at a discernable and reliable price). While liquidity is important, it is not the only factor that investors should value, though it is one of the easiest to measure. Because of this ease of measurement and because continuous liquidity serves its interest, the financial sector has emphasized it. As a consequence, longer time-scale benefits are devalued and the long-term needs of society are starved of capital. By realigning capital flows within the financial system, the FIX provides a plausible alternative to short-termism. It would allow institutional investors to support infrastructure and sustainability projects, and, in so doing, build momentum toward a more inclusive and resilient economy.

How the FIX Will Work

The FIX will be structured as follows: Revenues from a targeted set of financial transactions taxes will be placed in one or more public trusts with the fiduciary purpose of incenting pension funds, retirement accounts, and other large pools of public and private capital to invest in infrastructure, new technologies, environmental needs, education, and other social goods with long-term value. There could be a single federal trust that pays out subsidies to qualifying investors in projects that are brought forward by state or regional entities. Alternatively, there could be state and regional trusts established by state governments to pay out investment subsidies for projects within their jurisdictions. In that case, the trust funds could be administered by existing development or financing agencies previously established under state law.

Essentially, the FIX subsidies will be used to offset perceived liquidity costs of long-term investments. As a result, more institutional capital will be made available for such investment because it will be competitive with more liquid alternatives. Importantly, the FIX’s reliance on an FTT will not impose net costs on middle- and lower-income savers or retirees, because the revenue is channeled directly to institutional investors.

Directing subsidies to investors, rather than project sponsors or new companies (“sponsors”), is a critical feature of FIX. While obviously this benefits sponsors who are enabled to raise financing for their undertakings, directing subsidy to investors has a number of benefits. First, the sponsors must demonstrate to institutional investors that they are good credits with reasonable business plans. Government is not responsible for picking winners and losers and pricing enterprise value. Also, if the sponsor fails, the investors take a loss. A portion, but not all, of the subsidy may be lost. Thus, the subsidy is earned over time.

Importantly, the FIX design can and should have a decentralized governance structure to assess project choices, requiring ongoing community involvement in both the determination and prioritization of qualified investments and in setting workforce standards in connection with FIX-subsidized investments. Thus, the FIX is not only a large-scale infrastructure finance policy; it is also a new and potentially game-changing platform for inclusive economic development.

The FIX is also, plainly, a financial reform policy, aiming to curb harmful financial activities linked to volatility and asset bubbles. In this respect, predictable criticism will arise from supporters of the status quo, who argue that such taxation will restrict financial liquidity and consequently increase the cost of capital funding. However, any market liquidity costs experienced by investors will be more than offset by the investors’ enhanced returns on long-term assets and by improvements in macroeconomic performance linked to the growth in these assets.

Moreover, by directing the revenues to investors, it will constitute an alteration of investment patterns without having an impact on the federal budget and without being dependent on congressional appropriations. The tax revenues will be devoted exclusively to the FIX and will not pass through the budget. If the tax revenues are not sufficient, the recipients of the subsidy, the investors, will receive less subsidy. In fact, the FIX is designed to generate budget benefits for at least two reasons. It will increase economic activity by increasing investment, thereby lifting incomes and tax revenues. In addition, to the extent that the FIX is used in lieu of conventional tax expenditures for the exemption of state and local bond interest from taxation, there would be a budgetary benefit.

Why Do We Need the FIX?

The United States suffers from significant underinvestment in infrastructure and other broadly beneficial capital uses (“Sustainability Investments”), a condition that has deteriorated even further with the fiscal austerity of recent years. We have estimated that the deficit for clean energy and infrastructure alone is in the range of, at a minimum, $400 billion per year, measured by the goal of not falling further behind. This investment deficit is a major concern for the long-term health of our economy and for societal well-being in a time when collective needs and risks are growing in our society. Moreover, it is a foregone opportunity for substantial job creation in an economy with a shrinking supply of good jobs in the private sector and diminishing effective demand in the overall economy. Substantial sustainability investments will directly generate large numbers of secure and well-paying jobs while improving societal well-being and restoring infrastructural competitive advantages for our economy as a whole.

