Introduction

Today, the typical young person aspiring to go to college in the United States faces a higher education system that is fundamentally different from what previous generations enjoyed. For generations, our system of colleges and universities, and the federal aid system undergirding it, were generously funded and made higher education the primary lever of upward economic mobility. But today, there are innumerable potential entrepreneurs, teachers, engineers, and doctors whose academic and professional dreams remain stunted and unfulfilled due to the rising cost of college. As recently as the early 1990s, most students did not borrow to attain a degree. But now, nearly three-in-four graduates take on debt for a degree, and average debt for those who attain a bachelor’s degree has reached $30,000. Even a growing number—over 40 percent—of associate degree holders take on debt, something that runs counter to idea of an “affordable” two-year degree that acts as a standalone credential or a pathway to the bachelor’s.

Our system of college financing that once included loans as an option of last resort for middle-income families has now turned to loans as the primary financing mechanism, with the burden of undergraduate borrowing disproportionately borne by low-income students and students of color. Our public higher education system now solidifies privilege rather than overcoming it.

With this profound shift to a debt-based system of paying for college, policymakers have begun to grapple with what this portends for our system of higher education, our economy, and our notions of fairness and opportunity. In 2015, a group of Senators and Congressmen and women authored a resolution calling for “debt-free higher education” for all Americans—a call that has been echoed in the early stages of the 2016 Presidential campaign by at least three candidates.

These developments are in many ways a response to the views of American voters. Polls suggest that while 96 percent of Americans believe it is important to have a degree or credential beyond high school, a full 79 percent do not believe it is currently affordable for everyone who needs it. Fewer than half of Americans believe that the average debt level for four-year graduates—around $30,000—is “reasonable.” The number one reason cited for not enrolling in college is cost, particularly when combined with an ambiguous future benefit. And 78 percent of the general public believes that “the federal government should make sure that everyone who wants to go to college can do so.” These figures suggest that Americans view college as something bordering on necessity, but also view it with exceeding caution, and believe in the need for public policy to address that gap.

Voters’ perception that college is increasingly unaffordable is, unfortunately, correct. The rise in college prices and student debt is troubling precisely because it undermines one of our last avenues of upward mobility, and could have far-reaching economic consequences as an entire generation leaves college with a financial burden that few in previous generations endured.

This briefing paper details why a return to a debt-free system of public universities and colleges would help revive the promise of affordable higher education regardless of one’s family income, and as a result increase the percentage of people who can obtain a college degree, as well as reduce the number of Americans struggling to repay the student loans heaped on them by a higher education system that has strayed from its public mission.

Our Broken System of College Affordability

The rise in undergraduate student debt can in many ways be attributed to a decades-long slide in public investment for higher education, particularly at the state level, as well as inefficient and insufficient tools used by the federal government to address the issue. State governments once provided the vast majority of the funds necessary to educate a given college student, and kept tuition low enough that students could reasonably expect to cover the cost of college simply by saving from a summer job or part-time employment during the school year. But rather than meet the demands of their college-aspiring populations, states opted to reduce higher education expenditures per-student and require families to foot ever-greater percentages of their college bills. The Great Recession further accelerated these trends, and budget-crunched states slashed higher education budgets by nearly a quarter, just as the economic downturn meant more students enrolled in college. Even as state budgets have rebounded in the last few years, higher education budgets are still well below pre-recession levels, and many states continue to propose drastic cuts to their higher education systems.

