Introduction

Michigan has a proud tradition of affordable public higher education, from world-renowned public universities to a system of 28 community colleges that enroll over 350,000 students, all of which engender state pride and drive local and regional economies. It is also a state that has been central to the movement for free or affordable college: the Kalamazoo Promise, announced in 2005, inspired a wave of programs across the country offering a guarantee of free tuition.

Today, over 500,000 students attend Michigan’s public colleges and universities. For each of these students, postsecondary education is a key step in achieving their professional and personal dreams and seeking to guarantee some financial stability. And yet policymakers in Michigan have continuously made this step harder through divestment in Michigan’s public higher education system, resulting in skyrocketing college prices. Policymakers have cut per-student funding by almost 30 percent over the past 30 years, and Michigan’s higher education funding has yet to recover from the depths of the Great Recession.

This has coincided with record increases in the cost of living in many areas in the state, and childcare costs that average over $900 per month. For Black students, who constitute 1 out of every 8 public college students in Michigan, this disinvestment exists alongside a 40-year trend of declining wages for Black workers, reducing family savings and financial stability, and increasing the likelihood of taking on loans. As a result, today over 1.3 million Michiganders hold over $49 billion in federal student loans. Reversing these deep funding cuts is a first step to ending the affordability crisis—particularly for the state’s Black and brown students who face greater financial burdens from racially unjust housing and labor markets.

The COVID-19 pandemic and ensuing economic crisis has upended Michigan’s budget and forced hard conversations around what the state should do to secure families’ finances. At its peak, the unemployment rate in Michigan reached a staggering 24 percent. The pandemic has hit Black, brown, and young Michiganders particularly hard, and exposed the deep economic and public health divides facing the state. Lawmakers need to do everything in their power to help families weather this crisis, by helping those experiencing unemployment, housing and food insecurity, and uncertainty about their future. The federal CARES Act was a preliminary effort to help Michiganders pay their bills and stay in their homes, and help colleges backstop some funding cuts. Congress allocated funds to Michigan’s colleges based on both the full-time equivalent (FTE) enrollment and the FTE enrollment of Pell Grant recipients (a proxy for low-income students), and also allowed student borrowers to pause their debt payments through the current crisis, though their debt balances remain. Yet the recovery is likely to be slow, and additional federal support finally committed in late 2020 will not meet the need. Students facing a rent crisis, food insecurity, or a debt burden that still must be repaid are in urgent need of help from Michigan’s lawmakers for as long as Congress provides insufficient and lagging support.

Michigan’s policymakers must not take this as an opportunity to saddle institutions, families, and students with deeper cuts and higher college costs, all of which take a greater toll on Black and brown families and communities. Doing so would only increase student debt for some and close the doors of educational opportunity for others who feel that the cost of attendance is out of reach. It will make the recovery longer and more difficult, and move Michigan further away from the goal of building an inclusive economy.

Organizers in Michigan, and across the country, are working to ensure that we come out of this economic crisis by making long-term investments in the communities who have been long neglected even in boom times. Policymakers have begun to propose innovative remediation like offering a pathway to free tuition to frontline and essential workers, leveraging federal support in the process. A truly inclusive and comprehensive approach will require tackling the direct cost of college and reducing (or even eliminating) tuition and fees, but it will also require an acknowledgment that these are but one part of the college affordability puzzle. Families still need to pay rent for themselves and their children, pay for childcare each month, and work their way through school. A guarantee of debt-free college must include bold policy that ensures anyone who wants an education is not forced to drop out or take on debt to pay for these basic expenses.

Michigan has Divested in Public Higher Education as More Students of Color Seek Opportunity

