Key Findings

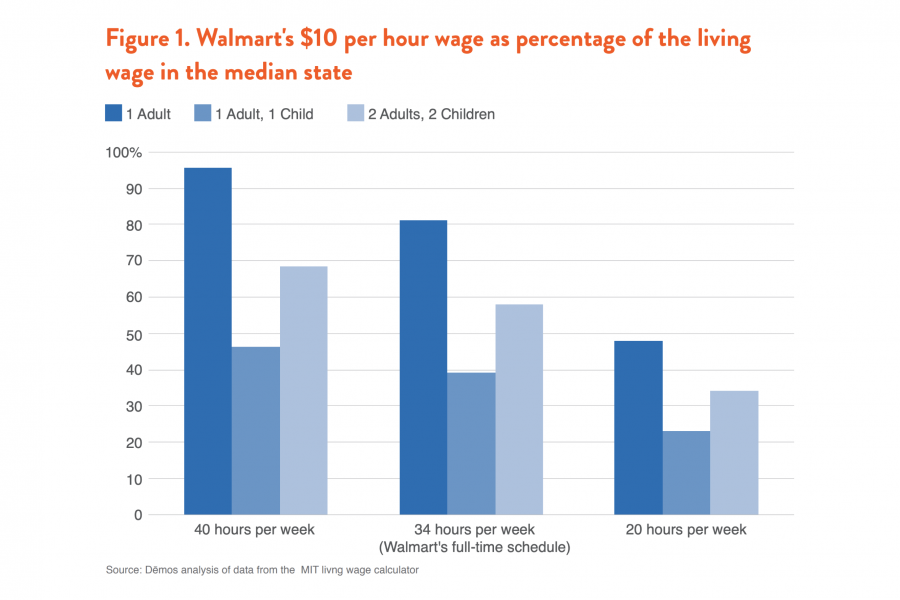

- Walmart’s forthcoming wage hike to $10 for its lowest paid workers is a step forward, but still does not provide enough income to support the basic needs of a single adult working Walmart’s full-time schedule of 34 hours per week in any state in the country.

- On a part-time schedule of 20 hours a week, Walmart’s forthcoming $10 an hour wage is equivalent to only $10,400 a year – less than half of the income needed to afford a basic standard of living for a single adult in 33 states.

- For workers trying to support a family, a $10 wage falls even farther short: in the median U.S. state, a Walmart worker would earn just 39 percent of the income needed to support an adult with a single child.

- With annual profit exceeding $16 billion and tens of billions spent buying back its own stock in recent years, Walmart can afford to pay its employees more and offer full-time hours to employees who want them.

Introduction

The productivity of American workers is on the rise. However, real wages have actually declined for most U.S. employees since 2009, with low-paid workers seeing the greatest decrease in their paychecks. Facing growing demands from workers earning too little to adequately support their families, companies such as the Gap, Ikea, and McDonald’s have recently announced that they will raise the minimum pay for their employees.

Under pressure from its own workers and the public, Walmart stated that it would also increase wages for its 500,000 lowest-paid U.S. workers. In April 2015, the nation’s largest employer hiked its minimum wages to $9 an hour; another increase to $10 an hour will take effect in February 2016 for all workers who have completed a 6-month training period. This is a positive step forward, but it still falls short of giving Walmart’s frontline workers the wages they deserve—and need—to provide a decent standard of living for their families.

In this research brief, we utilize the Living Wage Calculator of the Massachusetts Institute of Technology to evaluate the adequacy of Walmart’s wage increase in supporting workers and their families.

Working Hard but Not Getting By

As we noted in the Demos report A Higher Wage is Possible at Walmart, this company is particularly important because it sets the standard for the retail sector—one of the nation’s fastest growing economic sectors. With more than 1.4 million employees, Walmart is the nation’s largest private employer.

Walmart’s practices also impact the public sector and taxpayers when employees earn too little to meet their needs and require public assistance. Finally, Walmart’s current practices make it a leader in the type of employment model where workers earn too little to generate the consumer demand necessary for hiring and economic recovery.

For all these reasons, it is important to put a spotlight on the consequences of Walmart’s low wage approach. We use the MIT living wage calculator to test the adequacy of Walmart’s proposed $10 wage floor. The calculator is a measure of basic needs for various family types in each state in the country.

It includes the minimum cost of food, child care, health insurance, housing, transportation, and basic necessities such as clothing and personal care items in different states to provide geographically specific projections of the cost of living, as well as the baseline wage level necessary to afford a basic standard of living. We analyze wages for workers employed at Walmart’s full-time standard of 34 hours a week, a part-time schedule of 20 hours a week, and a more robust schedule of 40 hours a week.

It’s worth emphasizing that the $10 wage only affects workers who have completed a 6 month on-boarding and training period: with the high turnover rate that prevails in the retail industry, many workers will leave the company before they ever get to $10 an hour. As a result, a number of Walmart workers will remain below the $10 an hour threshold. Walmart’s forthcoming $10 an hour wage is equivalent to $17,680 annually for an employee working Walmart’s full-time standard of 34 hours a week.