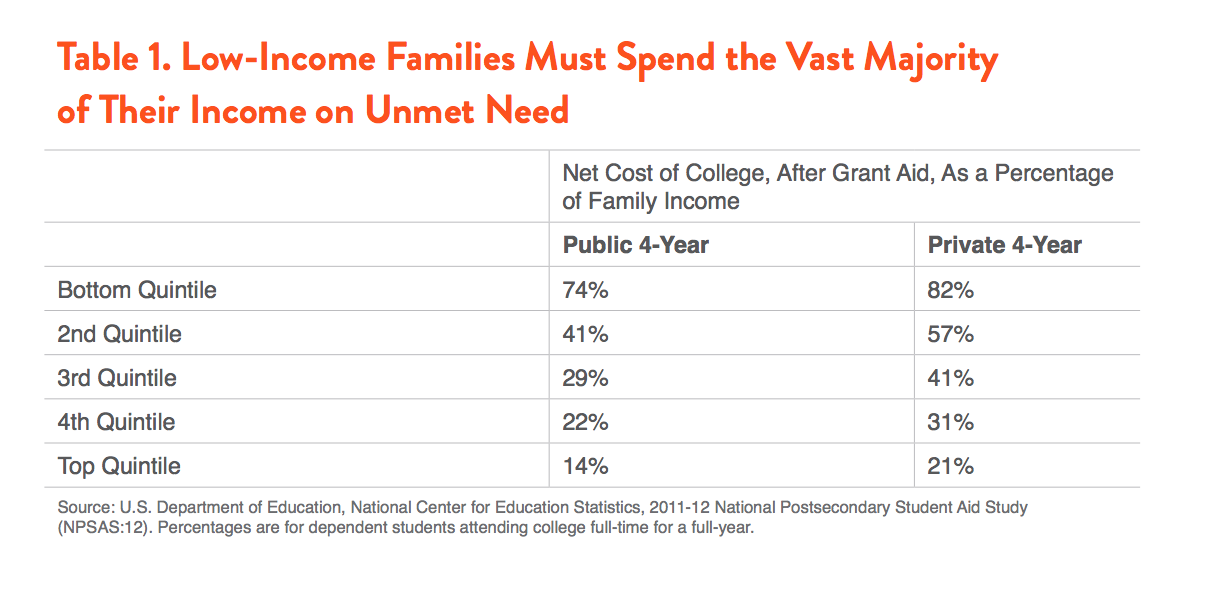

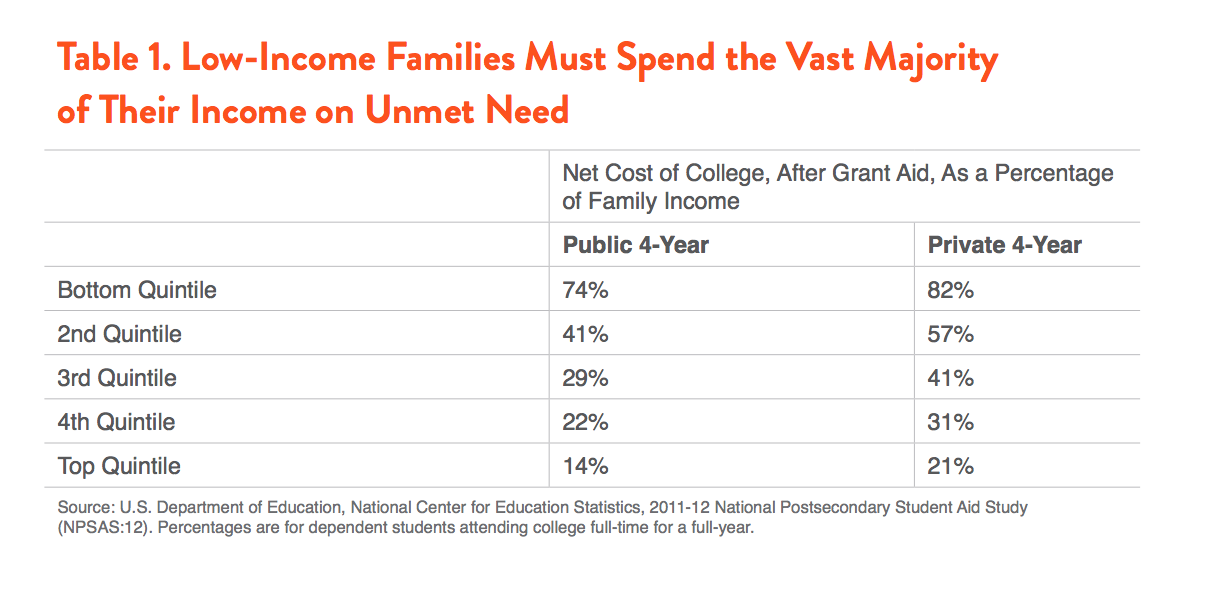

The result of state austerity has been a massive uptick in the net price that students face, particularly relative to stagnant family income. In fact, at public four-year institutions, low-income students (those in the bottom quintile) must spend nearly three-quarters of their families income to cover the net cost of college each year, while middle-income families must fork over between one-third and two-fifths of their family’s earnings.

