This is the third of several papers examining the underlying validity of the assertion that regulation of the financial markets is unduly burdensome. These papers assert that the value of the financial markets is often mis-measured. The efficiency of the market in intermediating flows between capital investors and capital users (like manufacturing and service businesses, individuals and governments) is the proper measure. Unregulated markets are found to be chronically inefficient using this standard. This costs the economy enormous amounts each year. In addition, the inefficiencies create stresses to the system that make systemic crises inevitable. Only prudent regulation that moderates trading behavior can reduce these inefficiencies.

Introduction

The 35-year experiment in deregulation of the financial markets created an environment in which innovative instruments and structures could be rapidly distributed around the world by their inventors (primarily, the largest banks) with little or no consideration of consequences, aside from potential profits. Information technology and the use of advanced valuation algorithms and statistics enabled the banking industry to create and market hundreds of financial products, many of which are so complicated that understanding them challenges even the most sophisticated market participants.

The first paper in this series discusses a groundbreaking study by Thomas Philippon of New York University’s Stern School of Management.1 Professor Philippon concluded that the cost of intermediation between the suppliers of capital and the productive consumers of capital has increased dramatically over the last 35 years notwithstanding IT advances, sophisticated quantitative analysis, massive trading volume increases and diversity in financial and derivatives markets that, intuitively, should have increased transactional efficiencies. This is significant because capital intermediation is the core social function provided by the financial system.

Philippon ascribed this surprising result to increased volume, but the first paper proposed that it was the quality of the trading activity rather than the quantity that was the root cause. It describes how advances in technology and quantitative analysis have led to asymmetric information advantages for sophisticated market participants that allow them to extract net value from the markets, a source of capital intermediation inefficiency.

The second paper described how changes to the characteristics of securities trading increase the cost of capital intermediation as well as increase market volume. This high volume trading, primarily high frequency trading powered by supercomputers and following complex algorithmic software, has reduced the reliability of market pricing mechanisms. In many cases, the HFT algorithms are designed to manipulate individual transactions. But even when it does not target discreet transactions, HFT impairs market reliability enabling the financial sector to exploit market distortions to extract value. Investors must price this unreliability into their investment decisions, further burdening the capital intermediation process.

This paper will explore the most important product innovation during the period of deregulation: Derivatives, financial instruments that detach the price risks and rewards from assets so that these risks and rewards can be allocated to a party without regard to interests in the underlying asset.

This discussion will describe derivatives in an entirely new way. Derivatives will be shown to constitute an essential element of the capital intermediation function. This differs significantly from the conventional view of derivatives as devices to eliminate risks.

The paper will then identify the costs of derivatives to the capital intermediation process and to the broad economy. These cost inefficiencies derive primarily from inaccurate valuation of financially engineered derivatives, leading to both mispricing and under-valuation of risk. The cost of entering into a derivative contract is generally very high, and the value of the contract received is much lower than typically understood. Sophisticated financial institutions understand these inefficiencies marginally better than other market participants and use this advantage to exploit them, to the detriment of the overall economy. Thus, derivatives are a major source of value extraction by the financial sector that renders the core function of the financial system, capital intermediation, less efficient and less stable.

Innovation In The Financial Markets

In policy and, too often, academic discourse, “innovation” carries a positive connotation. But the social implications of an innovation can be complex and often negative. Albert Einstein articulated the mathematics of physical relationships between mass and energy. But one practical application was nuclear weapons, and the consequences for the world have been mixed, to say the least. Similarly, the quantitative experts at the big banks have generated complex analyses of relationships among prices within and across asset classes: debt, equity, currencies and commodities. New financial instruments that are designed to reflect the relationships identified by the “quants” have proliferated. Innovation in the financial markets can be useful, but also harmful. As with Einstein’s work, some of the consequences of financial innovations are dangerous and volatile.

Well-regarded scholars have been remarkably tolerant of the emerging dangers from innovative financial engineering. Notably, Robert Merton, whose research provided the analytical foundation for derivatives markets, observed as follows:

As we all know, there have been financial “incidents,” and even crises, that cause some to raise questions about innovations and the scientific soundness of the financial theories used to engineer them. There have surely been individual cases of faulty engineering designs and faulty implementations of those designs in finance just as there have been in building bridges, airplanes, and silicon chips. Indeed, learning from (sometimes even tragic) mistakes is an integral part of the process of technical progress.3

To be fair, the quoted passage dates from before the financial crisis. Nonetheless, it expresses a widely held biased view that financial innovation, by definition, serves a public good that outweighs harm caused by a few unfortunate crises along the way. And it is particularly ironic that it comes from Merton, who was an integral player in the failure of Long Term Capital Management, a precursor to the 2008 crisis which is described in detail below.

The financial services industry has often raised the specter that financial market regulation will stifle innovation and thus, by definition, burden markets and the economy as a whole.4 Paul Krugman’s perspective on financial innovation identifies an important, endogenous cost that challenges this assertion, the obfuscation of risk:

(T)he innovations of recent years—the alphabet soup of C.D.O.’s and S.I.V.’s, R.M.B.S. and A.B.C.P.—were sold on false pretenses. They were promoted as ways to spread risk, making investment safer. What they did instead—aside from making their creators a lot of money, which they didn’t have to repay when it all went bust—was to spread confusion, luring investors into taking on more risk than they realized. [Emphasis added]5

Paul Volcker has famously expressed a similar view: “the most important financial innovation that I have seen the past 20 years is the automatic teller machine.”6 Perhaps more telling is a story he recounted that expands on his quip:

A few years ago I happened to be at a conference of business people, not financial people, and I was making a presentation. The conference was being addressed by a very vigorous young investment banker from London who was explaining to all these older executives how their companies would be dust if they did not realize the joys of financial innovation and financial engineering, and that they had better get with it.

I was listening to this, and I found myself sitting next to one of the inventors of financial engineering. I didn’t know him, but I knew who he was and that he had won a Nobel Prize, and I nudged him and asked what all the financial engineering does for the economy and what it does for productivity.

Much to my surprise, he leaned over and whispered in my ear that it does nothing—and this was from a leader in the world of financial engineering. I asked him what it did do, and he said that it moves around the rents in the financial system—and besides, it’s a lot of intellectual fun.

Now, I have no doubts that it moves around the rents in the financial system, but not only this, as it seems to have vastly increased them. [Emphasis added]7

Chairman Volcker identifies a second, but related, mechanism driving costs of intermediation higher: the allocation of higher and higher economic rents8 to the financial sector associated with innovative instruments. Ever-higher rents have been disproportionately allocated to dominant market participants. Innovation has become a means to extract value from the markets. As Professor Krugman observed, investors are ill equipped to understand the value of these products, especially when compared with the analytic capacity of the banks that invented them. Therefore, there is great incentive for dominant market participants to introduce and market innovations just to cause aggregate rents to increase.

This paper will articulate a theory that innovation in the financial markets has made the process of intermediation between suppliers of capital and productive consumers of capital less efficient. Innovation in the form of engineering of financial products has thus reduced the efficiency of capital intermediation, the central social purpose of the financial markets.

Fundamental Characteristics of Derivatives

The most significant financial innovations are tradable contracts that allow market participants to experience the financial consequences of rising or falling prices of asset classes without actually owning the assets. These contracts synthesize the financial consequences of owning an interest in the asset. For example, instead of owning a barrel of oil, an investor can “own” changes in the price of oil, up or down, from a set date to the end of the contract term. These “financial products,” known as derivatives, are based on dynamic measurement of value over time. Their utility to investors is completely dependent on statistical forecasts of price movements based on historic observations.

