U.S. Wealth Inequality Is Extreme and Republican Tax Plans Would Make It Worse

The Republican tax plans are fundamentally about making the super-wealthy wealthier.

While income inequality in the United States is at historically high levels, wealth inequality is even more severe. Wealth—assets minus debts—is increasingly recognized as the most important measure of overall economic well-being. Assets include savings, stocks, bonds, retirements accounts, homes, vehicles, and other property.

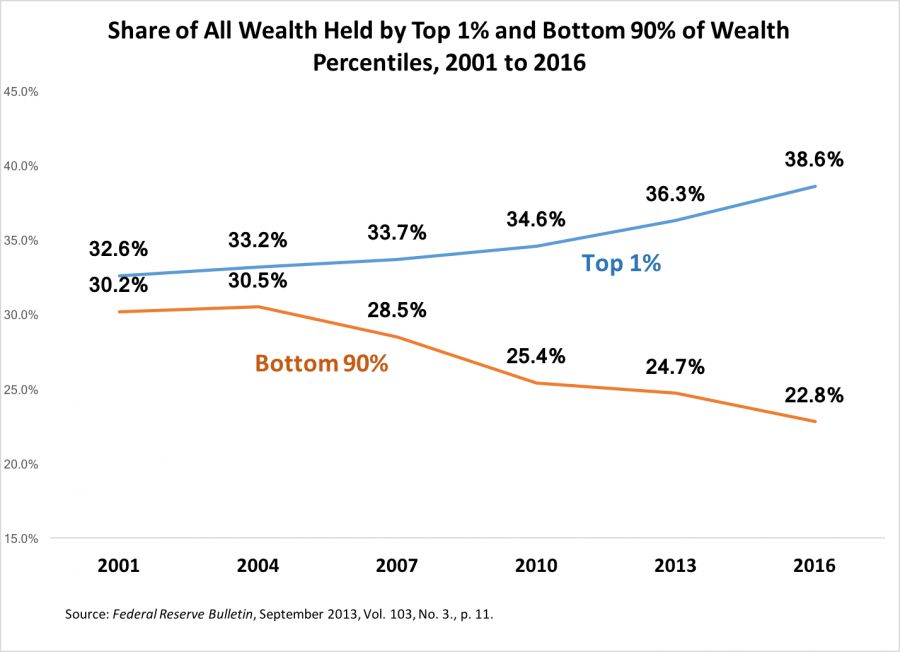

Data from the Federal Reserve indicate that the top 1 percent as measured by wealth is even more advantaged than the top 1 percent as measured by income. In 2016, the top 1 percent by income had a little more than one-fifth (23.8 percent) of all of the income in the United States, but the top 1 percent by wealth had nearly two-fifths (38.6 percent) of all of the wealth. The bottom 90 percent of all families combined only had about one-fifth (22.8 percent) of all of the wealth. The richest 1 percent by income does not have more income than the bottom 90 percent, but the wealthiest 1 percent does have more wealth than the bottom 90 percent.

Since 2001, the share of wealth held by the top 1 percent has grown at an increasing rate (Figure A). In 2001, the top 1 percent had 32.6 percent of all wealth. By 2016, they had 6 percentage points more, for a total of 38.6 percent. The share of wealth held by the top 1 percent continued to increase even from 2007 to 2010, the period covering the Great Recession.

The trend for the bottom 90 percent by wealth is very different from the top 1 percent (Figure A). The wealth of the bottom 90 percent has declined since 2001. The decline accelerated from 2007 to 2010, dropping 3.1 percentage points, the largest decline in the trend line. The bottom 90 percent was hurt in terms of wealth by the Great Recession, while the top 1 percent was not.

While the super-rich are already ridiculously wealthy—and their wealth has been increasing in recent years—Republican leaders are fighting hard to make them even wealthier. The goal of repealing and replacing the Affordable Care Act was never to provide better health insurance. This is why every plan the Republican leaders came up with would lead to tens of millions fewer Americans with health insurance coverage. The real goal of Republican “repeal-and-replace” plans is to provide tax cuts for the super-wealthy. Repealing the Affordable Care Act would provide billions of dollars to the wealthiest Americans.

The Republican tax plans are also fundamentally about making the super-wealthy wealthier. The vast majority of the tax cuts would go to the very wealthiest households. Donald Trump alone could end up 1 billion dollars richer if the Republican leadership gets its way.

America needs political leadership working for the country as a whole, not elected officials in the pocket of the wealthiest 1 percent. We need to elect leaders who by their actions—not their empty rhetoric—have shown that they are willing to fight for the 99 percent.