Millions of Jobs Are Needed to Get to Back to Peak Employment

The more Americans that are working, the healthier our economy. Policymakers and the Board of Governors of the Federal Reserve are supposed to strive to achieve maximum employment. The governors of the Federal Reserve, however, have begun to raise interest rates to put the brakes on the U.S. economy despite evidence that we are not yet at peak employment. The governors expect that inflation will increase when we reach peak employment, but inflation continues to be low. By their own standard, we are not there yet.

The economist Dean Baker nicely summarizes the problem. He asks why the Fed is raising interest rates.

We know this keeps people from getting jobs and workers, especially those at the bottom of the wage distribution, from getting pay increases. With no problems with inflation on the horizon, this looks like lots of pain for no obvious gain.

The governors should hold off on further interest rate increases, but the expectation is that they will continue to raise interest rates.

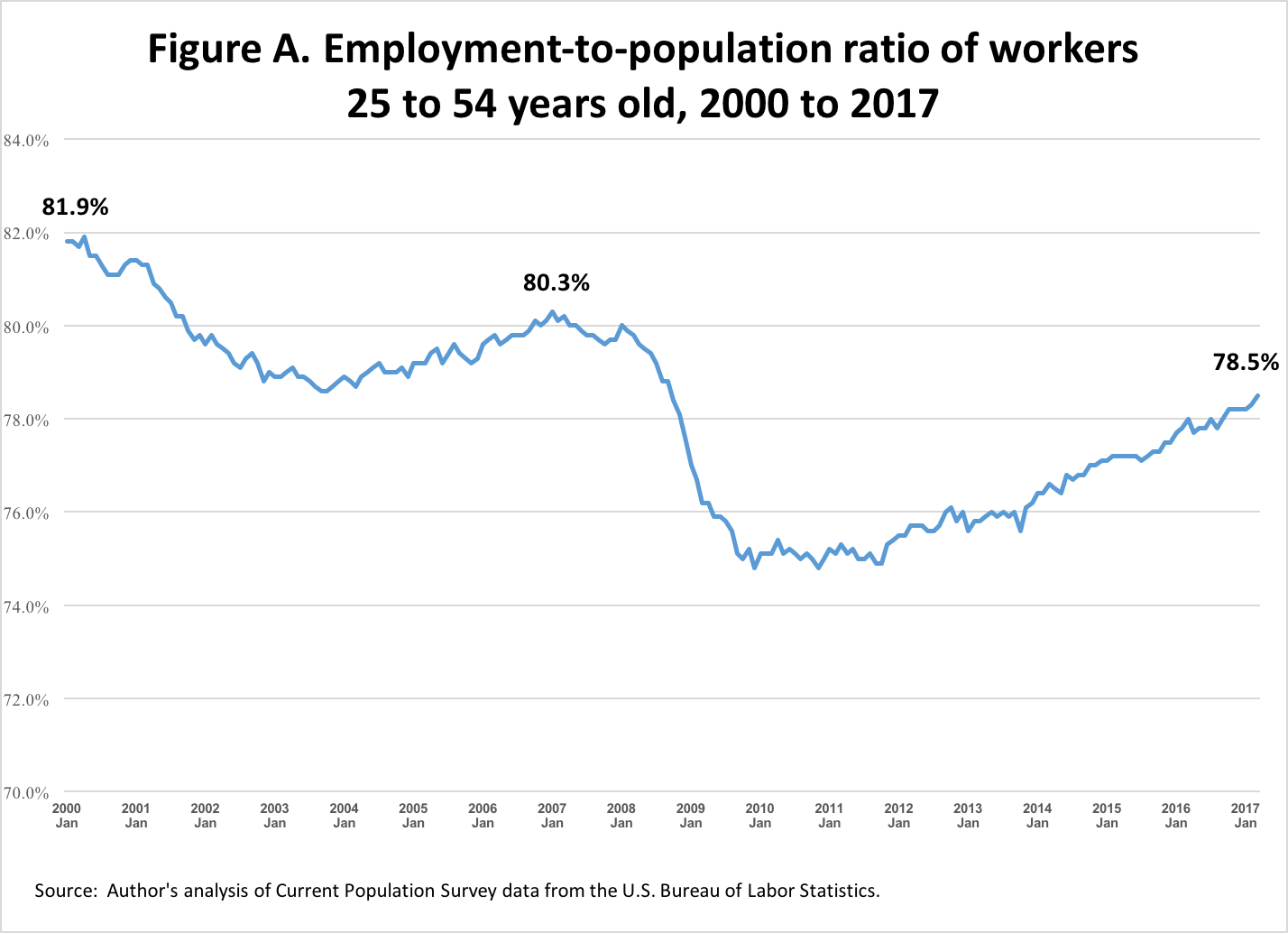

Another way to evaluate our employment level is to look at the share of prime-age individuals (25 to 54 years old) with jobs. The employment-to-population ratio or employment rate for prime-age individuals today is less than it was at the peaks of the last 2 business