The FIX funding proposal balances the investment misallocations because the financial activity to be taxed is causally related to the investment deficit. Structural change of the capital allocation process has been a major contributing factor, as traded capital markets and managed investments such as hedge funds have come to dwarf commercial lending and consumer credit markets. The primary benefit of the trading markets is that they provide better liquidity for investors, either through direct investments or indirectly via hedge funds and mutual funds. With efficiently functioning and active trading in secondary markets (meaning markets in previously issued securities and derivatives), investors have the opportunity to liquidate investment positions at predictable and transparent prices. Investors pay a premium for this liquidity by lowering their required return on investment, and this can benefit businesses, governments, and households that rely on capital funding by lowering capital cost.

However, the liquidity premium is largely derived from values that affect price over short time scales. The value of sustainability investments, on the other hand, is realized over much longer time scales, and, because of this, as well as the non-excludability of benefits in many cases, the values appear less certain. It is difficult to translate these values into short-term prices because they occur so far in the future and are relatively uncertain and diffuse. Thus, sustainability investment funding is burdened by being relatively ill-suited to investment sources in the existing market structure. The long-term benefits of sustainability investments are simply not valued in a financial system increasingly dominated by short-term trading activities and related trading technologies. In the existing market structure, mismatches between sources and uses of capital are often reconciled by derivatives intermediated by the financial sector. This form of intermediation is generally not available for sustainability investments and, as a consequence, investment in sustainability has been sporadic and unreliable.

The FIX is not intended to eliminate the accessibility of the benefits of short-term liquidity to investors. Instead, it is designed to rebalance investment toward assets and goods with longer-term valuations and returns, linked to sustainability. By tying the subsidy to sustainability investments, the proposal will shift capital allocation by major long-term investment pools toward purposes that will benefit the economy and increase the wellbeing of the public for many decades to come. Under the FIX, capital reallocation to long-term assets will benefit investors, rather than burden them. Thus, aggregate capital costs to businesses, government, and households will not increase, but the use of capital will be reprioritized in favor of sustainability. The failure of the private capital markets to fund these projects because of the rise of capital intermediation through traded markets will be remedied or at least mitigated.

Moreover, many sustainability investments (in particular, infrastructure) are subsidized by a grant of tax exemption of the interest on state and municipal debt. Using that form of subsidy narrows the categories of investors who are likely to invest in that debt. Investors who do not pay income taxes on current interest earnings cannot transmit the subsidy to the state and local debt issuers because the tax exemption is valueless to them. Longer-term investors who do not pay taxes, such as retirement funds and endowments of non-profits, are not appropriate buyers of tax-exempt debt. Instead, investors such as money market mutual funds, for whom the liquidity premium is extremely important, are prominent investors in tax-exempt debt. Banks often provide extraordinary levels of liquidity for tax-exempt debt through complex interest rate swaps and standby purchase credit facilities, a costly and risky alternative that absorbs much of the subsidy. The FIX will open up vast pools of capital to state and local governments with less risky financial structures while compensating them for the loss of the federal tax exemption, lowering the overall cost of capital to these governments.

Finally, in the face of likely fiscal constraints on discretionary spending in the coming decades, the FIX promises a new pathway for revitalizing public investment in foundational assets and collective needs. The FIX design of leveraging private capital investment with subsidies underwritten by a financial transactions tax is not only fiscally neutral but, in fact, is likely to be deficit-reducing due to long-run growth effects associated with sustainability investments.

How Will the Policy Work?

We propose a program to reconcile the needs of long-term investors with the value profile of sustainability investments. The program is not intended to provide direct subsidies to sustainability projects but instead will encourage private investment in such projects.

The policy is designed around four structural elements: (1) The types of investment to be incented; (2) The mechanism for delivering the subsidy; (3) The type of charge to be levied against financial transactions and the potential annual revenue from the charge; and (4) The target investors who will benefit directly from the subsidy.

Investments to Be Incented

The proposal is designed to increase reliable and sensible investment in activities that enhance the sustainability of the US economy and the well-being of households. The following classes of investments will be included:

- Next generation transportation, energy, water, and wastewater infrastructures

- Large-scale energy efficiency projects

- Green residential development initiatives

- Technological advances for sustainability needs

- Community-based energy development

- Improvement of the electricity grid to foster sustainability

- Early decommissioning costs for assets that adversely affect sustainability

- Leveraging community buyouts/ownership of power utilities

- Public broadband and other information infrastructures

- Community-sustaining public and private enterprise

- Education, community health, and other human/social capital investments

- Sustainable agriculture/local food economies

- Environmental restoration

- Conservation projects

- Sustainable fisheries

Within these categories, the FIX envisions criteria that would establish priorities for application of the subsidy based on regional needs as well as broad, nationwide benefits. As a result, channels of regional input will be needed as well as a methodology for assessing demand across regions, discussed below.

