The Financialization of US Higher Education

This post was first published on Debt & Society.

With the 2016 Presidential election bringing renewed attention to rising college costs, UC Berkeley researchers have just released a groundbreaking study on broad and growing financial inequalities in U.S. higher education. Entitled “The Financialization of U.S. Higher Education,” it’s available online here.

Published in Socio-Economic Review, the study uses a unique new database an innovative theoretical framework for analyzing how non-profits, state agencies, and households have increasingly assumed multiple new roles in relationship to financial markets.

On the one hand, 1) endowments provided highly concentrated net increases net resources for a small number of elite private universities during the first decade of the 21st century. On the other hand, colleges and students experienced broad increases in net financing costs from: 2) institutional borrowing by public and non-profit colleges, 3) operating margins at for-profit colleges for equity investors, and 4) interest payments on student loans. Estimated annual funding from endowment investments grew from $16 billion in 2003 to $20 billion in 2012. Meanwhile financing costs grew from $21 billion in 2003 to $48 billion in 2012, or from 5 to 9% of the total higher education spending.

Some other key findings include:

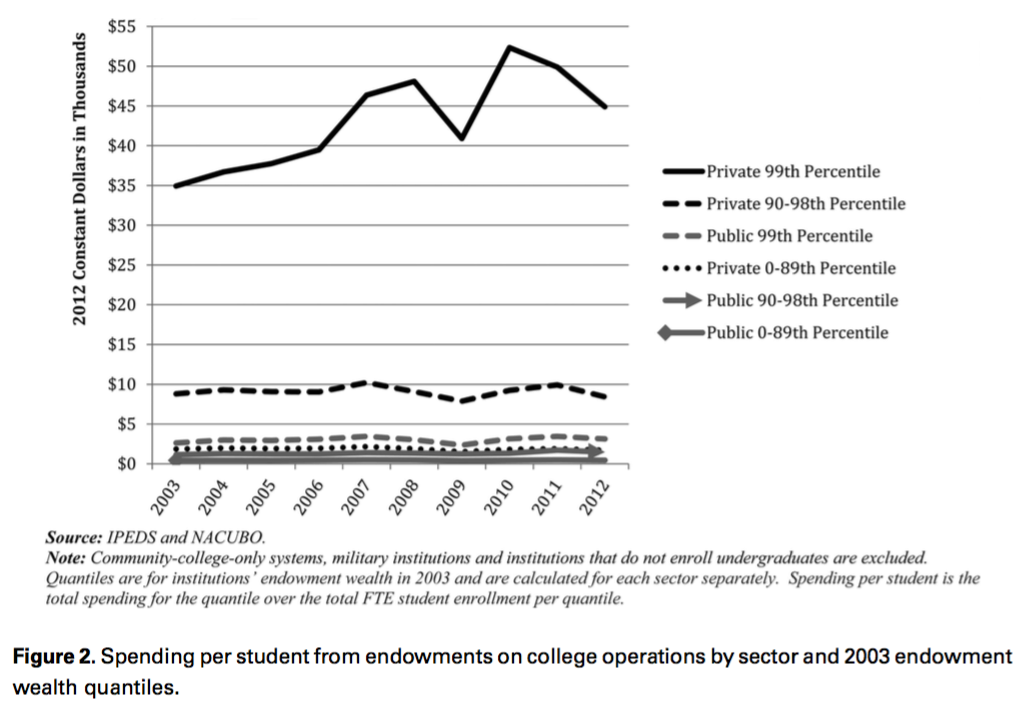

- Estimated annual funding for college operations from endowment investments also grew from $16 billion in 2003 to $20 billion in 2012, but growth was highly concentrated at the wealthiest colleges.

- Overall, interest for state and non-profit colleges’ institutional borrowing nearly doubled from $6 billion to $11 billion.

- For-profit colleges with capital form equity markets quintupled their annual operating profit margins from $1 billion to $5 billion before collapsing in 2011 amid federal and state regulatory crackdowns.

- Despite large increases in financing costs for state, non-profit, and for-profit colleges, spending on interest for student loans increased much more — from $13 billion to $34 billion. The vast majority of student loan interest growth was for federal student loans.

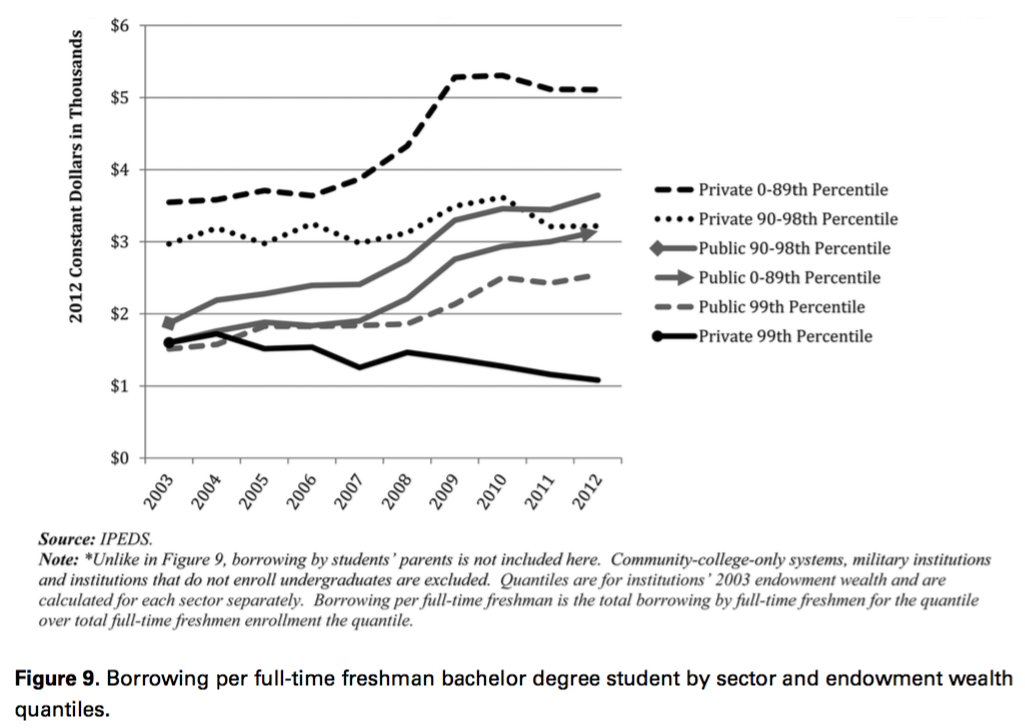

- While increasing student loan borrowing drove rising interest costs across most of the higher education system, the lowest levels of average borrowing by freshmen were at the wealthiest private colleges where average borrowing actually declined from from $1601 per student (not borrower) in 2003 to $1082 in 2012.

Here’s a figure from the paper showing the growing inequality in funding per student from endowments:

On the other hand, student loan borrowing actually decreased at the wealthiest private schools while increasing everywhere else:

The findings, however, were not all bad news. The researchers noted that public backlash and the regulatory crackdown by the Obama administration of for-profit colleges have substantially cut the profits of equity investors from for-profit colleges. Members of the research team are also at work on a new study regarding how students and their allies have built successful new political coalitions to make public colleges more affordable and reduce the costs of student loans. These efforts by activists created the climate for dueling proposals from Presidential candidates Bernie Sanders and Hillary Clinton for free or debt-free college.