It is perhaps no surprise then that borrowing rates for the working class exceed those of wealthy students. In fact, 84 percent of bachelor’s degree recipients at public colleges who receives Pell Grants borrow for the credential, compared to 46 percent of those who never received Pell, despite the fact that many Pell recipients receive over $5,000 to defray the cost of college. Over half of associate degree holders who receive Pell borrow for college, compared to 28 who do not receive Pell. And a lax regulatory environment combined with crippling budget cuts at community colleges has driven many working class students, veterans, and students of color to private for-profit institutions, where a bachelor’s degree means taking on $40,000 in debt, borrowing for a two-year associates degree exceeds that of the average debt taken on for a four-year degree at a public institution, and two-in-three borrowers of color drop out with debt.

Rather than call for structural reforms to expand public investment and provide incentives for colleges to keep prices down (particularly for low-income students), the federal government has allowed the Pell Grant to cover a dwindling portion of college costs, offered tax incentives that do little to reach students when they pay college bills (and in many cases do not reach working class students at all), and simply provided more loans to temporarily defray the cost.

How Undergraduate Student Debt Constrains Opportunity

While loans ostensibly help meet the sizeable gap that students face when confronted with high net prices, the overreliance on them to cover college costs is having a deleterious effect. First, it hampers our ability to broaden access to college. Evidence suggests that concerns about high college costs are limiting the ability of college-qualified students to both apply to and enroll in four-year colleges. The prospect of considerable borrowing could be impacting the educational ambitions of students, either by pushing academically-qualified students toward two-year institutions or by limiting their ability to go to college at all. In the face of high net prices, low-income high school graduates attend college at far lower rates than their high-income peers. The lowest-achieving students from wealthy families attend college at rates equal to that of the highest-achieving students from poorer families, indicating that financial burdens are artificially lowering college-going rates for students from non-wealthy households.

Beyond access, our reliance on debt has massively increased the negative consequences of dropping out of college. Whereas previous generations could leave college before graduating and only face the lost earnings and money already committed to college, today’s students who do not complete are far more likely to take a substantial student loan bill with them, only without the credential.