Each endeavor to be financed will involve returns to investors as well as public benefits. These direct and indirect returns on investment must be taken into consideration. There are several types of returns that must be addressed:

- The direct beneficiaries of the endeavors will sometimes pay for use of the assets to be financed. For example, user fees often back energy, transportation, water, and wastewater utilities over time. These cash flows can provide a return on investment. However, the direct benefits often accrue to users in subsequent years and over long periods of time. In many instances, the subsidies can be used to bring the cash flows forward to induce investment.

- Private entities also will generate cash flows. Technology advances for sustainability needs are most clearly within this category. Net operating cash flow can be used as return on investment.

- All of these categories involve substantial benefits to broader communities beyond the category of direct users. The FIX subsidies are intended to reflect this value and demonstration of this value will be an essential criterion for qualifying for the subsidy. Qualification for the subsidy will be conditional on demonstration of a substantial amount of this broader value.

In many cases, the subsidy valuation will require analytics similar to those used for social impact bonds. It is this value that must be assessed on a case-by-case basis. In the ideal structure, all communities will derive similar levels of benefit reflected by the subsidy. This will probably be elusive. However, individual regions will need to have fair opportunities to put forward proposals. Broader benefits will be in at least three forms:

- Improvement of economic welfare as measured by a combination of higher growth and improvements in household well-being. This will be the benefit that is easiest to estimate and, upon realization, to quantify, although actual outcomes may be uncertain at the inception of FIX investments.

- Quality of life improvements for households and communities, and related advances in objective and subjective well-being.

- Benefits in the form of avoided costs and harms from social and environmental problems.

The amount of the subsidy will be based on the form of the investment and the amount needed to provide reasonable assurance that the investment can be funded in the market. The subsidy amount will be capped at a percentage (perhaps 50%) of the benefits that are estimated to accrue to the public from the implementation of the investment, other than the direct benefits to users from use of the assets and activities funded. For example, a wastewater treatment facility would benefit the users of the wastewater system by providing for the disposition of wastewater in a safe manner in accordance with standards. However, if the facility is developed and implemented so as to use minimal energy and to exceed minimal standards for purity of output, additional benefits to the community, the region, and the nation will be generated. A percentage of these additional benefits will be the cap on the subsidy.

Mechanisms for Delivering the Subsidy

In order to allocate the pool of available subsidy, standards for qualifying investments will be developed, and a mechanism for transfer to investors will need to be in place. One approach is to establish a Sustainability Investment Trust to perform these tasks with independent oversight. The trust will review investment opportunities stemming from detailed criteria that it will publish based on authorizing legislation. The opportunities will be submitted for approval by states and municipalities or regional combinations thereof. The trust will then commit subsidy pending the closing of the financing. Sustainability investment sponsors will be responsible for arranging the financing with investors or through intermediaries.

An alternative, more bottom-up approach would be to administer the program through state sustainability trusts overseen by a federal agency or perhaps by the regional Federal Reserve banks. In this configuration, states could be allocated committed subsidy amounts based on submission of sustainability investment plans to independent review boards. Channels for community input could be considered a requirement for approval and release of funds in this process.

The criteria for qualified investments should include:

- Substantial long-range benefits for the continuing wellbeing of the public, including values associated with environmental welfare and reduced environmental risks, adaptation to climate change, community-sustaining economic models, and human capital development.

- Benefits to broad geographic areas and large segments of the population, with an emphasis on racial equity.

- Efficient use of the incentives so that the greatest value is derived from the available resources.

- High workforce standards in the FIX footprint, established through preferential scoring in FIX contract bidding pools.

There are several possible forms of the subsidy delivery mechanism, to be determined after further study. Two possibilities include:

- Subsidy Based on Investment Balance. The subsidy can be paid to investors based on a balance of funds invested in sustainability investments. Thus, if an investor holds an average amount of qualifying investment over a one-year period (with certain minimums that assure that the investment balance is relatively even over the period), the investor will be paid an amount based on its average amount of qualifying investment. This is intended to incent targeted investors to buy and hold sustainability investments.

