Is Student Debt "Good Debt," "Bad Debt," or Both?

Student loans are having quite the moment. Unfortunately, that moment has been a bit... confusing. From new polls and reports from reputable think tanks, to New York Times pieces, we’re being led to believe that either student loans aren’t that big a deal (or, more accurately, are the same “deal” they’ve always been), or they actively help increase college access. Oh, or they might make you sick and ruin your self-worth, not to mention your net worth, and you may be paying them off for twice as long as you used to. It could be artificially depressing the housing market, or maybe my generation just doesn’t feel like buying houses. Student loans could be the ticket to financial stability, or they could outright ruin your financial future. Who knows!

University of Michigan professor Susan Dynarski is the most recent to wade into the conversation, with a piece arguing that student debt loads cannot be divorced from the “benefit” they provide. Using studies from Chile and South Africa, Dynarski points to evidence that without student loans, a sizeable chunk of students wouldn’t make it to higher education at all. If you’re wondering why we need to travel to the southern hemisphere for evidence of the impact of student loans on college enrollment, it’s because—partly due to difficulty in asking the right questions and partly due to the fact that student loans on a society-wide scale are a pretty new phenomenon—there is surprisingly little good evidence from within our own shores on the question.

To give you a sense of how fickle the research around this can be, Dynarski herself in a 2003 paper found “weak evidence” that increased eligibility for loans in the 1990s had an impact on enrollment. Now that could be down to policy design, dataset, or it just being an entirely different country. But it underscores the complexities in determining what a good loan policy should be.

You could forgive student borrowers and policymakers alike for not knowing which way is up when it comes to student debt. And for as long as there are serious gaps in research on student loans, there will be some very different takes on whether or not using them as the primary mechanism to finance college is a good idea.

Dynarski rightly makes the point that the alternative to student loans is not necessarily a college degree plus an additional $50,000 in your pocket. But the opposite, at least in the United States, is also true: the alternative to student loan is not zero support in financing college.

That’s because we have a series of federal, state, and institutional grant aid programs designed to mitigate the need to pay out of pocket, or borrow, for higher education. Unfortunately, grant aid has not kept pace with college costs, or it has been used in inefficent and inequitable ways. But critically, unlike the research on loans, research on need-based grants in the U.S. is on pretty solid ground when it comes to college attendance and completion.

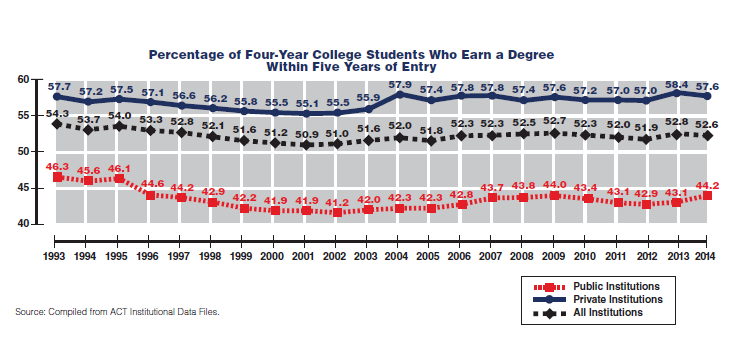

And completion is one area that really matters here. A lot of the defense of student loans boils down to the assumption that taking on loans for college means you’ll finish college. Not so. We haven’t really moved the needle on college completion over several decades (not to mention that college completion gaps have remained persistent between whites and students of color).

But borrowing has shot up, among both completers and noncompleters.

The debt-no-degree crowd is not an insignificant amount of borrowers either. This week’s report from the Fed indicated that this is a full quarter of the borrowing population (others, including Department of Education data from 2009, put the number at closer to one-third). For these students, the debt represents a fundamentally different proposition than those who took $50,000 to earn a graduate degree. They got the mortgage without the house, so to speak.

But that’s partially the point—student loans create risks where grant aid does not. And we’re requiring the majority of college students to bear that risk, whereas a generation ago we did not (which itself is a reason we don’t yet know the impact). But just as the college graduate with debt is fundamentally different from the dropout with debt, so too is the indebted dropout from the dropout with no debt.

But we do know certain things about student debt. For one, delinquencies are up and defaults are up. Borrowers are taking twice as long to pay off the debt. Basically, the availability of loans—or their use as the primary tool to finance college—means that a subset of borrowers are going to be more or less ruined by them. Whether on balance that means they are “good” or “bad” is less a less helpful discussion than asking how to prevent those outcomes. One way to do that is to—and I know this is self-evident—make it so fewer people have to borrow.

I understand that it’s a Sisyphean task to assume that we should replace student loans with grants (or just higher investment in higher ed), rather than replace student loans with nothing at all. But when it comes to what helps students get to and through college, it’s the conversation we should be having.