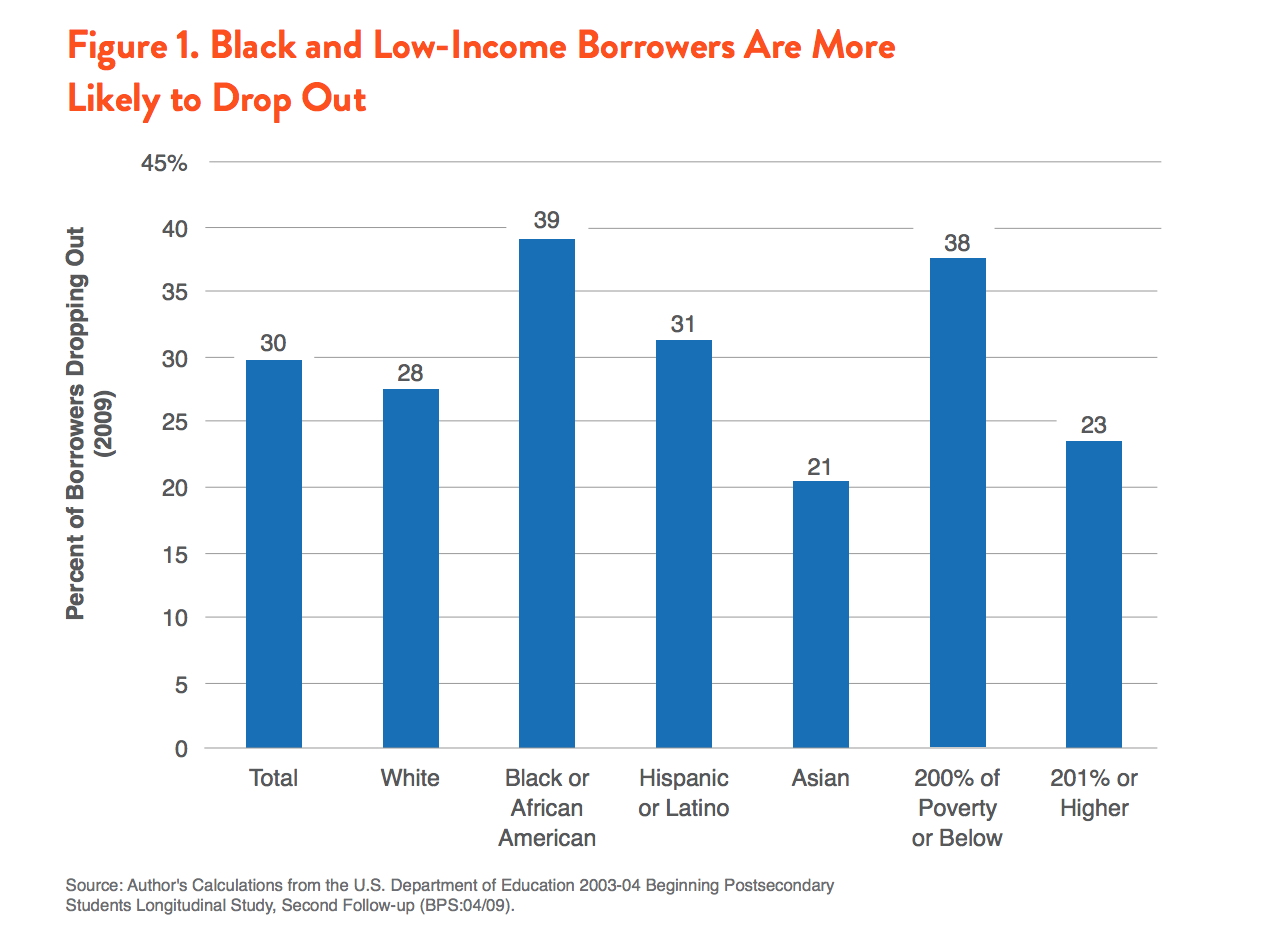

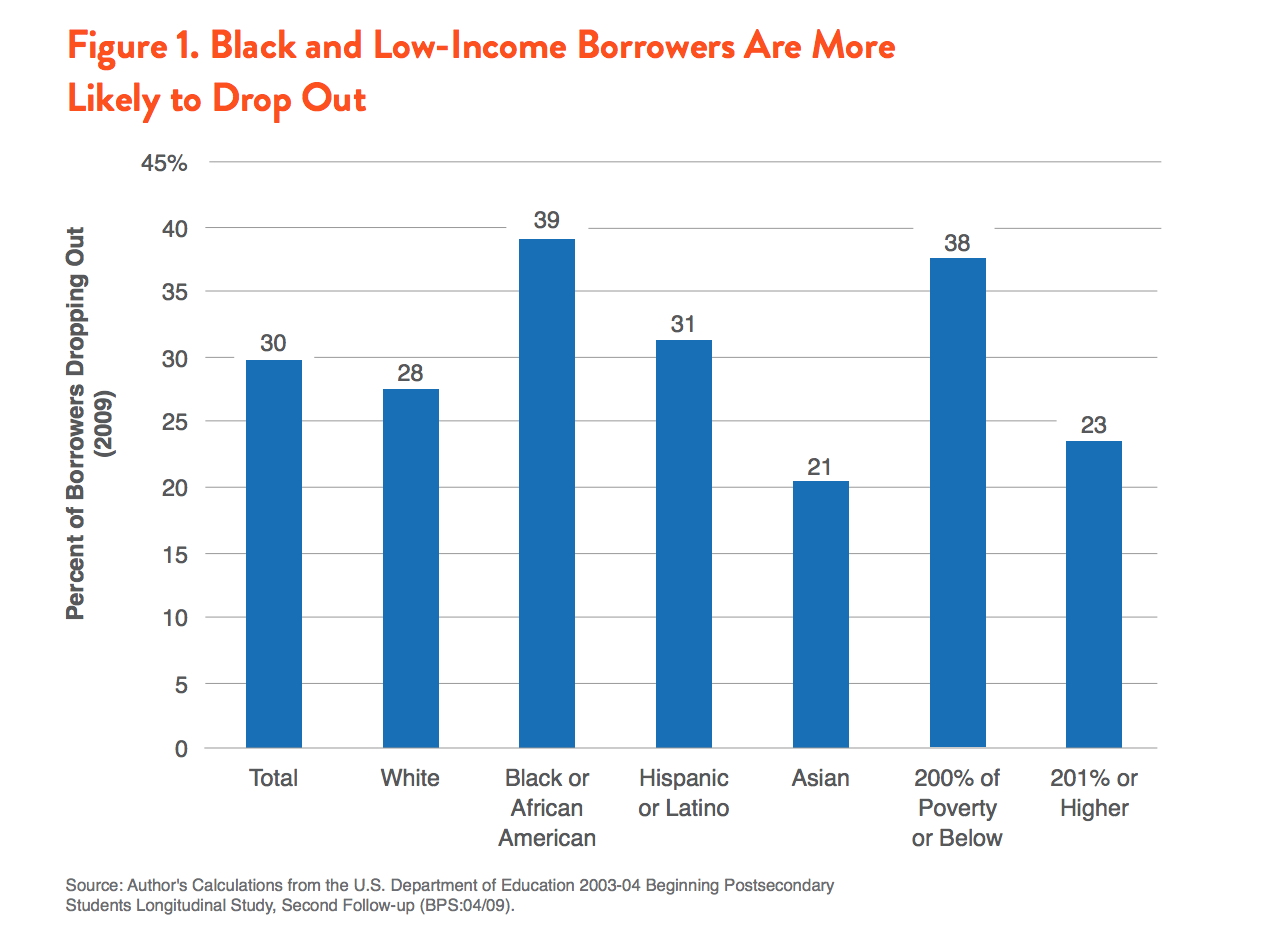

The effects are felt most by students of color and low-income students—in other words, those with the fewest available resources to buffer against economic hardship. These students are far more likely to default or struggle to repay their debt, adding to an already-powerful cycle of economic inequality.

A recent analysis by the centrist think tank Third Way confirms the riskiness inherent in our current system. While a small amount of student debt is positively correlated with higher graduation rates, amounts that exceed $10,000 are correlated with a lower likelihood of graduation. In essence, a small amount of student debt can mean the difference between dropping out and staying in school, but average levels of student debt at public colleges is well over twice what could be deemed “helpful” in getting more students through the system.

Beyond access and completion, though, student debt presents a burden to post-college financial prospects that could carry long-term economic consequences. Young households (those 40 years old or younger) with student debt have far less wealth than those without student debt. In fact, households with student debt and a college degree have less wealth than those with no debt and no degree. While the value of a college degree is high in the long-term, reducing the ability of student borrowers to save for retirement and create a nest egg prevents them from leveraging the years in which saving is most valuable – early in their career. Demos has found that average levels of student debt can lead to over $200,000 in lost lifetime wealth, relative to those who do not have to borrow for college.

As the timeline for repaying student debt has nearly doubled from 7.5 years to 13.4 years, students are facing monthly payments that are almost by definition not going toward consumption, saving, or building assets. Credit scores for student debtors are lower than those who do not have student debt, limiting the ability to buy a home or receive a reasonable deal on a mortgage, and for the first time, student debt has become a negative predictor of homeownership among young households. This likely helps explain why most members of Generation X have higher incomes than their parents, but far fewer have more wealth than their parents’ generation.

Student borrowers with high debt report less initial job satisfaction than those who did not need to borrow, lending credence to the notion that student debt constrains career choice or, at minimum, presents a burden in the workforce. The Philadelphia Federal Reserve has found that student debt has a negative impact on small business formation, potentially stifling innovation and constraining career choice among potential entrepreneurs.