- Subsidy Tied to Investment. In this format, the trust will use the subsidy to increase the return on the investment. For example, the trust might loan for a sustainability investment at 6.00% and borrow from a qualifying investor at 6.50%. The loan to the trust would be repayable only from the amounts repaid by the sustainability sponsor (a state or local government, or a private business or non-profit organization that has access to the value generated by the sustainability investment) plus the subsidy amount, here 0.5% per annum. The loan to the trust would be transferable by the qualified investor at which time the value of the subsidy would be captured by the qualified investor in the amount received on transfer. Existing development authorities that are widely used in many states and localities for the pass-through issuance of debt to deliver federal and state subsidies based on exemption of interest on debt from income taxation may be the best way to effect delivery of the subsidy in a way that maximizes local involvement. Instead of using them as a vehicle to deliver the subsidy from tax expenditures in the form of a tax exemption of interest, they could deliver the sustainability investment subsidy. The authority would act as a conduit for the debt payments made by the sponsor and the subsidy, both of which would be paid to the investors. In the few places where such an authority does not exist, one could be created.

The FIX Revenues Framework

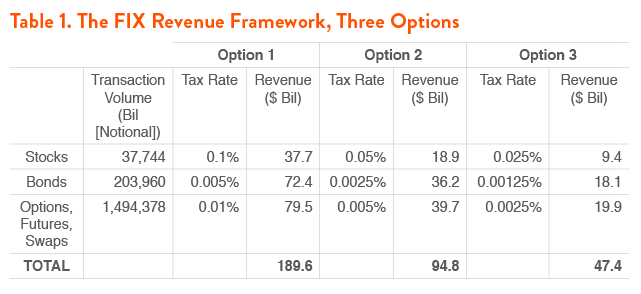

FIX revenues will be generated by a framework of financial transactions charges imposed against a variety of financial transactions, including the secondary market sales and purchases of shares of stock, the secondary market sales and purchases of bonds, the entry into derivatives contracts in the form of futures, swaps, and options on securities and commodities. Each of these transactions is distinctive so that a simple one-size-fits-all charge based on the size of the transaction is not feasible. We have provided three separate options with differing tax rates for each form of transaction covered (see also Table 1).

- Stock Transactions. There is a history of stock transaction taxes that can be relied upon as an option. The FIX tax will be between 0.025% and 0.1% of every purchase and sale of shares whether on an exchange or through off-exchange transactions involving a broker dealer. The exchanges will collect the FIX tax from the exchange member entering into the transaction. The broker dealer will pay the FIX tax on each off-exchange trade.

- Bond Transactions. The FIX tax will cover all corporate and governmental bond transactions on an exchange or that involve a broker dealer. Bond will be defined to include all debt instruments that were part of a public offering or a private placement at inception having a remaining period to maturity of 3 months or more. The amount of the FIX tax will be between 0.00125% and 0.005% of the principal amount of bonds for each year of remaining maturity for bonds having a remaining life of 3 years or less.

- Derivatives Transactions. Derivatives are contracts that require future payments based on a referenced amount of commodities or securities, the “notional” amount. The notional amount is the notional quantity of units under the contract (barrels of oil, shares of a stock, etc.) times price. The size of required payments is calculated by a fixed unit price (one side of the contract) and a market unit price (the other side) multiplied by the notional quantity. For swaps and futures, the typical contract has no intrinsic value (except for a premium charged by a bank for providing the contract) because the expected future price is equal to the then-market price so that the expected payments would net out. For an option, there is some value, though small relative to notional amount, at inception based on the probability that the option will or will not have value on the date it may be executed. Therefore, since there is no asset transferred, value changes over time and the appropriate size of the FIX tax is less straightforward. The FIX tax proposed will be between 0.00125% and 0.005% of the notional amount of all futures; between 0.025% and 0.01% of the notional amount of all options; and between 0.0025% and 0.01% of the notional amount of all swaps multiplied by the number of years until maturity, and 0.01% of the notional amount of all swaps multiplied by the number of years until maturity. Exchanges and swap execution facilities will collect the charge; for transactions not executed on these venues, the dealer will pay it directly.

The amount of revenue to be raised from any charge against transactions must take into consideration the volume of transactions in the markets and the effect that the imposition of a charge will have on the volume (elasticity).

Based on work done by the CBO, the IMF, and the University of Massachusetts at Amherst, preliminary revenue potential based on current volumes and three separate options for tax rates are calculated. Because of the low level of the rate, the tax revenue assumes that transaction volumes will not be affected by the tax.

