Breaking Up the Banks - The Dallas Fed Weighs In

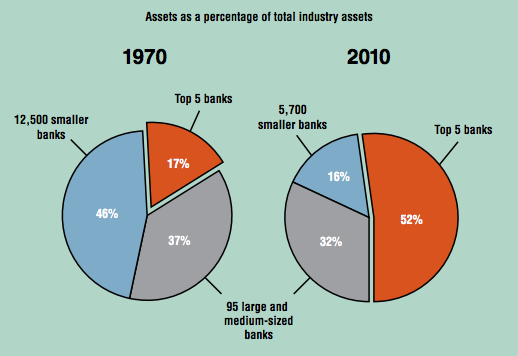

The Federal Reserve Board of Dallas released a report from its chief researcher, Harvey Rosenblum, which has caused quite a stir. The report cites Fed statistics showing that the five largest US banks hold a remarkable 52% of all bank assets:

U.S. Banking Concentration Increased Dramatically. Source: Federal Reserve Bank of Dallas

Fed statistics as of the end of 2011 identify the five as:

- JP Morgan Chase – $2.3 trillion

- Bank of America - $2.1 trillion

- Citigroup - $1.9 trillion

- Wells Fargo - $1.3 trillion

- Goldman Sachs - $1.0 trillion

The most dramatic part of the report and the covering letter by Dallas Fed President Richard W. Fisher is that they call for a “downsizing” of these megabanks. Their primary argument is that financial institutions remain “too-big-to-fail,” risking another painful and damaging bailout if a large financial crisis is threatened. In their view, the continuing cloud of too-big-to-fail hanging over the economy is simply intolerable and costly.

This is not a cry from progressive economists gripped by the fever of an unprecedented financial crisis. The Fed is hardly known for hyperbole. It comes at a time when debate rages over the implementation of the Volcker Rule, which prohibits proprietary trading and most hedge fund sponsorship by federally insured banks. In practical terms, it is a “downsizing” targeted at the most risky lines of business.

While Goldman Sachs drops out of the mix when deposits are considered, the other megabanks are found in this data. Post-New Deal concepts of investment banking and commercial banking have been eliminated both in substance and in law since the repeal of the Glass-Steagall during the Clinton adminstration. The most striking part of the data is that Goldman makes the top five in over all assets though it holds no traditional commercial banking assets. Goldman's trading assets are indeed impressively large.

However, this report also contains some intriguing observations that go beyond the systemic risk of over concentration in the banking system. Rosenblum states that:

When competition declines, incentives often turn perverse and self-interest turns malevolent.

This goes beyond worries about to-big-to-fail. It is not a concern with the intolerability of the risk of liquidation of a bank that is so large that it cannot be allowed to fail. Rosenblum identifies distortions in a market that is dominated by an oligopoly of banks. This passage points out the damage that can be done to the economy even if these banks do not fail. The systemic risk of to-big-to-fail exists by virtue of concentration. But, the pernicious oligopolistic marketplace that Rosenblum describes requires more attention than the report provides.

It is important that the oligopoly emerged over an identifiable time period. The report points out the dramatic increase in concentration over a 40-year period. In 1970, the largest five banks held 17 percent of total assets compared with the 52 percent figure applicable in 2010. Rosenblum selects an interesting time period for comparison. Several other dramatic changes occurred in the financial sector during that time.

- Financial sector share of total corporate profits grew from 15 percent to 33 percent.

- The percentage of US GDP represented by the financial mushroomed to levels that evidence a chronically ill economy.

- Trading volumes in all securities and derivatives markets exploded. For example, the domestic derivatives markets that did not even exist at the beginning of this period reaching $300 trillion per year.

- Wall Street bonus season became an orgy of cash, reported like the latest sports scores to an envious and increasingly angry public.

This all, of course, coincides with the decimation of regulation of financial services. Capital constraints were reduced to absurd levels, encouraging risky borrowing techniques. Highly leveraged asset bases maximized the dual potential for profit and disaster, the perfect business model for bankers that were rewarded with massive bonuses that were safe from future failures. The protections of the Glass-Steagall separation of commercial and investment banking were tossed overboard. Regulatory agencies were captured by the banks, and their missions morphed from protecting the public’s interests into preserving bank profitability. And huge swaths of trading activity were allowed to exist in a shadow market, free from regulatory oversight.

During this period, the United States developed a serious problem with income disparities. Jobless recoveries from recessions came on the scene, with each recession bringing a longer recovery rate. Basic manufacturing withered away, and with it jobs were transferred to the “third world,” as it was called at the inception of this period. Many things were going wrong, and the oligopoly did more than its share to speed the process.

This is not serendipitous. Institutions that are too-big-to-fail got that way as a result of concentrations of assets and businesses that interact with the market power inherent in oligopoly in a continuous loop. The Dallas Fed is right that banks should be “downsized,” a polite term for breaking them up into units that can be free to fail as well as free to succeed. It is the only safe thing to do. But oligopoly and too-big-to-fail are two sides of the same coin.

The lobbyists try to intimidate regulators and politicians with the fear that smaller, more diverse financial institutions will injure the economy and drive financial market activity overseas. This cannot go unchallenged. Like the trusts that were busted by Teddy Roosevelt, the financial oligopoly is extraordinarily profitable for its membership. But the vast majority of Americans will reap enormous benefits when it is busted. A century later, the same principles apply.