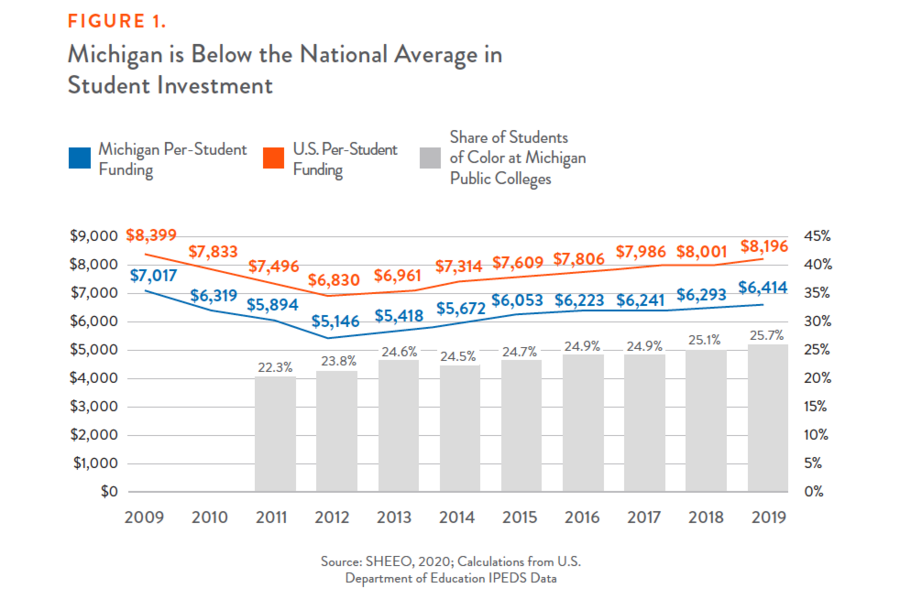

In the aftermath of the Great Recession, Michigan’s lawmakers took a hatchet to higher education funding, and only modestly increased per-student funding through the economic recovery. Funding still sits nearly 10 percent below pre-Great Recession levels. Michigan has hovered below the national average in per-student appropriations for years (see Figure 1), and currently ranks 27th out of 50. This reluctance to reinvest in public colleges and universities has coincided with a modest increase in the number of students of color attempting to access college, meaning that as these colleges educate a more diverse student body, they do it with fewer funds at their disposal. Just as non-white students began to seek opportunity in greater numbers, Michigan’s lawmakers decided not to extend the same investment as previous generations enjoyed.

Unsurprisingly and unfortunately for this generation of Michigan students, tuition has increased and now makes up a far greater portion of overall college funding. Whereas tuition funding made up 37.8 percent of Michigan’s educational appropriations in 1989, it now makes up over two-thirds (66.3 percent), as Figure 2 shows. What was once a public good, funded primarily through state and local appropriations, is now primarily paid for by students themselves.

In other states, students can often hope to counteract tuition expansions with state financial aid that can defray the cost of higher education. Unfortunately, in Michigan, state financial aid is largely unavailable; the state spends a measly $20 per full-time student on financial aid, compared to $808 per full-time student on average across the U.S. State aid is critical when, combined with Pell Grants and other institutional scholarships, it can reduce the need to take on debt. For Michigan students, the help typically comes out to less than the price of a textbook.

Michigan’s Affordability Crisis is Growing

Due to disinvestment, a lack of grant aid, and the rising cost of living, Michigan’s students face a steep hill in paying for college. The average net price of college—the total cost of attendance minus any grant and scholarship aid—at Michigan’s public 4-year colleges is $12,333 per year, as Figure 3 shows. This is an increase of nearly $1,500 a year over the past decade. For students from low-income households (earning under $30,000 a year), the annual burden is over $8,000. Multiplied over 4 years or longer, it becomes nearly impossible for poor and working-class families in Michigan to pay for public college without taking on loans, working excessive hours, or dropping out.

At Michigan’s community colleges, ostensibly the affordable or “nearly free” option, students still must pay thousands of dollars each year. The average public 2-year college charges a net price of over $5,600 a year. Michigan’s community college system remains lower-priced than those of other states, though lawmakers should be careful to call it truly affordable or ignore the fairly large oscillations from year to year that can upend family budgets and reduce the ability of students to make it through without too much financial trouble (see Figure 4).

Unequal and Unaffordable for Black and Brown Families, Young People, and Single Parents

Skyrocketing college prices harm all families and betray the promise of higher education as a public good. But as with so much in Michigan’s economy, college costs place a particular burden on Black and Latinx families who faced structural racism in the labor market, housing discrimination, and other economic headwinds well before the recent pandemic and recession.

For white non-Hispanic families, the average net price of college takes up a sizeable percentage of typical household income: nearly 19 percent. For Black and Latinx families though, the net price of college equals one-quarter and one-third of annual household income, respectively. For single mothers, college prices make up 33 percent of a year’s earnings. Combined with the rising cost of childcare and other necessities, this makes college without debt effectively out of reach (see Figure 5).