Targeted Investors

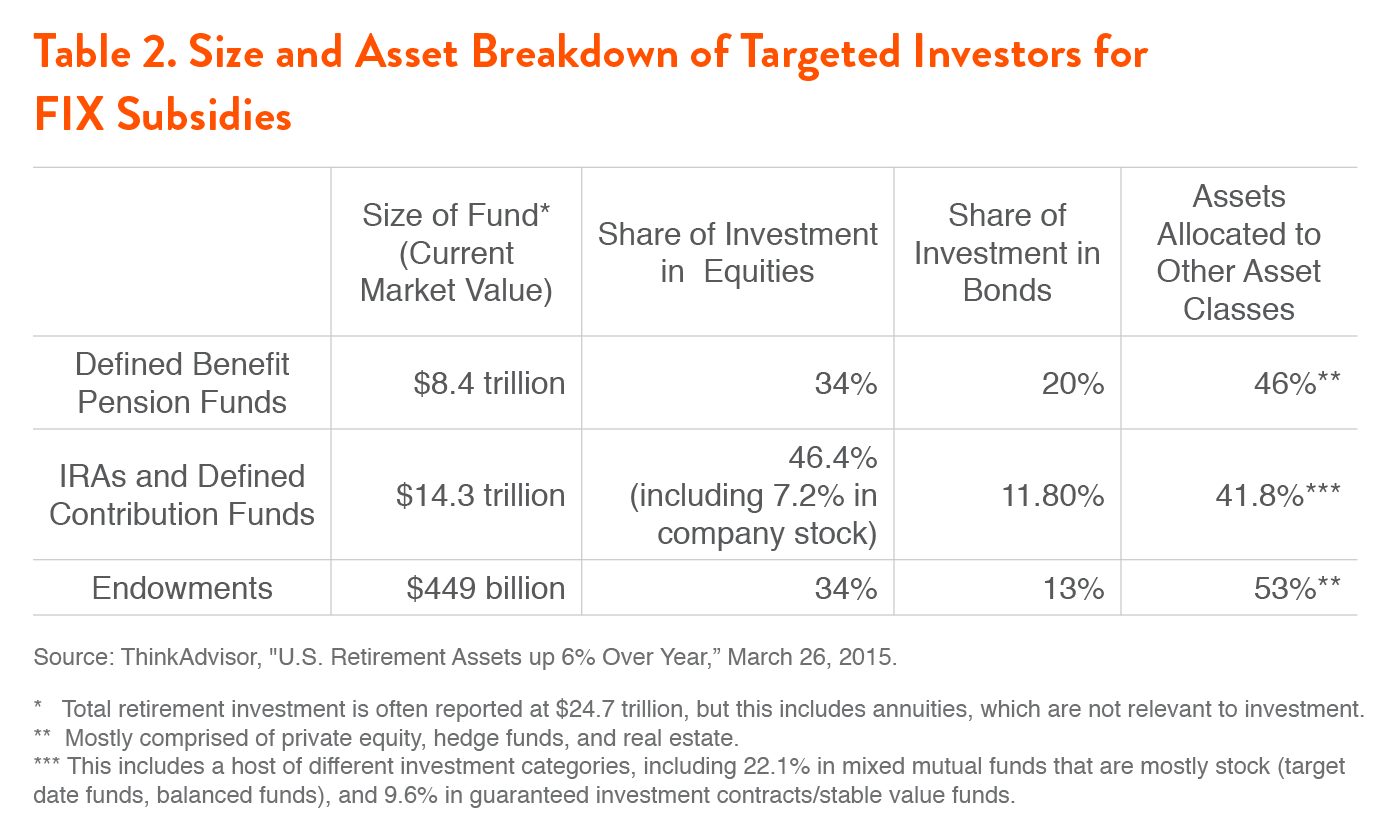

Targeted investors for FIX subsidies include pension funds and individual pension accounts, college and university endowments, and other capital sources. These are long-term pools of money that have predictable cash out-flows. As a result, they can hold onto investments over a long period of time.

These investment pools are targeted for three main reasons: 1) they are large sources of capital; 2) they are dis-incented from investing in infrastructure and other sustainability investments because of the current tax code; and 3) many such as public pension funds and endowments already have nominal commitments to socially-responsible investing.

A preliminary evaluation of these groups indicates that there are large sums to be tapped.

The investments that are subsidized by the FIX will largely displace investments in the Bonds and Other Asset Classes categories.

