As states continue to cut higher education budgets, rising tuition prices mean that increasingly students and their families rely on debt—both credit cards and student loans—to pay for college costs. Today, graduating college seniors leave with an average of over $25,000 in student loan debt.

In the wake of continued prolonged unemployment, defaults on these loans are on the rise. What’s less understood is how those defaults may impact a person’s credit score or how debt may impact the ability to stay in college. In addition, little is known about how these expenses contribute to the overall credit card debt carried by low- and middle-income households. To examine this and other factors that contribute to household debt, Demos conducted a nationwide survey of low- and middle-income households in early 2012. The findings in this brief summarize the relationship between college costs and credit card debt, and its impact on students and their parents.

Households Frequently Turn To Credit Cards To Cover Educational Expenses

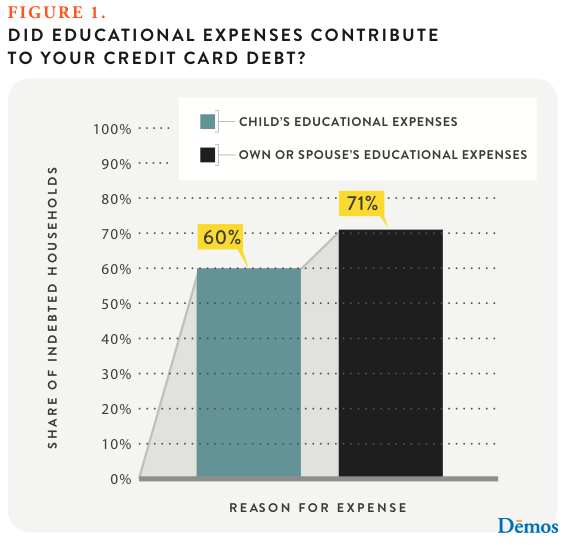

- Sixty percent of indebted households who had college expenses for a child in the past 3 years report that those expenses contributed to their current credit card debt. (see Figure 1)

- Seventy one percent of indebted households who had college expenses for themselves or their spouse in the past 3 years report that those expenses contributed to their current credit card debt.

- Twenty percent of past debtors with no current credit card debt cited college expenses as a factor that contributed to their past debt.

Households With Low Credit Scores Point To Late Payments On Student Loans As A Factor

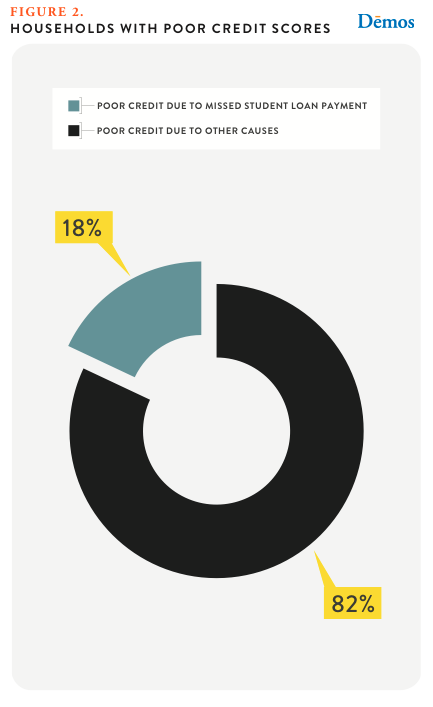

- Households identify late payments toward student loans as contributing to their low credit score. (see Figure 2)

Some Households Stop Attending School To Pay-Down Credit Card Debt

- Thirteen percent of households whose current credit card balance includes some college expenses report leaving school to deal with credit card debt.

- Four percent of all indebted households stopped attending school in the year prior to the survey in order to pay down their credit card debt, compared with 2 percent of those households without debt.

Even Households Without Debt Worry That College Expenses Will Put Them In The Red

- Among households that do not currently have credit card debt but also do not feel confident that they can remain out of debt, 13 percent cite educational expenses and tuition as contributing to their lack of confidence.

In the wake of declining incomes, rising college costs, and reductions in need-based financial aid, it’s likely that students and their families will continue to use a mix of credit cards and student loans to pay for college in even greater numbers and larger amounts. Our survey findings indicate that for too many students and their families, paying for college on credit too often comes with significant risk.