The COVID-19 Economy Worsens the College Affordability Crisis, and the College Affordability Crisis Worsens the Recovery

Michiganders are facing a new and often horrifying economic reality since the COVID-19 epidemic and the ensuing economic downturn. As Michigan, like other states, struggled to contain the virus throughout the summer and fall of 2020, families faced a public health disaster and economic precarity for which they could not possibly have prepared. The impact on Michigan families—especially Black, Latinx, and Native families—has been well-documented, worsening what was an already unequal economy. Before the pandemic, renters across the state faced a growing burden in terms of paying rent, as Table 1 shows. In some areas like Ann Arbor, Lansing, Detroit, and Traverse City, annual rent costs more than $10,000 on average. In many Michigan metro areas and towns, families were facing a rent crisis well before the latest recession: in Detroit, Ann Arbor, and Flint, for example, nearly half (46 percent) of renters were “cost-burdened,” or paying more than the recommended 30 percent of income on rent.

Naturally, the recession has threatened to deepen this housing crisis, and in so doing turn higher education from a burden to an impossibility. As Figure 6 illustrates, between late September and early October 2020, over 1 in 4 Black Michigan renters and 1 in 6 Latinx renters reported being behind on rent payments. Nearly 1 in 4 Black Michiganders reported experiencing at least some food scarcity as well. A staggering 7 in 10 Latinx renter households expressed concern about paying the next month’s rent, a number that reveals the precarity facing many families in the absence of sufficient federal or state action to boost the economy and keep people in their homes.

Obviously this is the result of a labor market being upended, and circumstances may yet get worse for many families. A staggering 56 percent of Latinx Michigan households and 60 percent of Black Michigan households have reported a loss of income since March (see Figure 7). Young households age 18-24 and 25-39 have reported similar income losses, while nearly a third of Black and Latinx households expected that they would lose income in the next 4 weeks.

Michigan’s Budget Outlook is Dire, but Lawmakers Still Have a Choice to Invest

This economic crisis impacts nearly all Michigan families, not just students or those who plan to send their children to college. However, addressing these basic needs has important and long-lasting implications for Michigan’s higher education system.

While overall fall college enrollment was down nearly 9 percent in 2020 due to the unique factors of the pandemic, we know from previous recessions that the ranks of those going to college will likely increase if broad economic pain lingers and jobs remain scarce. With families, particularly Black, brown, and immigrant families, digging out from under an economic collapse for which they could not have prepared, the idea that college prices will simply continue to grow is both cruel and counterproductive.

The federal CARES Act provided an initial injection of $350 million into higher education institutions in Michigan in the spring of 2020, with funds being allocated based on both the full-time equivalent (FTE) enrollment as well as the FTE enrollment of Pell Grant recipients (a proxy for low-income students). Funding may have initially stopped the budgetary bleeding, but with the state still experiencing an estimated $900 million budget shortfall as of the summer, and so many families losing access to basic needs, colleges still face less funding and uncertain demand. Western Michigan University reported a $76 million shortfall; University of Michigan-Flint cut 41 percent of its lecturers, and over 600 staff members at Michigan State were furloughed over the summer.

This is disinvestment on a rapid timeline, harming institutions and families alike. It is also potentially counterproductive; the more that families have to pay out of pocket or go into debt for an education, the fewer resources they will have to spend or save elsewhere, thus contributing to a slow recovery. The fewer spots open in public colleges could force students into predatory for-profit programs that have long recruited Black and brown students only to leave them worse off. Families are in a no-win spot: put their educational dreams on hold because of the economy, or face higher costs and greater financial uncertainty on the other side of the crisis.

Indeed, COVID-19 is upending the higher education plans of many Michigan families, as Figure 8 shows. Over 4 in 10 families where at least one person was expected to take college classes in the fall of 2020 reported that classes had either been canceled or their course loads reduced. Older students, Latinx students in particular, reported higher rates of disruption. Some of these students will return to college; others will not. A drop in enrollment in Michigan’s colleges not only harms students, but puts community colleges—which have seen a precipitous drop in enrollments and state and local funding, and are more likely to enroll poor or working-class students and students of color who may need extra financial support during the pandemic—in an even more precarious financial spot.

ss

Michigan Lawmakers Can Make A Down Payment on Debt-Free College in 2021

With uncertain budgets and tattered family finances, it may not seem like a time to focus on debt-free college in Michigan. And yet, given the years of disinvestment and the needs facing Michigan’s students—particularly students of color—it is vital that lawmakers consider a major down payment on college affordability.