The current concept is to initially attract at least $750 billion of investment annually from these sources. The long-range target is between 20 and 30% of the total amount invested in pensions, endowments, and retirement savings currently, or around $6.5 trillion.

These investor groups share a common characteristic: they do not pay income tax on the return earned on investments. The payouts from the pension funds and the retirement accounts are taxed upon dispersal (except to the extent that funds deposited into them are from after-tax income of the beneficiary). Thus, the tax on earnings is deferred.

However, as described above, many infrastructure undertakings are currently financed with bonds of state and local governments the interest on which is exempt from federal income taxation, an inefficient and costly subsidy. This is not a deferral of tax revenues, and tax is never collected on the investment earnings. This tax exemption is a tax expenditure of the federal government that reduces the interest rates on the state and local bonds because the holders accept a rate that is in the range of 30% lower than it would be if it were taxable. A very large portion of the market for these bonds is made up of relatively high-income individuals that have tax liabilities. The Obama Administration, as well as previous administrations, has tried unsuccessfully to limit or eliminate it in favor of other mechanisms in part because any substitution for the tax expenditure subsidy from tax-exempt interest would be subject to the budget process. The FIX will be outside the budget.

Tapping into the tremendous pool of investors target by the FIX proposal would be very advantageous for sustainability investment. To do so without cost to state and local governments whose alternative is tax-exempt debt would require a subsidy that would replace the incentive provided by tax expenditures. Thus, for investments qualifying for tax-exempt debt, the subsidy would have to include an amount in respect of the value of the tax exemption. For pension funds and retirement accounts, this value would be recaptured by the federal government when beneficiaries draw from the funds. This portion of the subsidy would bear a cost equal to the time value of funds pending tax recoupment when benefits are paid out to pensioners.

