The Paradox of the Student Debt Crisis and "College is Worth It"

It’s graduation season, which means we’re being treated to a few time-tested media traditions for today’s wide-eyed graduates: Grievances about commencement speakers, predictions of doom over the massive amount of debt students are taking on, tales of hyper-competitive parents doing anything to get their young ones into elite schools, and a slew of debates over whether or not the degree that the poor graduates walking across the stage this weekend is actually worth anything.

This is enough to make a high school or incoming college student weep in a corner, but the annual hand-wringing usually masks the fact that there are two contradictory arguments being made about higher education – sometimes by the same people: A college degree is more important than ever if one wants to have a stable financial future, but taking on large debts to finance that degree makes it a risky—and even poor – investment. If public policy goes too far in one direction, we saddle graduates with debt that they’ll struggle for a lifetime to repay. Go too far in the other, and we shut off access to the middle class by encouraging students not to partake in the one activity – education – that leads them there.

Put simply, how do we square that “college is worth it” from the increasing body of evidence that student debt is not necessarily good debt?

The unsatisfying answer, of course, is that it depends. It depends on what kind of school a student attends – or is forced to attend – and whether the value of a degree from that specific school outweighs the cost. It depends on whether or not a student stands a chance of graduating. It depends, sometimes, on a student’s income level, or race and ethnicity, or even gender.

Because the value of the investment depends on so many factors, it is extremely troubling then that we are making it disproportionately burdensome on certain populations – poor and minority students, namely – to make the investment.

Let’s backtrack a bit: If we consider “college” to mean an actual degree, it almost certainly is “worth it.” A recent Economic Letter from the Federal Reserve of San Francisco bears this out (see graph below), as do unemployment rates and median earnings at different levels of educational attainment.

Earnings Premium over a High School Education

On average, there are few better financial bets than a 4-year degree. But average, of course, hides a lot of variability.

Just this week, the Center for Economic and Policy Research released a study on economic circumstances and outcomes for recent black college graduates. The findings are predictably depressing: Even as college is, again, a good investment, unemployment rates for recent black graduates are over twice that of recent grads as a whole, at 12.4%. As Libby Nelson over at Vox notes, this rate is barely above the unemployment rate for workers without a high school diploma.