Policy 1: First-Dollar Free College

Michigan lawmakers should increase funding to public 2- and 4-year institutions through a “first-dollar” free college program, in which the state eliminates tuition and allows students to use any grant or scholarship aid on living expenses and other non-tuition costs. Modeled in many ways on the Kalamazoo Promise, nearly 20 states have a free college program, though many programs only offer funding once students have exhausted financial aid, and do not cover costs beyond tuition. Governor Gretchen Whitmer’s declaration of a tuition-free guarantee for essential and frontline workers is a necessary first step and should be extended to all families disrupted by the COVID-19 pandemic.

Michigan has an opportunity to build a truly comprehensive and progressive model that can start by providing relief to working-class students most affected by COVID-19 who are attending community college or colleges that enroll high numbers of Black and brown students, and that could be scaled up as budgets rebound. One approach would be to eliminate tuition up front and allow Pell Grants and other aid to be used to defray the costs of housing, food, childcare, and other essentials. Alternatively, the state could offer a tuition-free guarantee and housing relief for students at community colleges, addressing the increasing rent and eviction crisis for students and families.

Such a program could be funded in part through additional federal stimulus funds, but state lawmakers should seek out progressive sources of revenue. For example, Michigan currently has no inheritance tax, leaving wealthy heirs able to hoard fortunes while funding for public services continues to suffer. Michigan also currently has a flat income tax; modestly increasing income tax rates on the state’s high earners could provide enough revenue for a universal college affordability guarantee. As budgets return to normal, and ideally once the federal government has backstopped state and local governments, such a program could be expanded to include more students.

This approach is equitable and generous: all eligible families would receive the benefit of $0 tuition, while those receiving the federal Pell Grant could use funds to pay rent, childcare, books, and transportation costs that might otherwise put even a tuition-free college education out of reach.

Policy 2: Increase State Aid, Including Emergency Aid to Students

As mentioned, Michigan spends just $20 of state money per student on grant aid, and the average net price of college for low-income students is over $8,000 a year, showing that even after demonstrating financial need and receiving grant aid, students face considerable costs. Most state financial aid is actually awarded through federal TANF dollars, and reaches well under 10 percent of in-state students.

Through the CARES Act passed by Congress and signed into law in late March 2020, Michigan institutions received funding for emergency financial aid for students facing economic costs of COVID-19. The University of Michigan–Ann Arbor and Michigan State University received $25 million and $29 million, respectively, in Congressional funding, which could be used to give cash grants to students or address disruptions and unexpected expenses caused by COVID-19. Larger community colleges such as Macomb Community College, Oakland Community College, Wayne County Community College, and Lansing Community College, received between $5 and 9 million each. These funds were necessary—if likely insufficient—to help students make up for a loss of income, housing or food insecurity, or other ongoing unexpected costs related to COVID-19. For example, UM–Flint distributed a series of grants ranging from $250 - $750 to students, a surely helpful amount that evaporates quickly when faced with rent, insurance, or food bills.

While the funds come from a federal program, and additional federal support is desperately needed for vulnerable students, Michigan lawmakers should establish a state emergency aid fund for students beginning in 2021. Given the financial precarity facing Black, Latinx, and young Michigan residents, and the likely event that any economic recovery will be slower for families of color, a robust emergency aid fund will help families tap resources in future years as the job market continues to be shaky.

Policy 3. End Disparities in College Funding and Encourage Inclusion at Larger Public 4-Year Schools

When providing a guarantee of debt-free college, or expanding aid to students, Michigan lawmakers should consider historic disparities in funding between community colleges, regional colleges, and larger, well-resourced institutions. In designing any program, Michigan should first look to provide greater subsidies for community colleges, open-access 4-year colleges, and institutions serving high numbers of Black and brown students.

Simultaneously, Michigan needs to ensure not only that the institutions that enroll the lion’s share of working-class students and students of color are able to provide a low-cost education to students, but also that new investments are made through a reparative lens. For example, Black students are underrepresented at both the University of Michigan–Ann Arbor and Michigan State University, and both institutions enroll a lower percentage of Black students than they did a generation ago.