Summary of FIX Benefits

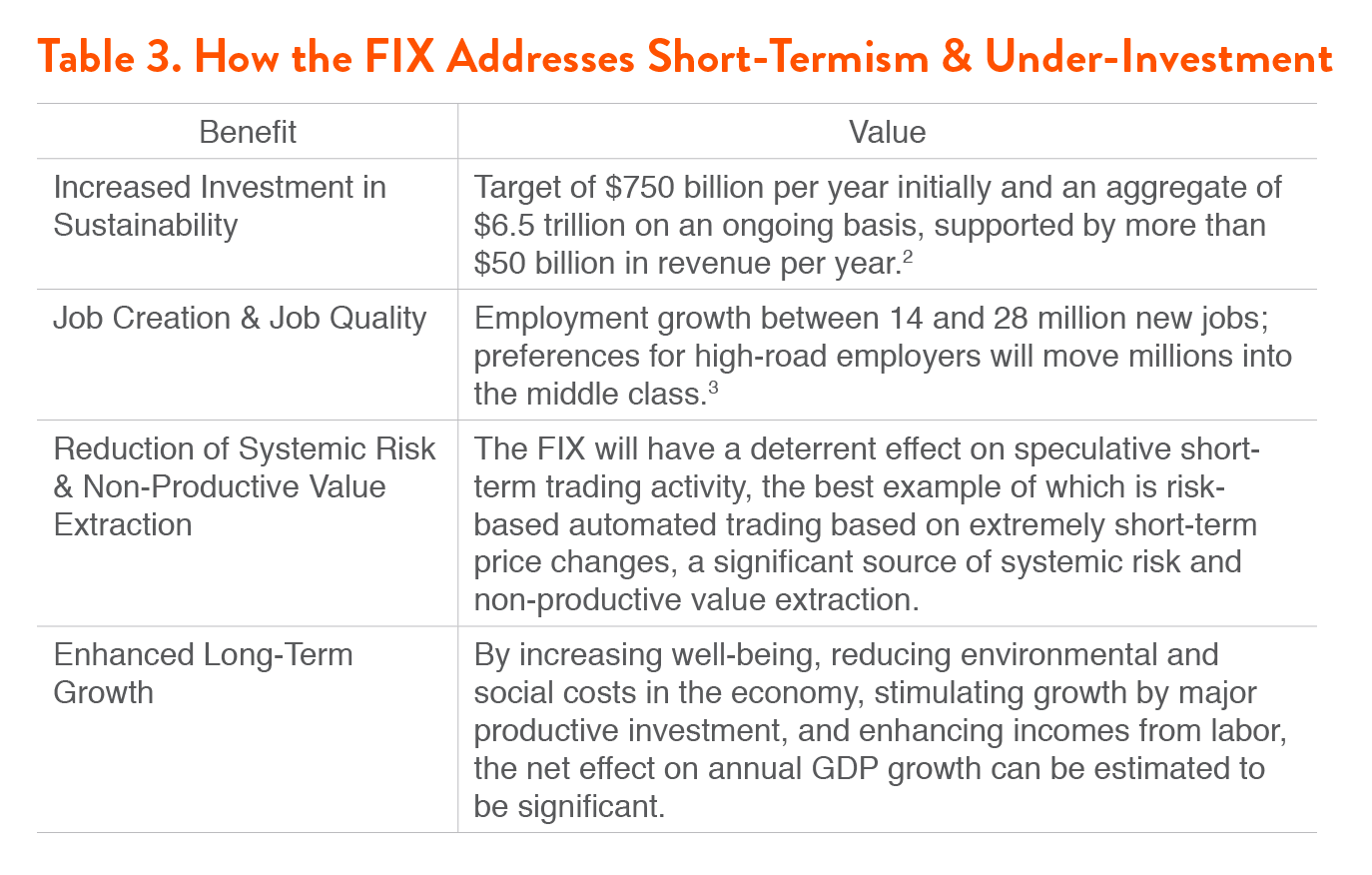

The FIX is designed to address two major concerns simultaneously: increasingly short-term investment horizons and chronic under-investment in sustainability needs. Table 3 illustrates how its major benefits achieve these goals.

Who Will Support the FIX?

With its social objectives and its alignment with large sources of capital, the FIX has significant potential to unite a stakeholder coalition with the power to overcome opposition to the policy:

- State and local governments. State and local governments are painfully aware of the need to provide infrastructure and other public goods that support a vibrant, growing economy while protecting the wellbeing of their populations against depletion of resources and degradation of the environment. Yet, states and localities face challenging capital constraints on long-term public investments, even in the face of potentially crippling social and environmental costs. In an era where neither fiscal policy nor conventional capital investment are sufficient for state and local needs, the FIX will be welcomed by state and local policymakers as a viable pathway for alternative financing of capital projects for renewable energy and other collective goods.

- Groups focused on middle- and lower-income job quality and income disparity. FIX sustainability investments are likely to be particularly effective in creating new, high-quality jobs, thereby addressing both unemployment and income disparity. Research has shown that a sustained program of construction and innovative business growth can generate 14,500 high-quality jobs for each $1 billion of investment (and grow the local economy by twice the investment). FIX investment flows on a scale of as much as $750 billion annually or more will be foundational for significant job creation in the United States.

- Pension funds and college endowments, especially those with a commitment to socially responsible investment. Most of these institutional investors struggle to invest in the sustainability of the economy, both as a moral duty and to better assure the long-term interests of their constituents. The primary obstacle is the difficulty in meeting today’s prevailing investment criteria. The FIX will help them overcome this obstacle.

- Private retirement fund managers. It is very difficult for private fund managers to offer investment alternatives to individuals who have a desire to use their retirement funds in socially responsible ways. The FIX will generate a pool of investments that will allow fund managers to market to these individuals successfully.

- Organizations and individuals concerned with climate change and the environment. A significant portion of the sustainability investments will address climate change and its consequences. The ability to attract private capital to those investments will be seen as a great benefit.

- Organizations and individuals interested in federal income tax reform. One of the largest and least efficient forms of tax expenditure is the exemption of interest on state and local bonds from federal income taxes. The sustainability investment subsidy will be a simpler, more efficient and more transparent method of subsidizing the state and local capital projects. Moreover, it will access a broader and deeper pool of investors than that which is available for tax exempt debt, reducing the underlying cost of capital.

- Community energy advocates. The policy could be a major source of capital for scaling community-owned renewable energy systems in some regions, for example by providing leverage to buy out private utilities.

- Public utilities. Sustainability investment will clearly include efficiencies to improve the delivery of energy to households, businesses, and governments. For example, a major target should be increasing the efficiency and flexibility of the transmission grid to achieve a more effective and efficient energy generation asset portfolio. This will improve the operations and the finances of public utilities.

- Construction and transportation industries; green technology industries. These industries will have strong market incentives to support the policy.

- Trade unions. FIX subsidies for qualified investments could be connected to a federal “good jobs” policy requiring high workforce standards and support for collective bargaining across the FIX footprint.