Derivatives could not exist without the ability to value them on a continuous basis. Price volatility, the frequency and amplitude of price movements, is a key factor in dynamic valuation of derivatives. The basic tool for measuring the value and risk of volatility is the Black-Scholes Option Pricing model first described by Fischer Black and Myron Scholes in 1973 and subsequently refined by Black, Scholes and Robert Merton. Scholes and Merton won the Nobel Prize for this work (Black had passed away) in 1997. By that time, Scholes and Merton had become principals in an investment fund called Long-Term Capital Management that developed a “fool-proof” strategy to make money based on quantitative analysis, specifically elaborations on the Black-Scholes model.

Within a year of their receipt of the Nobel Prize, LTCM had gone bust. It was bailed out by a consortium of Wall Street banks under the supervision of the Treasury Department and the Fed to avoid a systemic crisis, a precursor to the financial crisis of 2008. LTCM was a “hedge fund,” a trading business that uses complex mathematics to implement investment strategies with other people’s money. Much of the $130 billion invested in LTCM came from the large Wall Street banks and its failure threatened to migrate throughout the financial system.

The irony is inescapable. The 1998 failure of LTCM should have been a warning signal of the dangers of complex financial innovation. Instead, derivatives were freed from regulation by act of Congress in 2000.9 The stage was set for the growth of the US derivatives markets from a negligible amount to $60 trillion per year in the 10 years preceding the 2008 financial crisis. The total notional value of derivatives currently in existence is at least $600 trillion, though some estimates are as high as $1.2 quadrillion (which is 20 times world GDP).10

The business of Wall Street changed dramatically during this period. Since the New Deal, it had been divided between commercial banking (taking deposits and making loans) and investment banking (underwriting public securities offerings, mergers and acquisitions and, much less important, trading). The Glass Steagall Act that separated them was repealed in 1999. The combination of commercial and investment banking coincided with the rise of trading driven by massive increases in trading revenues in the deregulated environment. It has been estimated that two-thirds of the revenues from trading came from derivatives.11 Trading and traders now ruled on Wall Street and derivatives dominate trading.

The credit default swap is a notable example of a derivative. A credit default swap replicates the risk/reward results of owning a corporate bond. A market participant can synthetically experience the consequences of owning (or selling short12) a bond without actually owning it (or shorting it).

With CDS, the aggregate amount of risk associated with a company’s or a government’s bonds that is borne by all market participants is no longer limited by the amount of bonds that can be issued and purchased. By synthesizing the default risk of a corporation or government, the amount of that risk exposure can be multiplied many times over and propagated throughout the world. All derivatives, regardless of the underlying asset, share this property with CDS. This innovation produced terrible consequences when it was applied to mortgage-backed securities, as the risk of mortgage default borne by the economy was multiplied many times over just ahead of the crash of the housing market. There is no doubt that this phenomenon can recur in other asset classes.

Derivatives Primer

Derivatives are the foundation for most of the financial engineering of the last thirty-five years. Valuation and risk metrics for derivatives involve devilishly complex mathematics, but their structure is relatively straightforward. One need not be a “quant” to understand how they work and how they affect the efficiency of capital markets.

Understanding the basic principles underlying derivatives is essential to evaluating their effect on the economy. Financial institutions have consistently described derivatives in language that is designed to make them appear benign to customers and regulators. Derivatives are characterized as “financial products,” as if they are they are commodities that have been produced for sale, rather than synthetic derivatives of actual products. More importantly, they are said to reduce risk. This facile description is constantly parroted by academics and policy makers. A new and more accurate description is badly needed.

Many readers of this paper will already have an understanding of the mechanics of derivatives, but some will not. The following explanation provides a basic description of derivatives, but one that differs from the conventional description of derivatives in ways that are vital to understanding the cost that they exact on capital intermediation. Even though some readers may find a portion of the explanation to be basic, it is hoped that the insights will be useful even for those familiar with derivatives.

The fundamental characteristic of a derivative is that it is a bilateral contract between two parties, requiring performance in the future. It is not an asset like a share of stock or a barrel of oil. An existing derivative is not sold to another party. If a derivative counterparty wants to eliminate a derivative price risk from its book, it must enter into a contract that is the same, but take on the opposite obligations. The new “opposite way” derivative offsets the first derivative, but only if the party on the other side performs its obligations.

The value to a counterparty of a derivative on any given day during its life involves two central properties of the contract:

- The expected financial value of the performance in the future by the other party to the contract; and

- The likelihood that the required performance by the other party will not occur and that the expected financial value will not be realized (giving rise to credit exposures between the counterparties, as described below).

The values of these properties can be, and typically are, measured independently. However, measurement of these values and how they interact, even for a simply structured derivative, is a complex task.

All derivatives are swaps, but they may have different names based on the bells and whistles that are added, such as “futures” and “options.”13 A swap is a contract to exchange one value for another, the value most often being the price of a security or other asset (the “referenced asset”). Swaps are structured on hundreds of different “prices,” including prices of equity shares, currencies, energy and agricultural commodities, precious and commercial metals and debt (in the form of interest rates or component of interest rates, like credit standing of the debtor).

Derivatives are engineered from two basic building blocks: forward prices and options.14 These building blocks are used to construct relatively simple derivatives and are also packaged in various combinations to create new and more esoteric products.

Swaps on Forward Prices

A forward price, as of any date, is the expected price of a referenced asset on a specified date in the future. For example, a simple oil price swap is based on a future delivery date and location and a quantity. A common contract might refer to June delivery of 100 barrels of crude oil at Cushing, Oklahoma, a major distribution pipeline hub.

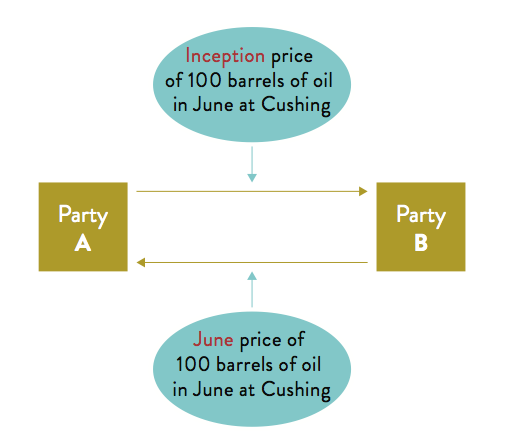

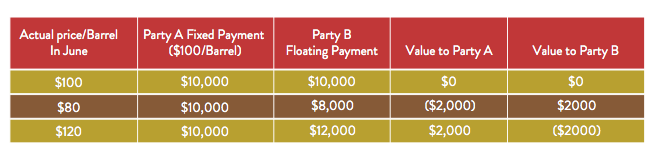

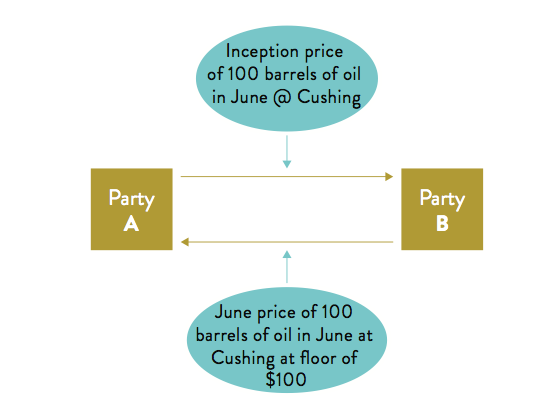

One of the values to be exchanged in the future may be fixed and determined at the inception of the contract. The performance required of one of the parties (we will call him or her “Party A”) is payment of a set dollar amount. This payment is calculated in our common example as the market value, at the inception of the swap, of 100 barrels of oil to be delivered in June at Cushing, Oklahoma. If the current forward price for a barrel of oil to be delivered in June is $100, a simple swap on 100 barrels of oil would require a fixed payment by Party A in June of $10,000.

All swaps involve swapping one value for another. At least one of the values is an amount based on a price to be determined definitively in the future. In our example, the other party to the oil price swap (“Party B”) is required to pay an amount in June equal to the then current price of 100 barrels of oil delivered at Cushing. Thus, the values exchanged on performance of the contract are today’s forward price for oil delivered in June and the actual price for oil delivered in June.