All of this speaks to the need to provide students with an opportunity to complete college without the burden of student debt. Removing student debt from the equation could allow more students to enroll in college, or in more selective colleges should they so choose. It could also increase student persistence and graduation, while eliminating the unnecessary debt burden on those who borrow but do not complete a degree. And finally, it could provide economic benefits by allowing student borrowers to save and build wealth, particularly in the initial years after college.

Our system of higher education financing has always included loans for families who wanted to use them as a cash-flow mechanism, or for students who preferred borrowing to work. They were never intended to be the primary way students paid for college, and in doing so we are undermining our notions of fairness and equity, as well as potential educational attainment and economic growth.

Frequently Asked Questions

Returning to a debt-free system of public higher education would provide all Americans the option of attending a high-quality public college or university at a cost that could be met entirely through modest family savings or part-time student work. It is a promise upon which our system of public higher education was founded, and achieving it is all the more important in an era where we are asking more students to complete a postsecondary credential. The following answers some common questions about the concept and delivery of debt-free college.

Isn’t student loan debt “good debt?”

Some form of postsecondary education is the surest path to financial stability. And the earnings premium for a college degree has increased relative to a high school diploma. Because of this, many have framed student debt as “good” debt, since it comes in service of a degree that has become more important to entering and staying in the middle class.

Indeed, the median college graduate is likely to pay off his or her student debt without seriously falling behind on payments or defaulting. But looking at the median college graduate obscures the suffering that occurs among students at the lower end of the debt and wealth distribution. Default and delinquency rates are alarmingly high, and given the increasing number of student borrowers, in absolute numbers far more Americans are struggling to repay their student loans. Among students who left school in 2009 and owe less than $5,000 in student debt, 50 percent have experienced serious delinquency or default.

While the average graduate degree-holder may be able to manage monthly payments, the requirement of borrowing at the undergraduate level has, as mentioned, can create significant hardships for those who drop out of college. Given that college graduation rates today are more or less the same as 20 years ago, the introduction of more student debt makes the proposition far riskier.

To better understand this, an analogy may prove useful: At the height of the Great Recession, the vast majority of home mortgages were neither underwater nor delinquent. In fact, only 1 in 10 mortgages were considered seriously delinquent (those 90 days late or more). However, no one would have argued that the United States did not face a housing crisis or that there was not a major public policy problem. In this way, looking at the median homeowner would have obscured the suffering endured by those in serious trouble, and the growing threat that the housing crisis posed to many communities – particularly communities of color and those with less wealth. While student debt does not pose the same systemic risk to the economy as housing, the fact that the average college graduate is able to meet his or her minimum monthly payments does not mean that student debt is not a pressing public policy issue.

Since students receive a benefit from college, shouldn’t they have to pay?

Given the economic premium of a college degree, some have argued that students should be required to pay for some of the individual benefit that accrues to them. New Jersey Governor Chris Christie recently articulated this sentiment by saying “if college graduates are going to reap the greater economic rewards and opportunities of earning a degree, then it seems fair for them to support the cost of the education they're receiving.”

Despite the rhetoric, this is actually compatible with the concept of debt-free college. First, any reasonable interpretation of debt-free higher education entails students taking academic responsibilities seriously, and in fact increases the likelihood that students will have more time and energy devoted to their studies rather than working excessive hours while in college. Far too many students disengage from college in order to find a way to pay for it; debt-free college seeks to reverse that trend. Second, debt-free college does not preclude a modest amount of work or family savings in order to meet the cost of attendance; it simply sends a message to students that costs will never exceed what could be reasonably earned from a summer or part-time job.

Finally, this notion narrowly focuses on higher education as something that only benefits the individual. But we know that public investments in education pay off many times over. The GI Bill—the broadest guarantee of affordable higher education in our history—returned $7 for every $1 invested in the program. Other estimates suggest that the total net public gain of supporting public higher ranges between $75,000 and $200,000 per student. Another way to understand this question is to look at our K-12 system; students receive a very large earnings benefit to completing a high school degree—but we do not require that they pay for public high school outside of what their family contributes in taxes. This is because there are very large social benefits to every level of education, well beyond what the students themselves receive.

Under any debt-free college proposal, students would still be required to work hard in school, and others could be expected to contribute by way of student employment, but students are not the only beneficiaries of social spending on education—the American public does as well.

