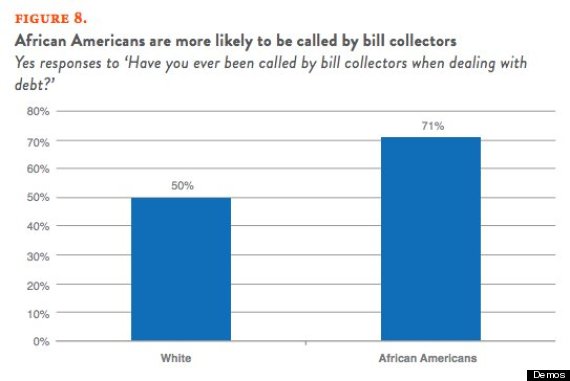

A new survey finds that African-Americans are much more likely than whites to be called by debt collectors, despite both groups reporting relatively equal levels of debt and repayment rates.

Just take a look at this chart:

Think tank Demos and the NAACP Economic Department collaborated to survey moderate-income American households with some credit card debt for the study. Black Americans weren't any more likely than whites to be late on a payment, the survey found, and they were also no more likely than whites to declare bankruptcy or get evicted.

So what gives? It's not clear exactly why debt collectors seem to be going after one race more than the other, but the study's findings could be the result of one unfortunate reality: Black Americans tend to have lower credit scores than white Americans, research has shown. And that gap got wider as a result of the financial crisis -- subprime lenders were more likely to target African-Americans during the housing boom. Those loans, with higher interest rates, were more likely to default. The result: credit scores that could be marred "decades," as the Washington Post pointed out in 2012.

"African-American households are more likely to have been called by bill collectors because they are more likely to have blemishes on their credit history that would send debts to collection agencies," Catherine Ruetschlin, an author of the Demos report, wrote in an email to The Huffington Post.

Read the full report: The Challenge of Credit Card Debt for the African American Middle Class