For Party A, the realized financial value of the future performance of Party B depends on the delivery price in June. If that price is higher than the forward price at inception of the swap (i.e., Party A’s fixed payment obligation), the swap will have a positive value for Party A equal to the excess. If it is lower, the swap will have a negative value to Party A equal to the amount the price has gone down since inception. Party B’s value in each of these cases will be the inverse.

To put numbers on it, remember the example in which the June forward price of oil was $100 per barrel at the inception of the swap, resulting in a fixed payment by Party A of $10,000. If the price per barrel is $120 on the performance date in June, Party B will be required to pay $12,000. After netting out the fixed payment by Party A, Party B is out $2000, which is also the benefit to Party A. But if the price is $80 per barrel, Party B will receive, and Party A will pay, $2000 on a net basis.

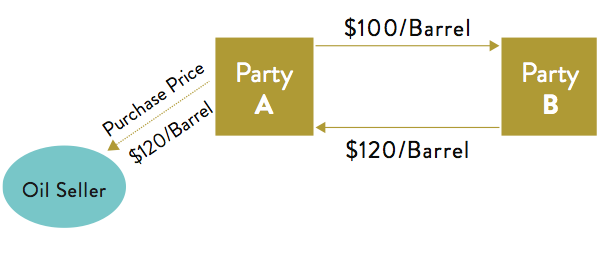

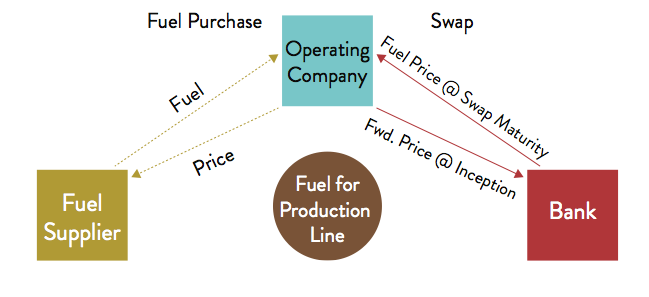

Swaps are most often used to hedge (meaning offset) a price exposure in the market for the referenced commodity or financial instrument. If Party A is certain that he or she is going to buy 100 barrels of oil at Cushing in June, Party A now knows (subject to performance by Party B) the financial consequence of the purchase. The combined effect of the swap and payment of the purchase price is the same as if the oil price in June were identical to the forward price at inception of the swap. Party A must pay the going price for 100 barrels of oil in June, but payments from Party B will offset the actual purchase price. Party A will pay Party B $100 times the number of barrels, the price at inception. From inception, Party knows that he or she will effectively pay $100 per barrel so long as Party B performs.

The same is true for Party B if Party B is certain that he or she will be selling 100 barrels of oil at Cushing in June. Both have exchanged the potential loss from an adverse price change for the potential profit from a favorable price change. This exchange of price consequences generates the financial value of the derivative, the first characteristic of the swap that determines its value.

It is often said that derivatives transfer risk. However, they actually transfer the consequence of a price change. That consequence might be positive or negative. If the June price is $120, the price consequence to Party A is positive because of the swap. If it is $80, the consequence is negative. If the forward price at inception of $100 is reliable, there are equal probabilities of negative and positive outcomes for Party A. So, the swap eliminates both risk of loss from an adverse price movement and the equally probable potential reward from a favorable price change. While the purveyors of swaps often ignore the transfer of potential reward, it is impossible to evaluate the rationale for entering into a swap without calculating the cost of giving up the potential reward.

Probability of Performance and Credit Extension

On each date prior to the definitive determination of the floating payment, the accrued value of the swap is based on the forward price on that date. Thus, the dynamic accrued value of any derivative over its life is dependent on the movement of a referenced forward price over a specified time period (i.e., the duration of the swap contract).

Assuming that the fixed payment (made by Party A) is accurately based on the June Cushing forward price at inception, the swap initially has no intrinsic financial value. At inception, the expected amount to be paid by Party B is the same as the fixed amount to be paid by Party A. As soon as the June Cushing forward price changes, however, value accrues. If the price increases the very next day after inception by $1, Party A accrues that positive value; if it decreases by $1, the accrued positive value is Party B’s. The counterparty in each case accrues an equal negative value.

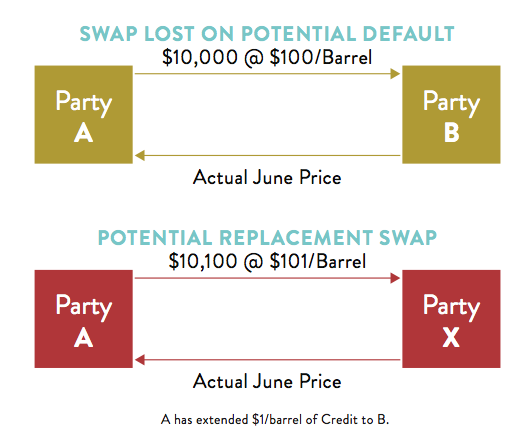

But, in contrast with this accrued value, the realized financial value is not actually known until performance is completed. The swap is a contract that has realized value only if the other party performs. It is not an asset that can be converted to cash by selling it on a date chosen by the owner. If Party A accrues a $1 value for each barrel, that value is at risk if Party B goes bankrupt or otherwise fails to perform. Party A is exposed to the credit of Party B. Party A can replace the swap immediately if Party B goes bankrupt. But the replacement swap will have a new inception date and, on that date, the June forward price is $1 higher in our example. Therefore, the fixed payment is based on a $1 higher price for 100 barrels. The consequence to Party A when June comes around is $100 worse.

This consequence is exactly the same as if Party A had loaned $100 to Party B and then Party B went bust. Party A has extended credit to Party B.15

This illustrates the second embedded property of a swap that determines its value. At any time the swap has a financial value based on the current forward price; but it also involves an extension of credit that has a separate value or cost. In a loan, the value and cost of an extension of credit is expressed as an interest rate. In a derivative, the credit extension has a parallel value or cost, but it its expression is obscured because it is embedded in the pricing of the swap. For example, the floating leg of the swap might be set at the June Cushing price less 50 cents. This compensates Party B for the potential extension of credit to Party A. Sophisticated derivatives counterparties price in potential credit extension using complex statistics measuring probable amounts of credit extended, especially if they have market power to demand it.

Uniformly banks price-in credit exposure, while, typically, businesses and governments that are the banks’ counterparties do not. Only banks and a few businesses are sophisticated enough to understand and price credit extension. The author has had more than one conversation with relatively sophisticated finance officers and treasurers who believe that large banks simply extend this credit at no cost. It is inconceivable that a bank would do this and, in fact, the trader who transacts the derivative is always provided a charge for credit exposure that he or she passes through.

More importantly, only the banks (and, in particular businesses sectors, other powerful entities, such as big oil companies in energy) have the market power to demand compensation for potential credit exposure. Currently, the four largest banks control 94% of the bank derivatives business in the US.16 Therefore, the large banks can demand compensation for the extension of credit inherent in swap, and they can also avoid paying compensation to counterparties.

The amount of this credit extension can be determined at any time so long as reliable market forward prices are available. However, there is no cap on the amount of credit extension that can accrue. Prices, in theory, can go sky high or sink like a stone. Therefore, the value or cost of any credit extension also has no cap. In this way, credit extended in a swap is much riskier than the extension of credit in a conventional loan.

Margining and Demands on Cash Liquidity

As described above, the changing accrued value of a swap generates credit exposures during the term of the swap. (See Figure 3) These credit exposures are not capped. An exposure’s size is measured by the movement of the referenced forward price during the life of the swap and this price movement has no limit.