Is debt-free college a giveaway to wealthier students and families?

Some have argued that since the percentage of the American population with a college degree tends to be wealthier—and conversely, those without a college education tend to have lower incomes and experience higher unemployment—offering a subsidy to college-goers through a debt-free guarantee would be a giveaway to wealthier families. Evidence offered to support this argument often includes the statistic that only 40 percent of the American population holds at least a two-year degree.

But this figure severely underestimates who stands to benefit from affordable higher education, and indeed misses much of the point of debt-free college entirely. In fact, most young Americans do enter higher education at some point: 64% of those age 25-29, and 58% of all Americans over 25, have attempted college. Additionally, 66 percent of high school graduates transition to college immediately, and half (49%) of low-income students. That many of these students do not receive a college credential can be explained in part by rising costs, the need to work excessive hours while in college, take care of a family with limited resources, and other financial concerns. Debt-free higher education would allow these students to focus more on academics, and provide them with more financial flexibility so that cost is no longer a determinant of non-completion.

This argument is also tautological: If college is affordable only for wealthy families, wealthy families will send their children to college at higher rates. The promise inherent in debt-free higher education is that the net price that students face will be manageable regardless of family income. A wealth of literature exists noting the impact of reducing the net cost of college on enrollment, persistence, and completion, particularly for low-income students that currently attend college in lower rates.

In short, the families who already have access to debt-free higher education—those with substantial wealth—have very little issue attending and graduating from college. Offering the same chance to all Americans, it stands to reason, would expand access and completion.

What’s the difference between free tuition and debt-free college?

As a remedy for student debt and college affordability, some – most notably Senator Bernie Sanders (I-VT)—have proposed offering free tuition to all American students at public institutions. Others, including leaders in Tennessee and Oregon, have created Free Community College plans that cover the last dollar of tuition that is not already covered by grant aid at public 2-year colleges. These plans have been touted as “free college,” and have received substantial support in the general public.

Offering to cover tuition, though, is a different proposition from offering debt-free higher education. The price that students face to attend college includes more than tuition and fees; it includes living expenses or room & board, books, computers and technology, child care, and transportation—all of which colleges include in their cost of attendance calculations, and which are the basis for the amount a student can borrow to attend a particular institution. Particularly for low-income students, tuition is only a small part of the total cost: At two-year colleges, non-tuition expenses make up 70 percent of student budgets; at four-year colleges, they make up 60 percent.

The idea of debt-free college assumes that a student’s total unmet need for the entirety of their education expenses is reasonable enough so that he or she does not have to borrow (while the rest could be made up for with part-time employment, or modest family savings). It would target resources explicitly at students who cannot cover the total cost of college without borrowing.

Why do students need access to debt-free college at all public institutions?

Similar to proposals for free community college, some have suggested that students need access to debt-free college at one high-quality institution within their state, but that not all public colleges and universities should be expected to offer a debt-free guarantee. While this could reduce the total cost of such a program to states, it creates two major potential problems.

The first is an equity concern. If a state designated one college or system as the debt-free option for students, others – likely the state flagship institution—would be free to enroll higher-income students and generally not be required to fulfill the public mission of being representative of the state population. In this way, it replicates many flaws that plague the current public higher education system, in which many state flagship institutions currently educate very few low-income students or students of color, and often use their own institutional aid on students who do not demonstrate financial need.

Should students have debt-free college at private colleges as well?

Our system of federal financial aid is a voucher system—students receive a grant or loan from the federal government, and are free to take them to any institution that both accepts them and is eligible to participate. Some state-based programs operate this way as well. Because of this, there is an argument that students should have the opportunity to attend all colleges, regardless of sector, without taking on debt.

There are reasons to limit this promise to all public institutions. First, private colleges and universities already receive incredible support from the federal taxpayer, not only from being eligible to participate in the federal aid voucher system, but because these institutions are tax-exempt and have a substantial amount of control over how they spend their own endowment money. Put simply, extremely wealthy institutions do not need additional federal subsidy to offer debt-free college.