Yet even in low-cost states such as Nebraska, Oklahoma, Ohio, South Dakota and Walmart’s home state of Arkansas, this wage provides only about 90 percent of what a single employee needs for a basic standard of living. In the median state nationwide, Walmart’s wage of $10 an hour for 34 hours a week provides just 81 percent of the income needed to support a single adult.

Even for workers able to pick up extra hours and average 40 hours a week for the year, a $10 an hour wage would only meet the needs of a single adult in 17 states. Yet many Walmart workers are not single adults and are not employed full-time. In a recent earnings call, Walmart disclosed that approximately half of its U.S. workforce is employed part time. On a sample part-time schedule of 20 hours a week, Walmart’s forthcoming $10 an hour wage is equivalent to only $10,400 a year – less than half of the income needed to afford a basic standard of living for a single adult in 33 states.

The dramatic inadequacy of part-time wages is particularly troubling given that, compared to other U.S. workers, retail employees are disproportionately likely to be involuntarily employed part time. In other words, many part-time retail workers want to be working full time but are relegated to part-time hours and grossly inadequate part-time pay.

For workers trying to support a family, a $10 wage falls even shorter of providing a basic standard of living. In the median U.S. state, a Walmart worker paid $10 an hour and working the company’s full-time schedule of 34 hours a week would earn just 39 percent of the income needed to support an adult with a single child. Even if a single parent managed to get scheduled for extra hours and averaged 40 hours a week of work, their pay would remain less than half of the level needed to support a child in most states.

Even two-earner households would struggle to meet basic needs at this wage. Consider a hypothetical family of two Walmart workers, both employed at the forthcoming minimum wage of $10 an hour at the company’s full-time schedule of 34 hours a week. With a pre-tax household income of $35,360 annually, the two-income family would still fall short of meeting basic needs for two children in every state. At best, their earnings would result in just three-quarters of the income needed to support a family of four in even the lowest cost state.

In the median state, their full-time Walmart earnings would meet just 58 percent of the cost of living for their family. Given the inadequacy of Walmart’s planned $10 an hour wage, it is not surprising that Americans for Tax Fairness calculates that Walmart employees would still need substantial tax payer subsidies to make ends meet.

Programs such as Medicaid and the Supplemental Nutrition Assistance Program (food stamps) would be needed to support the families of even full-time workers, filling in the gap left by Walmart’s low pay.

Walmart Can Afford Better Pay and Hours

In Demos’ previous analysis of Walmart’s finances, we noted that Walmart spent $6.6 billion in 2013 to buy back shares of its own stock. Stock buybacks occur when a company repurchases public shares of its own stock, reducing the number of shares traded on the market. Consequently, the same level of earnings are distributed over fewer owners, making each remaining share worth more. These buybacks do nothing to boost Walmart’s productivity or bottom line.

We noted in 2013 that if these funds were redirected to Walmart’s low-wage workers, they would each see a raise of $5.13 an hour – far in excess of the $10 rate Walmart has proposed. In addition, curtailing share buybacks would not damage the company’s competitiveness or raise prices for consumers and could instead help to boost productivity and sales.

While we cannot claim that our analysis was persuasive for the company, Walmart has in fact decreased its rate of share repurchases, redirecting funds to “current cash needs” which may include the wage increases currently planned for the lowest paid workers. Yet Walmart could do far more. As Walmart noted in its most recent annual report, as of January 31, 2015, authorization for $10.3 billion of share repurchases remained under the current share repurchase program.

Additionally, Walmart brought in more revenue than any other company in the world in 2014, yielding $16.182 billion in net profit in the fiscal year ending in January 2015. Clearly, substantial additional resources are available to invest in the company’s frontline workforce.

Higher Wages are Win-Win

The growing body of research on human capital management in retail finds that experienced employees with broad knowledge of the company are better equipped to serve customers, leading to higher sales numbers and better performance overall. Research from management experts at the Wharton School of Business shows that stores see an average of $10 in new revenue for every additional dollar spent on payroll.

Better staffing practices lead to higher sales, since customers can rely on stocked shelves and knowledgeable employees. Further, by putting more money in the pockets of workers who will spend it immediately, consumer spending would increase at Walmart’s own stores and improve company performance.

This year Walmart unveiled a television advertisement publicizing its wage increase, acknowledging that “it’s hard to see a future if you can’t see past today. That’s why Walmart is investing in the most important part of our company: our people. Because a raise in pay raises us all.”

The company’s reasoning is sound, but the planned increase to $10 an hour does not go far enough, especially for part-time employees who want additional or full-time hours. The nation’s largest private employer is the pacesetter for America’s economy: Walmart has a singular opportunity to lead on the improvement of wages and schedules, setting a higher floor for workers who deserve better.