To protect against losses, banks generally require that credit exposures be fully or partially collateralized by their counterparties. This is referred to as “margining.” If a swap’s credit exposures are fully collateralized, the bank will require that the full amount of credit exposure as of the prior day’s close of business be on deposit in an account that secures the bank. If the forward price moves in the bank’s favor, the amount of margin required to be on deposit the next day increases. If the forward price moves in favor of the counterparty, margin collateral can be withdrawn.

Since the amount of credit extended under a swap is uncapped and unpredictable, margin can pose severe cash liquidity risk to the counterparty. In a volatile price environment, the challenge can be greater as prices move by relatively large amounts over short periods of time. In the real world, the threat based of the need to access cash immediately is the most dangerous element in the use of derivatives.

Generally, banks allow counterparties to accumulate credit exposure up to a cap before they must make a deposit of margin collateral. These are typically referred to as “margin thresholds.” Banks treat margin thresholds like revolving loans, decrementing credit capacity to lend to the swap counterparty on an unsecured basis for all purposes.

Banks also require “credit triggers,” provisions that require full margin collateralization, regardless of thresholds, if the credit of the swap counterparty deteriorates. The most common trigger is a downgrade by a credit rating agency. The implementation of a credit trigger is the extreme form of the dreaded “margin call.” One need only recall the credit default swap margin call made on AIG in 2008 that precipitated its bailout in the amount of $185 billion. Margin calls have bankrupted many businesses and governments around the world.

A credit rating downgrade trigger means that the business or government must come up with cash at precisely the time that cash is most difficult to secure. This amplifies the cash liquidity risk posed by margining generally. The company might be pushed into a default for lack of cash, which triggers cross defaults to other financing arrangements, even though default caused by its underlying business is remote. Historically, this is the way derivatives have had catastrophic consequences for businesses and governments.

An inescapable feature of swaps, even if they are perfectly designed to offset some price risk that is absolutely going to be realized in the future, is that if the business or government cannot meet a call for margin, either because a credit threshold has been exceeded or because a credit trigger has been tripped, it will likely go bankrupt. The swap terms will be breached and all other financial arrangements that have cross default provisions will be breached as well. Thus a swap that poses zero financial exposure to a counterparty can also bankrupt that counterparty through credit exposure.

These risks are poorly understood and almost never valued when businesses and governments decide between swap hedging and the use of simpler alternatives. Moreover, these risks are not considered in the academic literature that analyzes the use of swaps. This is remarkable. From AIG to Jefferson County, Alabama to Enron, credit triggers have been the immediate source of swap-induced bankruptcies.

The unmargined derivatives credit exposures that are widespread in the economy are a form of “Ponzi“ financing described by the newly revered economist Hyman Minsky, whose work foresaw the financial crisis.17 He states that financing that can neither be currently repaid or at least repaid from future identifiable revenues creates high levels of instability in the economy. As experienced by AIG and scores of businesses and governments around the world, there is a high likelihood that margin calls cannot be funded by current cash flow. The only way to avoid default is to find financing that replaces the financing under the derivatives that has suddenly become unavailable. This is reminiscent of subprime mortgage loans that were at the center of the financial crisis. As for AIG, the replacement financing came from the US taxpayers.

Finally, as described above, credit exposures in swaps run both ways. Banks protect themselves with margins, thresholds and credit triggers. However, if a business or government transacts a swap with a bank, the credit exposure is equally likely to involve an extension of credit to the bank. This extension of credit is almost never priced into the transaction by the business or government and they rarely benefit from margining, threshold and trigger provisions. Since the vast majority of swaps are held by four banks, the ability of businesses and governments to negotiate favorable terms is negligible, even if they understand the risks involved. It is as if the market has concluded that no risk of bank default need be considered. The swap counterparties of Lehman Brothers might find that conclusion particularly unpersuasive.

Advanced Engineering

For readers who are interested, Appendix A includes a description of two more complex forms of derivatives: composite swaps and options. These are extraordinarily important concepts, but knowledge of them is unnecessary for following the balance of this paper.

Summary. In summary, derivatives share specific core characteristics. In terms of value:

- Derivatives are executory contracts based on the exchange of financial consequences of determinable price moves from inception to a date certain.

- At any point in time, the current financial value of the derivative contract depends on the expected forward price that is referenced in the derivative.

- The realized value of a derivative is dependent on performance at the required date. If, at any time prior to required performance, the performance by one counterparty has an accrued positive value based on current forward prices, the other party who has accrued that value has extended credit to its counterparty. That credit is valuable to the counterparty who receives it. It also is a cost to the party that extends the credit.

In terms of the use of derivatives, the potential price consequence to a business of future price movements is exchanged for a fixed consequence (or another referenced consequence of a price movement). The consequence can be either positive or negative. Risk of loss and reward of profit from price moves are transferred from one counterparty to another.

The Effect of Derivatives on Capital Intermediation Eficiency

In order to understand the affect that derivatives have on the capital intermediation system, we must identify how derivatives are used. It should be obvious that derivatives can be used to place a bet on a price move in lieu of buying an asset. For example, a trader desiring to speculate on increasing oil prices could buy 100 barrels of oil and hold on to them. But he or she would have to pay for storage and transportation costs. Alternatively, the trader could enter in to an oil price derivative that increases and decreases in value as prices change.

This kind of speculation through derivatives is commonplace in all of the derivatives markets. Traders at financial institutions speculate. But so do retirement funds and endowment funds of colleges and health care institutions. Each of these entities can adopt a strategy that seeks out the price risks and rewards of asset ownership and often uses derivatives to achieve this end.

In this context, derivatives are an important part of the financialization of the American economy. Derivatives synthesize ownership. They allow total amount of exposure of asset price risk to multiply far beyond the actual assets that exist. The potential for distortion is great and will be discussed in detail in a subsequent paper that considers financialization broadly.

Derivatives are also used to offset price exposures. Banks use them to shift the consequences of currency and interest changes that could affect their role as providers of payment intermediation among customers. And many different kinds of businesses and governments use them to alter the consequences of price movements to which they are exposed in their operations, such as prices of commodities, interest rates and currencies. These uses are referred to as hedges.

Derivatives as an Element of Capital Intermediation

The capital intermediation function, the core social value afforded by the financial system, allows investment funds to be deployed to productive purposes. One element of this process is simply matching investors up with capital demand. But the needs of investors and consumers of capital are often not the same. For instance, investors may want to lend at floating rates of interest while a borrower may want to have a fixed rate. A big part of the services provided by capital intermediaries is to reconcile these differences.

As described in the first paper of this series, traditional commercial banking provides capital intermediation. In that model, banks deploy customer deposits and their own capital to fund capital needs in the economy. The mismatches between the two, such as term, interest rate and credit, are absorbed by the banks’ capital base. If the sources of capital and its uses become unbalanced (for example if customers with draw deposits or the bank suffers loan defaults) the banks’ own capital is available as a cushion. To secure integrity of the system, the government provides FDIC deposit insurance to the customers to discourage panic withdrawals and the Federal Reserve allows banks to borrow at the discount window to provide liquidity.

A second model of capital intermediation is the trading market. This has become the dominant form of capital intermediation over the last 35 years. The trading market model can be thought of as an intermediation pipeline, just like the commercial bank model. In the “primary market,” a business or company issues new securities into the pipeline to raise capital. At the same time investors supply new capital funds by putting money into the pipeline to acquire the newly issued securities.

The major difference with the commercial bank model is that investors can put their investment back in the pipeline whenever they wish to, in exchange for cash or replacement investments. This is thought of as a major advantage for investors, one that can make capital less expensive for productive users of funds raised in the primary market. Intermediaries also buy and sell investments that are in the pipeline, intermediating the secondary market. This is “secondary market” trading, and it is absolutely vital to capital intermediation through the trading markets. Without it, investors cannot easily trade out of their positions and they cannot anticipate prices if they are considering doing so.