In fact, many private institutions have enough wealth to offer debt-free college without additional federal subsidy. In fact, at least 16 elite private colleges already offer no-loan guarantees for students regardless of income. Another 22 wealthy institutions (the majority of which are private colleges), have explicit “no loans” policies for at least a subset of low-income students, while other colleges offer to meet unmet financial need for low-income students from a particular region. These programs should be better marketed to price-conscious low-income students, and to be sure they should be considered an important part of our nation’s commitment to debt-free college.

More importantly though, the voucher system of federal financial aid has allowed a degree of waste and abuse that should give caution to anyone who believes that all institutions of higher education should be eligible to participate. Because students can take their financial aid to any institution that participates in Title IV aid programs, many for-profit institutions have targeted low-income students, students of color, and veterans as a means of securing a disproportionate amount of taxpayer money. The example of Corinthian Colleges – which went bankrupt and shuttered earlier this year – is instructive. Corinthian Colleges received over 83 percent of its funding from federal financial aid programs, including Veteran and Department of Defense benefits. But with insufficient quality control, institutions like Corinthian could enroll ever greater numbers of students while offering very little quality in the labor market, leading to high levels of student loan delinquency and default.

Finally, the idea of debt-free higher education is entwined with our notion of education as a public good. There is a reason that states have set up public systems of higher education and historically subsidized them enough to maintain high quality and low cost. Similarly, there is a reason why we provide compulsory, free education from Kindergarten through 12th grade – while private elementary and high schools exist, we have historically viewed them as another choice that parents can make for their children, should they want to pay for it. But our higher education system has reduced that choice, by allowing prices at public colleges to rise faster than those at private non-profit colleges, many students no longer have a public option for higher education. If there are private institutions of higher education that prove effective at enrolling and graduating high numbers of low-income students, and do not have the wealth to continue doing so even with the already-substantial federal benefits, the federal government should consider offering incentives to those colleges to continue doing so. But the notion of debt-free college should first be one that is compatible with our extensive system of public colleges and universities.

Shouldn’t we focus on slowing rising college costs?

The rising cost of college and its causes has been the focus of a substantial amount of academic and policy debate, particularly in the last decade. Demos and others have shown that at the institutions that educate the vast majority of college students – public, non-selective or semi-selective institutions – the main culprit to student cost increases is declining state investment. Crucially, community colleges in particular are not spending any more to educate students than they were a decade ago, despite the loss of state dollars. In other sectors, including elite private colleges and some public flagships, the costs of research and administration have contributed to the rising cost of delivering education. And productivity gains in higher education have not offset wage increases, given the labor-intensive nature of delivering education.

In addition, some institutions themselves operate somewhat inefficiently with their own aid dollars, using them as a mechanism to entice students who do not show much if any financial need. There are likely other efficiencies that could be attempted at the institutional level, and processes that could be centralized, from information technology to human resources and purchasing and procurement.

Where possible, the federal government should offer incentives to states and institutions that can create efficient delivery mechanisms that, critically, maintain quality for all students. Too often when people speak of a less expensive college degree, they are speaking of a stripped-down version that only applies to students who cannot afford the same educational experience as others. For the same reasons that debt-free college should be offered at all types of public institutions, reducing the cost of delivery should not place the burden on students who have the fewest financial resources and often the most academic need.

In short, the rising cost of delivering an education should be addressed in a thoughtful, long-term manner—but the ability to make that same education affordable right now in a way that gets more students to and through college should be the focus of federal and state policymakers.

Conclusion

Time and again, the United States and the rest of the world have proven that public investment in education pays off—from better health and well-being, to reduced crime, increased civic participation, and in measures of economic output and competitiveness. It is an investment that pays for itself many times over, and is also the golden ticket to economic mobility in the United States. But as the American economy demands more workers with high-quality credentials and training, we have erected new barriers to affording and completing college instead of lowering them, and relegated those who do not complete to contend with excessive financial hardship.

A return to debt-free college would be a powerful signal to this and future generations of Americans that college is attainable through hard work and ambition alone, and that your family’s economic circumstance does not dictate your destiny. It is not only important and equitable, it is achievable through the right mix of incentives for states, colleges, and students.