cycles (Figure A). Over the last 4 quarters (from 2016 Q2 to 2017 Q1), the employment-rate average for prime-age individuals was 1.9 percentage points lower than it was in 2007 (Figure B), the peak year of the last business cycle. If we had the same employment rate today as in 2007, we would have over 2 million more Americans working (Table 1).

The employment-rate gap between today and the peak of the business cycle ending in 2000 is even greater. The employment rate in 2000 was 3.4 percentage points higher than our employment-rate average over the last 4 quarters. This gap translates to over 4 million “missing” jobs. This jobs gap is one of the reasons why policymakers should support the Congressional Progressive Caucus’ infrastructure plan, which will create 2.5 million jobs. Find out more about the Millions of Jobs campaign here.

Table 1. Estimate of number of jobs "missing" if the average employment-to-population ratio for 2016 Q2 to 2017 Q1 were the same as the 2007 and 2000 averages by race

|

Jobs deficit relative |

Jobs deficit relative |

|

|

All |

-2,389,397 |

-4,307,203 |

|

White |

-1,650,670 |

-3,109,957 |

|

Latino |

-363,606 |

-345,724 |

|

Black |

-206,253 |

-542,993 |

|

Asian |

-177,233 |

-199,114 |

Source: Author’s calculations based on Current Population Survey data from the U.S. Bureau of Labor Statistics.