Derivatives are an integral part of the trading market intermediation model. They reconcile mismatches between capital sources and uses, typically maturity, interest rate, creditworthiness and currency differentials. They act just like bank capital reserves in the commercial bank intermediation model. This use of derivatives is neither primary nor secondary market trading. It is a third form of trading that is integral to capital intermediation, but this role is virtually unrecognized in the literature.

For example, a company or government can enter into a derivative contract with a bank to synthetically convert the form of an obligation into another form. Using derivatives, an investor who seeks a 10-year, fixed rate bond denominated in Euros can be a source of funds for a company seeking a floating rate loan denominated in US dollars. The company can synthetically convert the bond that the investor wants to buy into funding based on terms that the company wants to procure.

In our example, the company enters into a swap contract with a bank. Under the contract, the company receives payments equal to its fixed rate interest payment obligation; and it pays the bank an amount equal to the interest obligation that it would have had if the interest obligation had been at a floating rate. The investor is paid its fixed rate interest indirectly by the bank and the company pays floating amounts to the bank. The company’s obligations denominated in Euros are similarly swapped with the bank for a like obligation denominated in US dollars. Capital intermediation has worked and the mismatches have been reconciled.

Derivatives are also used to reconcile credit mismatches. Credit default swaps can be used to transform credit exposures, as a bank that writes the swap effectively becomes the guarantor of the credit exposure.

As discussed herein, businesses and governments can also use derivatives to hedge risks embedded in their enterprises. Credit rating agencies often urge this use of derivatives. Ratings are based on probability of default rather than potential for success. As a result, ratings agencies are biased toward derivatives that exchange profit potential for certainty of outcome. The agencies reward the reduced potential for default and are unconcerned about the lost opportunity for profit. By securing a favorable credit rating, capital can be raised at a lower nominal cost.

As the capital intermediation model has grown relative to commercial bank intermediation, the need to reconcile differences between sources and uses of capital invest ment using derivatives has also grown. Banks are the dominant source of derivatives for businesses and governments. Therefore, bank balance sheets are still at risk for investor/capital user mismatches, but not directly as in the commercial bank model. They are at risk under the derivatives, a far more complex set of risks than those experienced in the commercial bank intermediation model. The question is whether this is a good thing or bad.

Enterprise Risk Hedging

In contrast with speculation, swaps are most often used by businesses and governments to hedge (meaning offset) a market price exposure that the business or government experiences in its operations or in its capital structure. Unlike speculation, the value of hedging is not derived from market price moves. The value is in the offset between the actual price exposure and the synthetic price exposure under the swap.

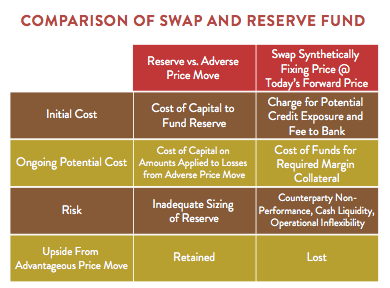

Derivatives do not eliminate risk. They are contracts that exchange one set of future consequences from a price change for another, assuming the other party performs. Picture a business whose profit and loss during a period in the future depends on price movements of a commodity or security. In order to avoid the consequences of an adverse price move, the business could establish a reserve from borrowings or earnings. Alternatively, it could enter into a swap that (assuming performance by the counterparty) fixes the consequence of this price exposure at the current price level.

The distinctions between these alternatives – capital reserves and derivatives - should drive the decision between these two methods of managing the risk of price movement.18 The use of derivatives is often characterized as a “risk reduction” device. Instead, it is a contract that is one of a number of devices to alter the consequences to an enterprise of an exposure to price changes. If a reserve is used, the business must pay for the capital to fund it. If a swap is used, the company pays the value of a beneficial price move if it occurs. That value is transferred to a bank counterparty. If a reserve is used, the risk is that an adverse price move has consequences beyond the reserve. If a swap is used, the basic embedded risk is that the counterparty fails to perform - but swaps include many other risks as well.

The enterprise price risk that is hedged by a derivative occurs sometime in the future, presumably at the same time the payments are required under the derivative contract. That reflects an offset of one of the basic properties of derivatives, their financial value, against an experienced outcome of the enterprise. However, the other basic property, credit risk extension, comes into play from the inception of the derivative contract. A company either funds margin collateral during the term of the derivative contract or it receives an extension of credit from the counterparty, which is almost always a bank.

The business or government could set aside funds as reserves. They could deposit the amount it would have been putting up in margin or in the embedded extension of credit under the derivative contract if no ongoing margining is required. At the time the enterprise price risk is experienced, the company or government would be equally protected from a price shock (assuming, of course, that the derivative counterparty performs its obligations). However, if it uses a reserve fund it would benefit from a favorable price movement. And if it uses a derivative it would not experience a negative price shift.

The business or government should be indifferent between borrowing money to fund a reserve and receiving an extension of credit under the derivative. As discussed above, a derivative involves an extension of credit, with many of the characteristics of a loan to fund a reserve. A bank has finite capacity to extend credit to any company or government. When it makes a loan, the bank decrements available credit capacity to keep track of how much exposure to the borrower has been taken on. Similarly, when the bank enters into a derivative, the embedded credit exposure is decremented from credit capacity. Both consume finite credit capacity, limiting what the business or government can borrow for other purposes.

The question is whether the costs and benefits are accurately reflected in the pricing of the contract and the consequences to the two parties.

Since the alternative approach to managing a price exposure is to establish a reserve, derivatives can be described as a substitute for capital funding. This is the best way to evaluate the effects of the derivative innovation on the underlying social purpose of the financial markets - the efficient intermediation between capital sources and capital uses. To the extent the use of derivatives rather than capital reserves increases the efficiency of intermediation, derivatives provide a social value. To the extent their use decreases efficiency of intermediation, they impose a social cost.

There is an important difference between conventional credit and credit embedded in a derivative, however. In 2007, I made a proposal to the head of an energy division of one of the largest banks in the world whose responsibilities included lending to energy companies. I suggested that the bank transfer credit capacity for certain companies that had been allocated to the bank’s derivatives trading desk to the lending group. This would enable the companies to use loan proceeds to collateralize derivatives credit exposures to the bank rather than merely grow them organically by transacting derivatives. It would be done through a system my company had developed to increase the efficiency of derivatives credit management. If the bank charged uniformly for the extension of credit, it would be indifferent as to the allocation of the credit capacity since the exposure to the bank would be the same. It appeared to be a matter of form rather than substance. But the customer would benefit from the increased risk management efficiency.

However, the derivatives desk refused to reallocate the credit capacity. This was because its profit from credit extension embedded in derivatives was reportedly ten times the profit that could be earned from making a loan. This confirmed what was commonly understood to be true.19 Because the pricing of derivatives was so complex, customers almost never understood how much a bank charged for entering into the derivative.

This constitutes a massive distortion of the credit markets. In an efficient market, credit is priced similarly regardless of how it is deployed. As mentioned above, derivatives are used to reconcile differences between the needs of the sources and uses of capital investment. This is an alternative to the commercial bank intermediation model. In both cases, the users of capital “rent” the balance sheets of the banks to acquire reconciliation. Large differences between the rent charged for derivatives and the rent charged in the commercial banking intermediation model for the “use” of the bank balance sheet constitute an extraction of value from the capital intermediation process in excess of the value provided.

Only the banks that overcharge are aware that the overcharging occurs. In order to examine pricing, one must compare the original pricing with the market at inception of the transaction, and data is difficult to find. However, there are rare glimpses into the practice. One was a package of LIBOR swaps entered into by the Denver Public Schools as part of a complex financing of its pension fund deficit. LIBOR swaps are extremely liquid, and are near commodities. The price for a LIBOR swap is low and easily tracked. Andrew Kalotay, the founder of Andrew Kalotay Associates that provides quantitative analysis of fixed income products, was asked to look into that financing after it collapsed in the wake of the financial crisis. Dr. Kalotay is an adjunct professor at NYU and serves on the Municipal Securities Rulemaking Board (MSRB) advisory committee that oversees the certification of municipal advisors. Dr. Kalotay testified concerning his investigation before the SEC in a general inquiry on municipal finance practices.20

Dr. Kalotay determined that the school district was over charged by more than $13.5 million for the swaps, an immense amount for such a commonplace swap. Troubled by his finding, Dr. Kalotay estimated that state and local governments throughout the country had been overcharged by $20 billion in the years 2005 to 2010 by the financial sector.