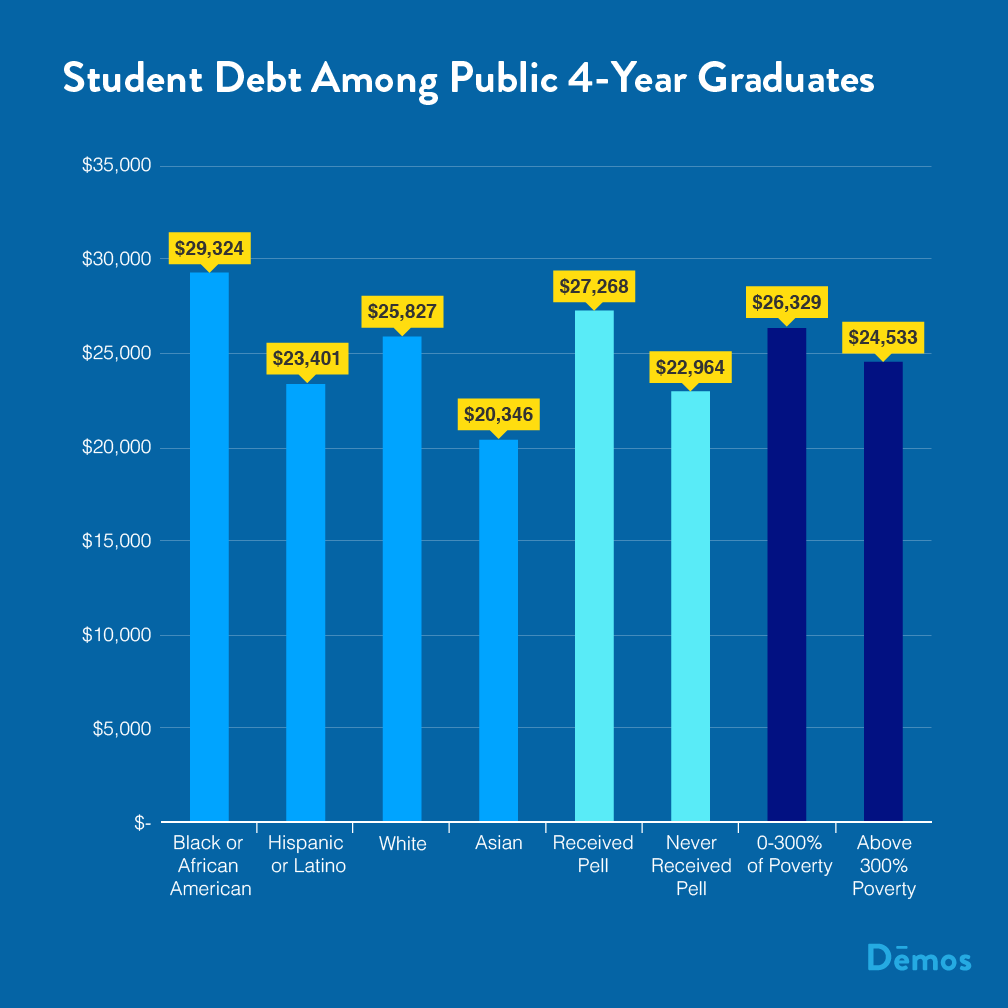

Even if unemployment rates evened out over time – which they don’t; black college graduates at every age face higher unemployment rates – this further masks that black students, as well as low-income students are far more likely to need to take on debt to earn a degree than their white (and high-income) counterparts, even at "affordable" public schools:

So we have a situation in which disadvantaged students are more likely to have to take on debt if they want to graduate, more likely to take on larger debt, and—at least in the case of black students—more likely to be unemployed even when they do graduate.

But to truly understand the danger of a debt-based system, one also has to understand that when it comes to graduating, not all is equal either. Graduation rates vary wildly by type of institution, but more importantly, so do the percent of those who take on student loans but drop out. As Mary Nguyen, formerly of Education Sector, showed in a 2012 report using U.S. Department of Education data, borrowers at for-profit institutions are much more likely to drop out than their counterparts at public 2- and 4-year institutions. This, and the fact that for-profit schools simply cost more, probably helps explain why default rates on federal student loans are far higher at for-profits.

In any event, borrowing without receiving a credential can be disastrous; dropping out is likely the biggest predictor of whether or not a student defaults on a loan. Alarmingly, both default rates and the percent of borrowers who drop out have increased in recent years.

So, you might say, the goal should be to make sure that students a.) attend schools where they’re more likely to graduate, and b.) equalize (or simply reduce) the percentage of students who are forced to borrow to attend school. Unfortunately, it seems we’re heading in the wrong direction on both fronts.

On the public school side, states have been slashing higher education budgets for the better part of three decades. Educational appropriations – including instruction, student services, etc. – have been slashed by 15% over the past five years (and 7.5% over the past 10 years), adjusted for inflation (see Table 3 of this report). This means two things, more or less: Higher tuition and less need-based grant aid, which research shows has a positive impact on degree attainment; and fewer dollars to allocate toward the instructional and student services that would get more students toward graduation. So students—at least those who need the resources—may be getting less, just as they are expected to pay more.

It’s not like the Federal Government has really helped either—the value of the maximum Pell Grant has decreased to about a third of college costs. So the less we invest in students or institutions, the more that students run the risk of dropping out due to not being able to afford it, not wanting to borrow, or not attending an institution that has the means to support them – either under-resourced public schools, or predatory education programs where graduation and post-graduation outcomes are dismal.

What all of this boils down to is that disadvantaged students are facing a vicious paradox. On one hand, going to college is a good deal, bordering on necessity. On the other, in order to meet that necessity, some students have to take on more debt and are less likely to graduate or attend an institution that has the resources capable of making their time worth it.

If you're one for strained analogies, consider nutrition. No one in their right mind would recommend that you starve yourself in order to stay in shape. On the other hand, no one in their right mind would recommend anyone eat fast food for every meal, either. The alternative to fast food isn't starving, it's making sure there are enough healthy foods at your disposal to stay in good health. Likewise, the alternative to expensive higher education shouldn't be no college, it should be ensuring we invest enough in the system that it doesn't have to be a choice.