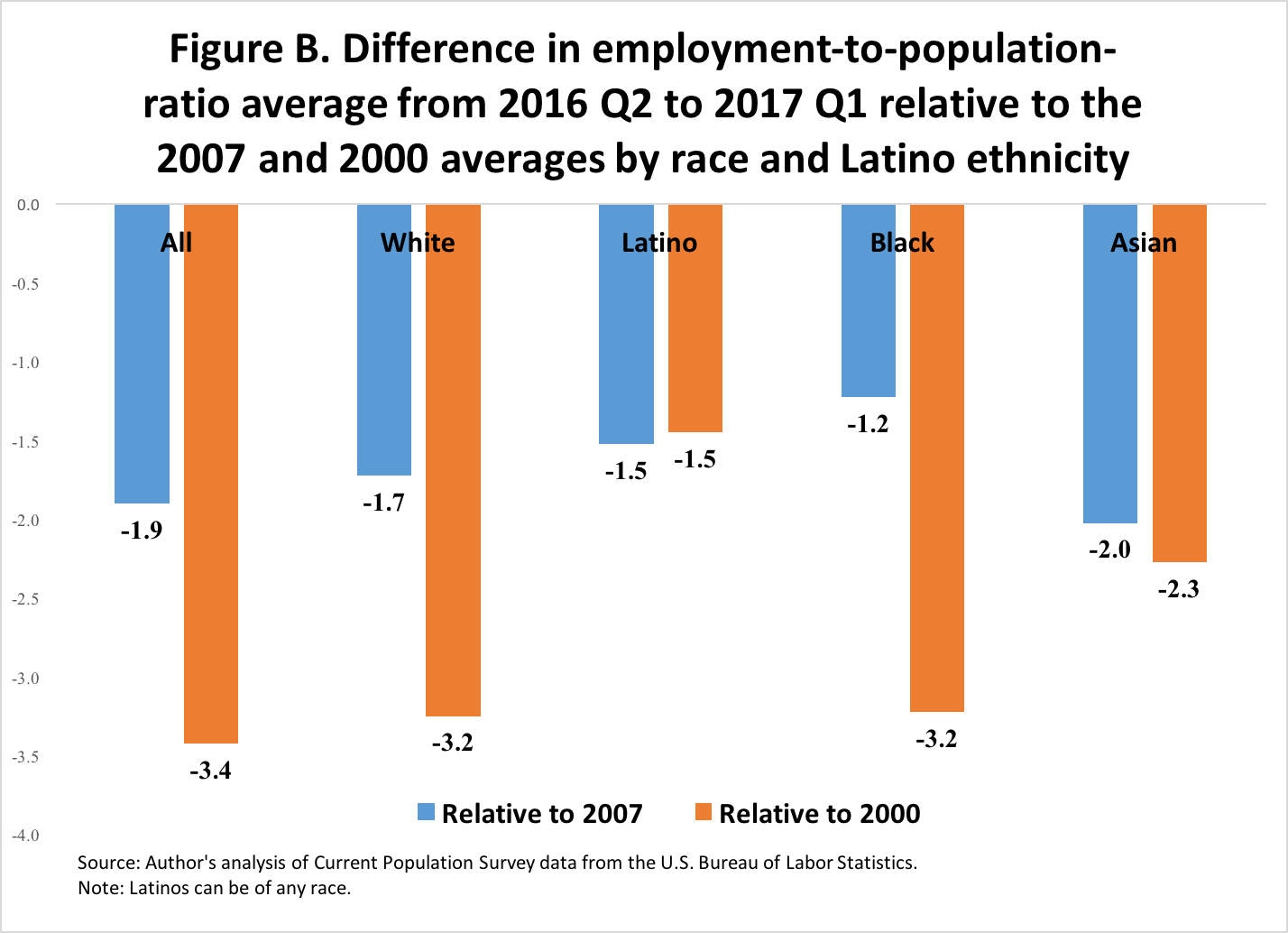

The Jobs Deficit by Race

It is useful to see what the jobs gap looks like by race and Latino ethnicity. Whites and African Americans follow the overall pattern of the average employment rate for 2007 being higher than the average rate of the last 4 quarters, and the rate for 2000 being higher than the rate for 2007. For Latinos and Asian Americans, the employment rate for 2007 is higher than the current rate, but about equal to the 2000 rate (Figure B).

The white employment rate over the last 4 quarters is 1.7 percentage points less than the white employment rate for 2007 and 3.2 percentage points less than the rate for 2000. This translates to about 1.7 million fewer white people working relative to 2007, and about 3.1 million fewer white people working relative to 2000 (Table 1). For blacks, the recent average employment rate is 1.2 percentage points less than in 2007 and 3.2 percentage points less than in 2000. In other words, there are about 200,000 fewer black people working relative to 2007, and about half a million fewer black people working relative to 2000.

For Latinos, the recent average employment rate is about 1.5 percentage points lower than both 2007 and 2000. If Latinos had the employment rate they had in 2007 or 2000, they would have about 350,000 more jobs today. For Asian Americans, the recent rate is about 2 percentage points lower than in 2007 and 2000. The 2007 and 2000 employment rates would result in nearly 200,000 more Asian Americans working today.

The weak jobs report that we received on Friday (June 2) for May showed a slight decline in the employment-to-population ratio. The decline in the employment rate and the weakness of wage growth provide more evidence that the economy is not overheating and that it does not yet need the Federal Reserve to cool it down. We need at least 2 million more jobs before we have a truly healthy economy. The governors of the Federal Reserve have done a lot to restore the U.S. economy back to health since the Great Recession. But now it appears that they are very eager to return to normal, less unusual practices even if we are not fully recovered. Policymakers, however, did not do enough to stimulate the economy. Today, they can make up for past misguided austerity policies by adopting the Congressional Progressive Caucus’ infrastructure plan, which promises 2.5 million jobs—enough to fully restore the American economy back to health. Find out more about the Millions of Jobs campaign here.