Overcharging of private companies is even more obscure. They are less likely to be subject to public scrutiny. However, as described above, the evidence of general overpricing is compelling.

Measuring Derivatives Effect on Capital Intermediation Inefficiency

Overpricing directly affects the cost of capital intermediation. But that is only half of the analysis. The other side of the analysis is the value of the product that businesses and governments receive in exchange.

As mentioned, credit capacity is finite. The large disparity in the profitability of lending and derivatives credit extension means that businesses and governments will be prevented from tapping into capital lending sources or pay more for scarce capacity. It would be different if the credit extension were ten times more valuable to the company or government than a loan. However, the academic research suggests that this is not the case, especially when the research is read in the context of the practical use of derivatives in the marketplace.

The best sources of relevant knowledge about this issue are the academic studies of the choice between using derivatives and using reserves. The Gamba and Triantis study cited above21 provides the most elaborate comparison of the alternatives. The study concludes that the methods produce similar value and that a combination of the two, based on specific price exposures, is the most rational policy for a company or government. Based on the academic analysis, it is clear that derivatives are not ten times more valuable, but are in fact comparable to reserves.

Unfortunately, academic study of derivatives uniformly falls short because of the difficulty of valuation and an incomplete understanding of the true cost implications of derivatives. Even in the Gamba and Triantis study, significant valuation issues are omitted.

First, the study considers only the elimination of a risk and ignores the basic function of a derivative as a change in consequences. It is true that both alternatives – derivatives and cash reserves - mitigate the immediate consequences of an adverse price move. However, a funded reserve allows a company to profit from a favorable price move. If a swap is used, in contrast, the value of a favorable price rise is foregone. The derivative used to manage price risk could, of course, be constructed as an option so that the value beyond the “floor or cap” described above is not swapped. That is to say the benefit of a favorable price move is retained. To compare risk mitigation methodologies, an option should, in fact, be the comparison case since the option value represents the potential of a beneficial price move. Alternatively, if a swap is used, the implied cost of foregoing upside measured by option value should be included in the cost comparison. The cost of foregoing the potential upside is simply not considered by Gamba and Triantis.

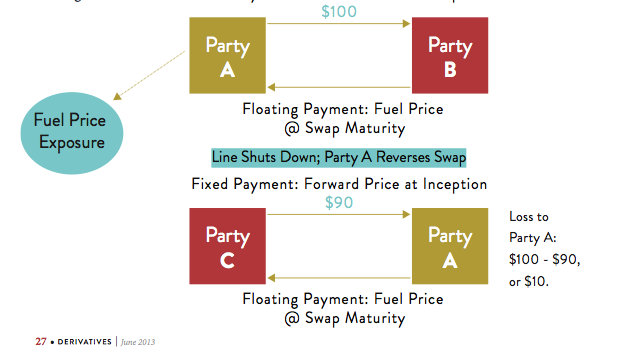

Moreover, the use of a swap as a risk management device deprives a business of flexibility, a cost that Gamba and Triantis does not consider. This problem is most obvious in swaps used to hedge commodity price risk. For example, a business that is exposed to the prices of its output can manage the consequences of a price downturn by altering its operations. For instance, it can shut down a production line.

This operational response can be used if the business manages price risk with reserves. If it uses a swap, however, it must continue the operation as a matched offset to the swap. If it shuts down a line, the business is exposed to the price movements reflected in the swap payments, with no offset from product sales. The price risk exposure incurred if it shuts down a production line is the mirror image of the risk it sought to manage in the first case.

Note that this loss of flexibility is a cost to the general economy as well as a cost to the individual company. In our example, shutting down a production line limits supply to the market supporting the price of the product, a self-correcting device that benefits the entire economy. If the company has entered into a swap, it is incented to continue output so that the price movements of the swap are offset. The self-correcting effect of price moves on production is muted. This is a major inefficiency cost of the derivative innovation. It impairs the fundamental forces of price, supply and demand.

The problem of derivatives market illiquidity is also not considered in Gamba and Triantis. The utility of a derivative as a hedge depends on the existence of a price exposure to be hedged. However, circumstances change. For instance, a plant might be closed down unexpectedly, eliminating an exposure to fuel prices. A company that had hedged fuel price risk using a swap is, in that case, exposed to the very risk it sought to avoid (fuel price change), with no way to manage it other than to enter a reversing swap. If the market accommodates the new, reversing swap, all is well. But there may be no market availability of the reversing swap. Alternatively, limited market availability may mean that the reversing swap is available only at a high price. The exposure to the liquidity in the derivatives market is a very real cost. This cost is not an issue with a reserve, which can be redeployed to other purposes if the fuel price risk in our example no longer exists.

Fixed Payment: Forward Price at Inception

But even if the swap described in the preceding paragraph can be reversed in the market, the company would have lost all of the value accrued as prices moved against it from the inception of the swap. The reversing swap will be at the new market price, not the price at inception. The accrued value of a derivative has no analog in the alternative in which a reserve is used. The cost of establishing the reserve is fixed, and can even be reduced by liquidating or redeploying the reserve.

In addition, Gamba and Triantis does not address the issue of liquid access to cash. As described above, the extension of credit in the amount of accrued value is embedded in every derivative. It is common practice to require a counterparty to whom credit is extended to post collateral as security against default. This is often referred to as margin. Since the amount of credit extended is uncapped and unpredictable, margin can pose severe cash liquidity risk to the counterparty. In a volatile price environment, the challenge can be greater as prices move by relatively large amounts over short periods of time. In the real world, the threat based on the need to access cash immediately is the most dangerous element in the use of derivatives. The Gamba and Triantis study values the credit extension to the company entering into a hedging swap. But, it does not consider the cash liquidity risk associated with margin collateral.

For most swaps, however, the credit extension is initially uncollateralized, at least up to an agreed cap. Almost invariably, swap agreements require immediate and complete funding of margin collateral against a credit exposure under certain conditions. The most typical is a credit rating downgrade, with the consequence that the company must come up with cash at precisely the time that cash difficult to secure. This amplifies the cash liquidity risk. The company might be pushed into a default for lack of cash, which triggers cross defaults to other financing arrangements, even though default caused by its underlying business is remote. Historically, this is the way derivatives have had catastrophic consequences for businesses and governments.

Finally, as described above, credit exposures in swaps run both ways. The Gamba and Triantis study explicitly assumes that the swap alternative under consideration in the study is entered into by the subject company with a bank. It concludes that no risk of bank default need be considered. The swap counterparties of Lehman Brothers might find that conclusion particularly unpersuasive.

In summary, the study by Gamba and Triantis, while it is the most comprehensive available, still runs afoul of the incredible complexity of even a relatively simple swap transaction. This illustrates clearly that that derivatives are difficult to value. More complex derivatives are even more challenging as additional risks compound the valuation problem. It is completely unrealistic to believe that participants in the derivatives markets accurately value the transactions that they enter into. A recent study describes this problem:

The practical downside of using derivatives is that they are complex assets that are difficult to price. Since their values depend on complex interaction of numerous attributes, the issuer can easily tamper derivatives without anybody being able to detect it within a reasonable amount of time. Studies suggest that valuations for a given product by different sophisticated investment banks can be easily 17% apart and that even a single bank’s evaluations of different tranches of the same derivative may be mutually inconsistent.22

Under these conditions, it is clear that the very complexity of valuation of derivatives constitutes a major inefficiency in the intermediation of capital sources and capital uses. Derivatives are a substitute for capital-funded reserves and constitute a form of synthetic leverage. They are an integral component of the capitalization of many businesses. No studies have comprehensively valued the use of derivatives as a substitute for straightforward capital funding, possibly because valuation is simply too great a task. And it is obvious that the valuation issues are so complex that no company or government could practically value the use of a derivative in lieu of reserves in an ongoing operation.