Any affordability promise to larger institutions like UM–Ann Arbor and Michigan State could include a mandate that they take steps to enroll a more economically (and ideally, racially) diverse student body, or that they contribute a portion of endowment or other funds to providing need-based aid to underrepresented groups as a condition of their commitment.

Policy 4: Keep Families in Their Homes, and Offer Rent Relief and Cash Assistance for Students

Students cannot hope to learn, particularly in an age of online and hybrid courses, without a roof over their heads, food to eat, or basic needs addressed. In the spring of 2020, a full 58 percent of college students, including 71 percent of Black students, reported insecurity in addressing basic needs such as food and housing, according to a report from the Hope Center for College, Community, and Justice.

To address this, earlier in the pandemic Governor Whitmer signed several executive orders that created an eviction moratorium and offered payments to landlords in return for keeping renters in their homes. Additionally, the Centers for Disease Control and Prevention (CDC) issued guidance that limited evictions for many households through the end of 2020, though many tenants were unaware or had to deal with paperwork and bureaucracy to ensure their eligibility to stay in their homes. And certainly, many families who were rent-burdened before the crisis are likely to continue to struggle to repay once moratoria have been lifted and the recovery drags on.

It is not enough to offer a halt to evictions. Michigan must offer real rent relief and affordable housing for all families, especially those that include someone hoping to attend school. For students, tuition makes up only 20 percent of the cost of attending community college nationwide; the rest consists of housing, food, transportation, childcare, and other necessary expenses. For example, Michigan has the highest cost of car insurance in the country, an expense that can eat at the budget of commuter students who disproportionately attend community college. Any one of these costs could be the difference between enrolling and dropping out, or taking on unpayable debt.

These needs can be met as a part of any free college program or through other policy mechanisms. For example, lawmakers should increase the supply of available affordable rental units to Michigan families and address the 85 percent of low-income households in the state who are cost-burdened by housing. And especially considering the contingent and remote nature of learning facing most students across the state, lawmakers should create an additional fund that increases financial aid for those living off-campus or provides cash assistance to pay rent or other needs. Funds could be expanded for students who are parents, who make up over a quarter of all college students nationwide.

Policy 5. Bold and Targeted Loan Forgiveness and Protection for Current Borrowers

While most student debt comes in the form of federal loans, there is nothing stopping states from addressing the burden of student debt for their residents. Michiganders hold $49 billion in federal student loans—and while borrowers were exempt from making payments through the end of 2020 due to the CARES Act and an executive order from the Trump administration, that debt will still be on the books awaiting repayment when the federal government deems the economic crisis to be less of a worry.

Michigan should consider canceling a portion of debt for its residents who attended college in the state. A one-time debt payment—of $5,000 per borrower, for example—would work to jump-start Michigan’s economic recovery, allow people to meet basic needs and potentially start businesses and engage in useful economic activity in the months and years ahead. It would also eliminate debt for those with relatively low balances, or those who have taken on debt but not graduated, who research suggests are exceedingly likely to default on a loan.

Additionally, many states, including nearby Illinois, have begun experimenting with worthwhile protectionary measures for student borrowers. Some efforts, such as creating a Student Borrower Bill of Rights, are aimed at expanding oversight of loan servicers operating within a state, reviewing borrower complaints, compiling data on student debt, and empowering attorneys general to bring cases on behalf of students who see their payments mishandled or are otherwise misled by their loan servicer.

It’s Time to Invest in Michigan’s Students

In many ways, Michigan is synonymous with higher education, and has been a state where the movement for free or affordable college has been renewed. Black and brown families deserve the same shot at a well-funded, affordable system of public college that previous, whiter generations of students enjoyed, instead of a system that runs on higher and higher tuition. Today, right when a college degree can be an insurance policy for many families, and as families face an economy more uncertain than any in recent memory, Michigan’s leaders have refused to commit to a future that funds public colleges and provides opportunity for those who have traditionally been locked out. Now, as going to school is even harder to do given the cost of rent, childcare, and other necessities, it’s time to recommit to policies that help families thrive, that built world-class public colleges for all Michiganders, that allow everyone to get a degree without going into debt or going broke trying to avoid it. We need to ensure Michigan is a state where families can dream big, develop their potential, and realize their greatest aspirations—and that means making public 2- and 4-year colleges truly affordable to everyone.