The inadequate valuation of derivatives imposes inefficiencies and costs on the intermediation of capital in the financial markets and contributes to the increased cost of intermediation observed by Professor Philippon. Sophisticated banks understand valuation far better than their customers. This means that prices can never be adequately evaluated. In this way, the financial sector extracts value from the financial markets through derivatives prices that are never adequately understood by customers.

Price Transparency And Clearing

The Dodd-Frank financial reform law addresses derivatives primarily by requiring transparent pricing procedures and clearing for certain derivatives. Unfortunately, the exceptions to these requirements leave out the derivatives that involve the greatest capital market inefficiencies from coverage.

Price transparency is enhanced by requiring certain derivatives to be traded on regulated exchanges or on “swap execution facilities” that are subject to less stringent requirements. Under the final regulations implementing the law the effectiveness of swap execution facilities will be limited. It is very likely that complex derivatives and derivatives that are not widely traded will not be traded at exchanges or swap execution facilities.

Dodd-Frank also requires that certain derivatives be cleared. Clearinghouses stand in between the two sides of a derivatives contract, entering into mirror contracts with each side. Thus, all of the market price risk is held by the two parties that contract with the clearinghouse. But the credit risk of performance of each of these parties is held by the clearinghouse. The clearinghouse manages the credit risk using uniform risk metrics and requiring immediate funding of margin collateral. This is an upgrade over practices that are used in bilateral, un-cleared derivatives.

However, Dodd-Frank excludes “end user” derivatives from the clearing requirement. This exception encompasses virtually all derivatives used to hedge enterprise risk by businesses and governments. As a result, much of the cost and risk of the derivatives market will remain.

These reforms are beneficial, but far from universal. The inefficiencies of the derivatives markets and the cost to capital intermediation will persist.

Conclusion & Next Steps

Dramatic innovations over the last 35 years, especially since 2000, have changed trading markets dramatically. By far the largest and most dangerous innovation is the derivatives market. Derivatives were created and marketed aggressively by the large financial institutions that dominate trading. These sophisticated market participants are very well situated to understand the distortions and inefficiencies that are embedded in derivatives. In most cases they are ongoing participants in the activities that are required to maintain the markets.

Armed with superior technological and analytical capabilities and intimate knowledge of distortions and inefficiencies, these large financial institutions are able to exploit them. They understand the pricing and valuation of derivatives much better than their customers. This knowledge advantage is immensely profitable for them.

The value that they extract is large. For the most part, it exceeds the value provided by the innovations themselves. For example, most studies indicate that the value of using derivatives to manage risks is roughly the same as the value of using a reserve for the same purpose. But the complexity of even the simplest derivative goes unaccounted for in the academic literature and in the marketplace. Complexity obscures the evaluation of efficient results. Therefore, studies that show that the use of derivatives to hedge provides little if any advantage over alternatives omit many costs that would tip the scales against derivatives.

The marketplace is biased toward complexity because it favors market participants with asymmetric information advantages and oligopolistic market power. Under these circumstances there is an inherent bias toward risk taking by large financial institutions: the larger the risk, the larger the reward; and if the rewards are structurally higher, immediate profits (which translate in to shareholder value and executive compensation) can be seized. The periodic catastrophic failure is worth it for traders and executives who keep their earnings.

But in the interim, American businesses, governments and the general public suffer. Inefficiencies that transfer earnings to the financial sector are like a tax that redistributes wealth upward. This system cannot persist. Constraints on innovation, especially innovation in derivatives, based on much greater evaluation of costs and benefits, are desperately needed.

The capital intermediation system, and as a result the economy as a whole, would benefit greatly from a reduction of the derivatives markets. A number of regulatory measures have been suggested that would move in this direction.

- The end user exemption from clearing and price transparency provisions of the Dodd-Frank Act could be eliminated or at least interpreted narrowly. This exemption was included for political expediency in the debate over Dodd-Frank. Businesses and governments with direct access to members of Congress continue to support the exemption, but the value that they perceive from it is misguided and springs from illegitimate incentives, such as obfuscation of debt in disclosure and tax technicalities.

- Pricing of derivatives, especially for state and local governments, must be made more transparent and fair. Two measures would improve this situation:

- Generally, state and local governments employ independent advisors to evaluate swaps. Many of these advisors are ill equipped to evaluate the transactions. Even worse, they are highly susceptible to influence by banks in direct and indirect ways. The Dodd-Frank act requires registration of advisors by the Municipal Securities Rulemaking Board, but the statute omitted the term “financial” in its description of “advisors.” As a result, implementation of the registration regime has been bogged down for years. Immediate registration and a strong set of standards would be beneficial.

- Further, a bureau like the Consumer Financial Protection Bureau for state and local governments is completely justified. The mispricing of financial products, particularly derivatives, to these entities imposes a heavy burden on the economy.

- The problem of properly evaluating the use of derivatives by businesses and governments is daunting, eluding even fine scholars who study the matter. Derivatives impose dangerous and costly risks that are rarely considered. Ultimately, these are risks and costs that are material to investors in these businesses and governments. Comprehensive disclosure of these risks and costs would require the businesses and governments to actually examine them. The SEC should develop a template for evaluation of these risks and costs and require disclosure under its terms. Investor disclosure would improve, but even more importantly businesses and governments would be provided the tools to understand the consequences of their transactions.

- Accounting rules are directly related to disclosure. Derivatives that are used to hedge enterprise risk are given short shrift under accounting rules. Accrued value, i.e., mark-to-market value, is disregarded because the ultimate outcome of the derivative is offset by an exposure that is embedded in the enterprise. However, this exposure may or may not be realized. And, far more importantly, during the period prior to the end of the term of the derivative contract, the business or government potentially incurs large and extraordinarily risky debt. The existence of this debt is only disclosed indirectly and incompletely. Enhanced accounting rules governing derivatives could inform the businesses and governments considering their use of the negative potential consequences.

Appendix A: Advanced Financial Engineering

Composite Swaps

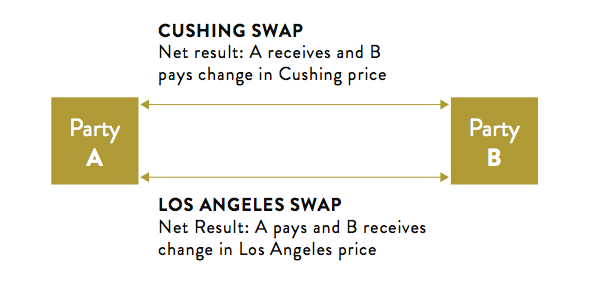

Around this basic swap structure, an enormous number of derivatives “products” have been financially engineered and marketed. For example, the payment obligation of both parties can be derived from values to be determined in the future. That is to say the swap may require no fixed payment, but instead two floating payments. In the context of the oil price swap, Party A‘s obligation might be the June price of oil delivered at Los Angeles instead of a fixed payment. Party B’s obligation would be based on the June price at Cushing. As a result, the value of the ultimate performance would be the difference between the changes in June Los Angeles and June Cushing oil prices from the swap inception date until June.

This is the financial equivalent of two simple swaps between the parties, executed simultaneously but documented as a single swap. The first of the two swaps is the simple Cushing swap described above. In the second swap, Party B pays the fixed market price for Los Angeles oil at the inception date, and Party A pays the actual price in June. If they are done simultaneously, the result is a Los Angeles/Cushing floating-to-floating price swap. Figure 4 illustrates how such a swap would work.

This type of composite swap can be used as a hedge. In our case Party A may be a buyer of oil at Cushing and a seller of oil at Los Angeles, and Party B may be a buyer in Los Angeles and a seller in Cushing. Each of the two parties has secured the financial result of buying and selling at the June forward price as of the swap inception date for each of the two locations.

Derivatives that are the composite of simple swaps are a common example of second-level financial engineering. Almost all complex, engineered swaps can be decomposed into simpler forms. Indeed, sophisticated financial firms do just this when recording and monitoring price and credit risk in their derivatives businesses. Unfortunately, many customers of these sophisticated financial firms, and worse many regulators, fail to appreciate the simplification provided by the decomposition of superficially complex swaps.

Advanced Engineering – Options.

The next level of advanced engineering is based on instruments known as “options.” The contract is written as an option to buy (a “call”) or force the sale (a “put”) of something, specifically a security or a commodity, at a determinable price on (or sometimes on a date before) a future date. It can also be a contract to force the other party to enter into a swap, known in the market as a “swaption.”

It is obvious that the option holder will execute on his or her rights if there is value in doing so. If one has the option to buy a barrel of oil at a price of $90 and the current price is $100, he or she will exercise the option. It is also typical that the value of the item to be obtained or sold is readily calculable and can be converted to cash. Otherwise, it would be difficult to know what the value of the derivative was at inception or during its existence. In fact, almost all options are settled at the option exercise date based on cash equivalent payments rather than actual purchase and sale of the underlying asset or security. In the example above, instead of the option holder buying the oil at $90, the other party pays $10 per barrel.

Therefore, it is useful to ignore the technicality that the contract is structured as a right to buy or sell an asset. That allows one to think of an option contract as its financial equivalent expressed in terms of a swap derivative: a swap in which the net cash to be exchanged in the future has a cap or floor that applies to one of the parties. If the cap (or floor) is breached, performance is excused. (in option parlance the floor or cap is the strike or exercise price.) Thinking of the transaction as a swap with a cap or floor simply assumes that the “option” will be exercised if it is valuable, which of course is the way an option is valued and traded.

If the price is below $100, the net swap contract payments flow. If it is above, no net payments are made. This is the financial equivalent of an option to call barrels of oil @ $100 owned by Party A.

Because of the cap or floor, there is an additional financial value that must be calculated in order to value an option prior to its exercise date, beyond the value of the forward price and the value of credit extension. It is based on the probability, as of the date of valuation, that the cap or floor will be breached at the time payments are required. This is referred to as the “option value.” For example, if the forward price is below the exercise price, the option has no forward value to a holder of a right to buy. But there is still a chance that actual price on the exercise date will exceed the exercise price. This probability has valuable.

The Black-Scholes Model and its variants are used to calculate the value. This expected value is measured by statistical algorithms. The calculation of the value of this probability depends in large part on expected price volatility from the date of calculation up to the performance date. If prices have historically moved so as to exhibit a great deal of amplitude, there is a greater chance that a floor or cap may be breached on the performance date of the contract. Option value is, for this reason, higher in volatile markets. Traders, who always believe that they will profit from the positions they take on, prefer volatile markets because the profit potential is relatively higher.

The best way to think of an option derivative is that, like a swap, it is an exchange of consequences. However, for one side, the positive consequences or negative consequences are limited.

In the oil price swap example above, Party B might have retained the value of a potential price drop by using an option in which Party B’s payment was limited to a price $1 lower than the price at inception of the option. For that floor, Party B would pay Party A the option value at inception, reflecting the probability that Party B’s performance will be excused.

Endnotes

1. Thomas Philippon, “Has the U.S. Finance Industry Become Less Efficient?” November 2011, available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1972808.

2. Id. The two other major functions are risk transfer and payments systems. This paper defines “risk transfer” narrowly, including insurance but excluding derivatives. Derivatives will be defined as an element of capital intermediation. Payments systems are important, but are part of traditional, more mundane banking capital intermediation. Payments systems are important, but are part of traditional, more mundane banking that involve relatively low risk and revenues.

3. Merton, R. and Bodie, Z., “Design of Financial Systems: Towards a Synthesis of Function and Structure,” Harvard Business School Working Paper #o2-074, revised July 2, 2004.

4. See, for example, Chicago Mercantile Exchange, Comment Letter on Proposed Regulation of the CFTC on “Core Principles and Other Requirements for Designated Contract Markets, February 22, 2011, available at http://comments.cftc.gov/PublicComments/ViewComment.aspx?id=27876&SearchText=cme.

5. Krugman, P., “Innovating Our Way to Financial Crisis,” New York Times, December 3, 2007 available at http://www.nytimes.com/2007/12/03/opinion/03krugman.html?_r=0.

6. “Paul Volcker: Think More Boldly,” The Wall Street Journal, December 14, 2009, available at http://online.wsj.com/article/SB10001424052748704825504574586330960597134.html.

7. Id.

8. A measure of market power, economic rent is the value in excess of marginal costs extracted by market participants. See, The Economists, “A to Z Terms,” Definition of Rent, available at http://www.economist.com/economics-a-to-z/r#node-21529784.

9. Commodity Futures Modernization Act of 2000. For an excellent discussion of the events leading to the adoption of this law, see Simon Johnson and James Kwak, “Thirteen Bankers,” Pantheon Books, 2012.

10. Global Research, “Financial Explosion,” May 2012 available at http://www.globalresearch.ca/financial-implosion-global-derivatives-market-at-1-200-trillion-dollars-20-times-the-world-economy/30944

11. Corporation for Public Broadcasting, Frontline, “Money, Power and Wall Street,” Episode 4, Remarks of Bertrand de Pallieres, available at http://video.pbs.org/video/2229573868.

12. Selling a security short is agreeing to sell that security at a price when one does not actually own it. When the sale is settled, the seller must acquire the actual security for delivery at the then current price. If the price is lower than the price agreed in the short sale, the seller makes money. Therefore, a short seller experiences financial consequences that are the inverse of the owner of the security. It is the mirror image of owning a security or other financial asset.

13. Futures are structured as forward purchase contracts for historical reasons, but financially are identical to swaps. They trade on organized exchanges. Options are structured as rights to buy or force the purchase of assets. As described below, they are the equivalent of a swap based on a reference price that is subject to a floor or cap.

14. Awrey, D., “Regulating Financial Innovation: A More Principles-Based Alternative.” University of Oxford, Legal Research Papers Series, Paper No. 79/2010, November 2010.

15. Mello, A, and Parsons, J., “The Collateral Boogeyman – Packaging Credit Implicitly and Explicitly,” October 2010, available at http://bettingthebusiness.com/2010/10/.

16. Office of the Comptroller of the Currency, “Quarterly Report on Bank Trading and Derivatives Activities – First Quarter 2012,” available at http://occ.gov/topics/capital-markets/financial-markets/trading/derivatives/derivatives-quarterly-report.html.

17. Minsky, Hyman, “Stabilizing an Unstable Economy,” McGraw-Hill, 2008, pp. 230-238.

18. Andrea Gamba and Alexander Triantis, “Corporate Risk management: Integrating Liquidity, Hedging, and Operating Policies,” July 2011, available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1475154; (herein referred to as “Gamba and Triantis”)

19. This is confirmed, even as to the ten times factor, in Corporation for Public Broadcasting, Frontline, “Money, Power and Wall Street,” Episode 1, Remarks of Christopher Whalen, available at http://video.pbs.org/video/2226666502.

20. Recording of the hearing available at http://www.sec.gov/news/otherwebcasts/2011/munifieldhearing072911.shtml.

21. See footnote 16.

22. Arora, S., Barak, B., Brunnermeier, M., Ge, R., “Computational Complexity and Information Asymmetry in Financial Products,” October 19, 2009, available at http://scholar.princeton.edu/markus/publications/term/39.